Digital Health

IFBD: New growth strategy leading to expanding customer base

By M. Marin

NASDAQ:IFBD

Founded in 2001, Infobird Co., Ltd (NASDAQ: IFBD) provides SaaS (software-as-a-service) AI-powered customer engagement solutions…

By M. Marin

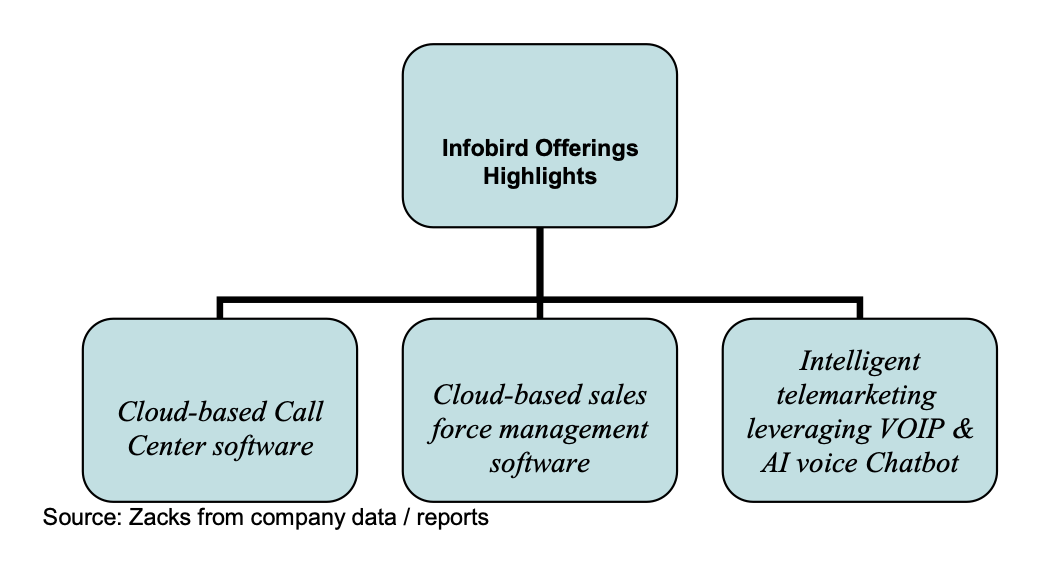

Founded in 2001, Infobird Co., Ltd (NASDAQ: IFBD) provides SaaS (software-as-a-service) AI-powered customer engagement solutions to corporate customers in China and recently began its expansion into other markets in Asia through a Singapore based channel partner. Infobird offers artificial intelligence (AI)-powered cloud-based customer engagement and sales force management software products. Infobird’s software solutions are designed to help clients manage end-to-end customer engagement services, including customer support interaction, and drive revenue, lower expenses and boost customer stickiness through improved customer service. Infobird opened one of China’s first cloud call centers and, with more than 10 years of experience offering solutions, particularly to the finance industry, believes it is a leading SaaS provider serving the financial services, retail and healthcare verticals. The company completed its IPO on April 22, 2021; the shares trade on the Nasdaq under the symbol IFBD.

In 2021, Infobird initiated measures to broaden the base of small and mid-size (SMB) customers it serves, reorganizing its corporate, sales and marketing operations, while simultaneously expanding its industry sales teams to grow its customer base. The company, utilizing its telemarketing capabilities, believes its SaaS solutions are easy-to-deploy and can enable SMBs to lower costs and shorten the time it takes to attain scale. With respect to larger corporations with more complex needs, the company can also provide standard solutions by integrating different standard products, without much customization efforts upfront, in a relatively short amount of time. The company’s outreach appears to be successful thus far, as evidenced by a growing number of new contracts in industries such as retail, healthcare and new energy vehicle (NEV) (see below).

Targeting rapidly growing sectors…

The company’s target verticals are experiencing strong growth. For instance, within the retail space, the global sportswear market revenue reached US$188.2 billion in 2020, according to iiMedia Research data, and is expected to grow to nearly US$201 billion by 2025, which represents a greater than 10% increase, with growth in China expected to outpace that of the general industry, according to market research firm Frost & Sullivan.

In the important food service distribution space, the company recently engaged with a global high-profile multinational customer to deploy Retail Rubik’s Cube (see below) in order to enhance the customer’s digital operational analysis of its operations. The multinational customer operates in more than ten sectors and operates a number of important projects in China. Infobird views this relationship as an important milestone, as it marks the company’s entry into this industry vertical and underscores the functionality and versatility of the company’s suite of digital tools for customer engagement and operational evaluation. The multinational customer intends to leverage Infobird tools principally to focus on three important areas of operation for restaurants, including 1) customer flow analysis, 2) customer engagement and 2) merchandising.

… reflecting rising EV adoption & increased focus in China on dental care, among other factors

The NEV vertical has also been characterized by growth. For instance, the improving performance of electric vehicles (EVs) and regulatory measures to boost sales is spurring growing EV adoption in China. The number of EV OEMs has proliferated as sales of EVs and hybrids grow. Nevertheless, despite significant increases in the number of EVs sold over the past decade, this segment of the automobile market remains relatively low, implying potential for upside. International Energy Agency (IEA) data indicates that EVs represented 2.6% of all new sales of cars worldwide in 2019 and comprise roughly 1% of the global car base. According to IEA data, China has about 45% of the world’s EV fleet and generally ranks among the largest markets in terms of new EV sales per annum, followed by Europe and the U.S.

Importantly, in 2021, global EV sales appear to have accelerated in terms of volume and market share, according to Green Car Reports, citing a report from the International Energy Agency (IEA). Encouraging in terms of further consumer adoption is continued improvements in EV performance and regulatory restrictions on automobile emissions. On average, the minimum …

Full story available on Benzinga.com

artificial intelligence

ai

software

healthcare

shares

markets

nasdaq

Keep it Short

By KIM BELLARD OK, I admit it: I’m on Facebook. I still use Twitter – whoops, I mean X. I have an Instagram account but don’t think I’ve ever posted….

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….

Seattle startup Olamedi building platform to automate health clinic communications

A new Seattle startup led by co-founders with experience in health tech is aiming to automate communication processes for healthcare clinics with its software…