Digital Health

KLAS: 340B 2023 – Functionality & Pricing Drive Purchase Decisions

What You Should Know: – Purchasing energy in the 340B market has been high in recent years as (1) healthcare organizations have sought to increase savings,…

What You Should Know:

– Purchasing energy in the 340B market has been high in recent years as (1) healthcare organizations have sought to increase savings, particularly in cost centers like pharmacies, and (2) 340B vendors have expanded the types of customers they serve, according to a recent KLAS report.

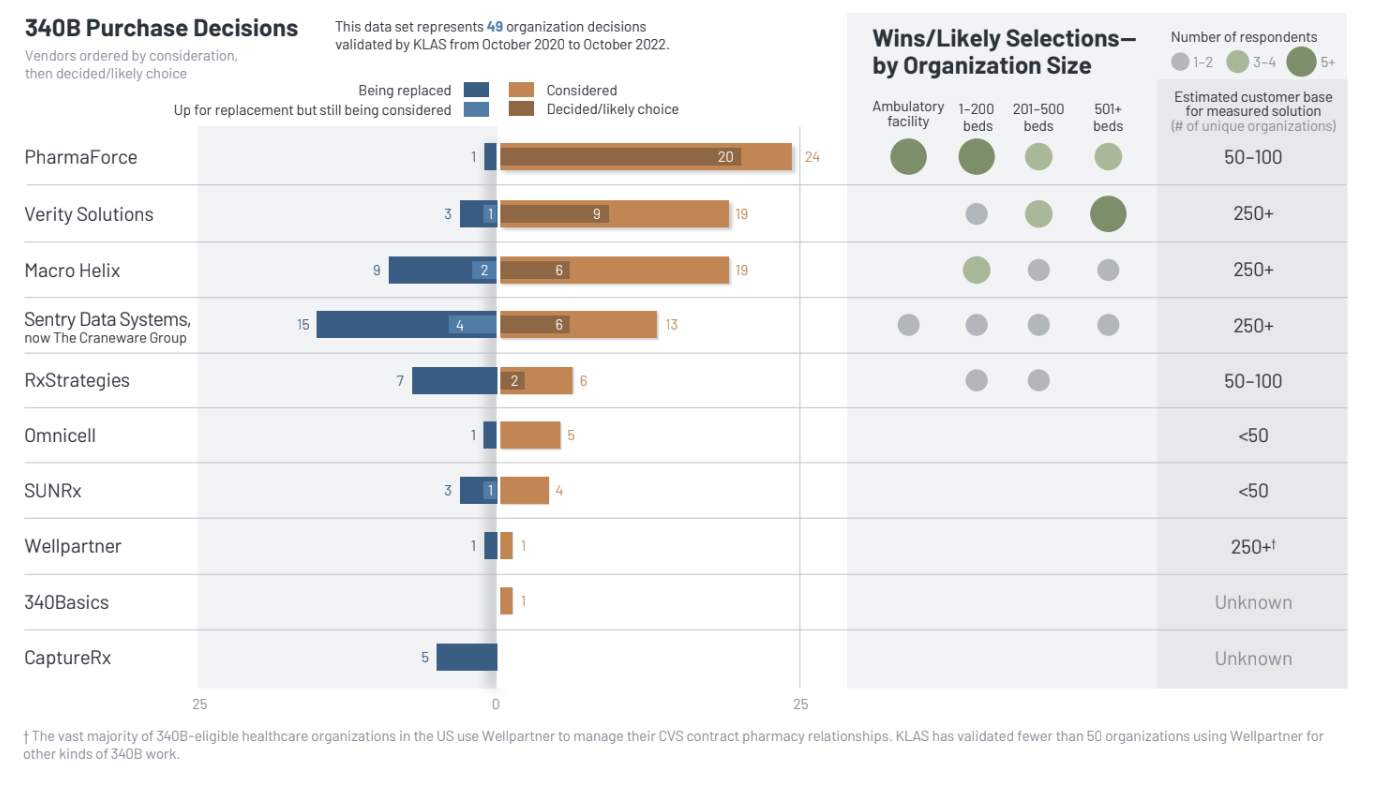

– This new report examines 49 recent purchase decisions validated by KLAS between October 2020 and October 2022 to understand why certain vendors are seeing the most purchase energy and who is being replaced. When available, satisfaction data from current customers is also included.

Trends and Insights Regarding the 340B Market in 2023

Each year, KLAS interviews thousands of healthcare professionals about the IT solutions and services their organizations use. For this report, interviews were conducted over the last 12 months using KLAS’ standard quantitative evaluation for healthcare software, which is composed of 16 numeric ratings questions and 4 yes/no questions, all weighted equally. Combined, the ratings for these questions make up the overall performance score, which is measured on a 100-point scale. The questions are organized into six customer experience pillars—culture, loyalty, operations, product, relationship, and value.

Key insights are as follows:

PharmaForce Highly Considered and Selected Thanks to Functionality and Rapport during Sales Process

Newer entrant PharmaForce, who initially started in contract pharmacy, is 2023 Best in KLAS winner† for 340B and is highly considered and selected in this report sample. Though PharmaForce has historically served ambulatory and critical access organizations, large-organization customers also report satisfaction. Organizations who select the vendor cite reasons like ease of use, the ability to customize the solution, and the vendor’s engagement during the sales process.

Additionally, the pricing is seen as transparent, predictable, and fair. PharmaForce’s one validated replacement is due to the organization consolidating systems. Current customers say that as the vendor has grown their customer base over the past two years, they have provided a consistently good experience. It remains to be seen how well the vendor will scale as they continue to work with an increasing number of large organizations.

Large Organizations Look to Verity Solutions Due to Consistency and System Capabilities

Verity Solutions is a longtime 340B vendor that has set a high standard in the market with its proactive, high-touch support model. They are most often selected by large acute organizations, whom they typically serve; the vendor has also recently seen growth among smaller organizations. Reasons for selection include the solution’s strong reporting capabilities, the vendor’s reputable consistency, and the customer service structure, which includes dedicated account managers. Organizations who considered but didn’t select Verity Solutions say other solutions’ usability and pricing are more appealing.

Three organizations plan to replace Verity Solutions—one cites system consolidation, another says the system’s contract pharmacy capabilities don’t meet their organization’s needs, and the final organization reports a poor experience post-implementation. Current customers say Verity Solutions is a consistently high performer that has maintained its culture, support, and customer relationships over the years, particularly while transitioning customers from legacy products and after being acquired by Cigna in 2019.

McKesson-owned Macro Helix is also highly considered in this data sample and is typically chosen by smaller acute organizations. One factor that drives selections is the vendor’s relationship with McKesson’s wholesaler division, which facilitates smooth integration. Those who considered but didn’t select Macro Helix point to the pricing structure and the lagging technology and reporting.

Sentry Data Systems and Macro Helix Most Frequently Being Replaced; Customers Cite Functionality, Relationship, and Pricing

Sentry Data Systems (now The Craneware Group) and Macro Helix both have six wins and are most often up for replacement. Sentry Data Systems—which was purchased by The Craneware Group in 2021—has customers who report seeing positive changes in recent years. Still, many have experienced challenges, leading them to replace the vendor. Those who are leaving perceive the product as lacking functionality, noting difficulties with getting it to a usable level; some feel it is cumbersome and that the reporting is limited. Another frequently mentioned reason for replacement is a poor relationship with the vendor.

The majority of leaving organizations say the service has always felt reactive and slow, and the handful who were initially satisfied with the service have recently noticed more delayed responses and a lack of follow-through. Additionally, multiple reports of nickel-and-diming (around reporting, implementations, and turning off services) and poor implementation led to ongoing difficulties with integration and mapping.

Organizations moving away from Macro Helix identify functionality as a frustration more frequently than other vendors’ leaving customers, specifically saying the solution’s ease of use, ability to help with compliance, and referral capture capabilities could be improved. Current Macro Helix customers say they have seen prices significantly increase over time, prompting them to look at other options.

Declining Data Quality Prompts Customers of RxStrategies and CaptureRx to Consider Other Options

Three organizations replacing RxStrategies use the legacy product, 340B Plus, which is no longer being updated. The other four organizations leaving RxStrategies use the newer product, 340B Dashboard, and say it doesn’t work as promised. Both customer groups mention data inaccuracies in the reporting and declining support, describing the support team as reactive and unable to address problems in the solution.

Additionally, some say the vendor struggles to keep up with customer needs (e.g., correct identification numbers, easy-to-use solution that doesn’t require many resources). Organizations that are leaving CaptureRx report problems with functionality, relationship, and nickel-and-diming. The product’s data is not seen as trustworthy, and users are unable to self-audit, resulting in compliance difficulties. Some respondents say CaptureRx has become less responsive and that the account managers are difficult to work with.

Keep it Short

By KIM BELLARD OK, I admit it: I’m on Facebook. I still use Twitter – whoops, I mean X. I have an Instagram account but don’t think I’ve ever posted….

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….

Seattle startup Olamedi building platform to automate health clinic communications

A new Seattle startup led by co-founders with experience in health tech is aiming to automate communication processes for healthcare clinics with its software…