Digital Health

KLAS Report: ERP Vendor Performance & Adoption in 2023

What You Should Know: – With regulatory and financial pressures increasing, many healthcare organizations continue to move to cloud-based enterprise…

What You Should Know:

– With regulatory and financial pressures increasing, many healthcare organizations continue to move to cloud-based enterprise resource planning (ERP) solutions, utilizing them to boost efficiency and provide insights into how business processes can improve. To implement and optimize these solutions, organizations rely on their ERP vendors, who sometimes provide an inconsistent customer experience.

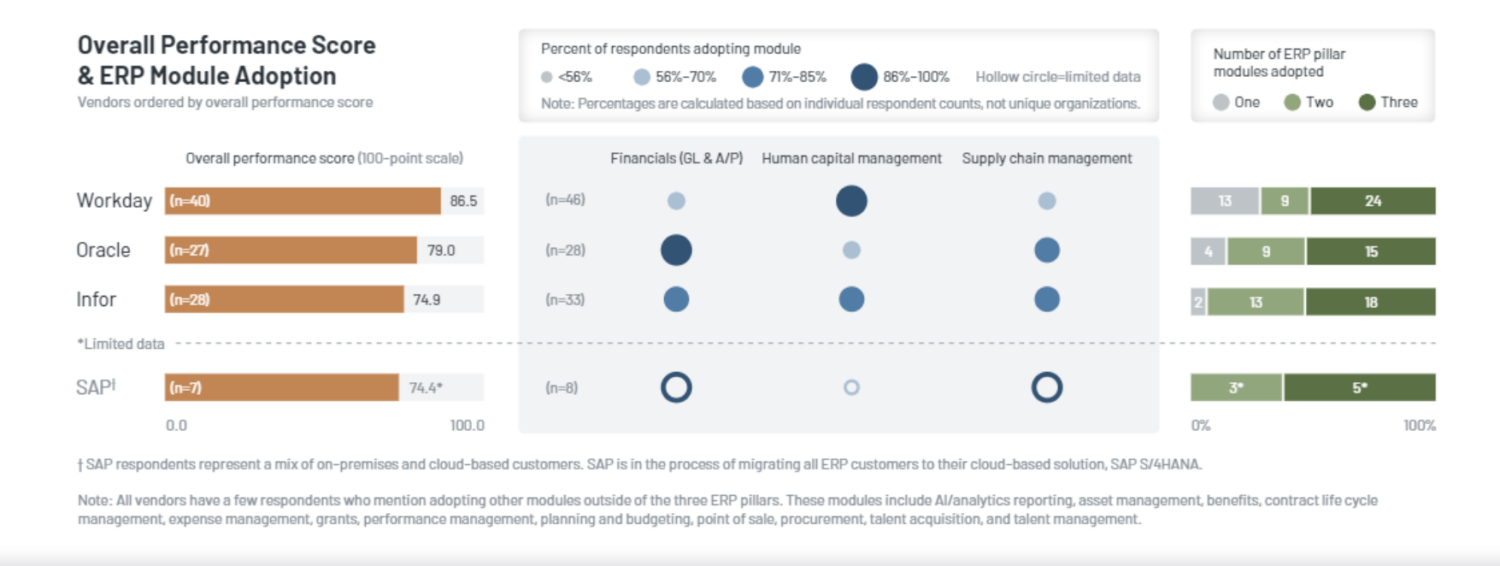

– A new KLAS report examines (1) customer adoption across the three ERP pillars—financials, human capital management (HCM), and supply chain management—(2) the performance of enterprise ERP vendors, and (3) customer optimism about how vendors will perform in the future.

Key Trends and Insights on Cloud Vendors’ Performance in 2023

Each year, KLAS interviews thousands of healthcare professionals about the IT solutions and services their organizations use. For this report, interviews were conducted over the last 12 months using KLAS’ standard quantitative evaluation for healthcare software, which is composed of 16 numeric ratings questions and 4 yes/no questions, all weighted equally. Combined, the ratings for these questions make up the overall performance score, which is measured on a 100-point scale. The questions are organized into six customer experience pillars—culture, loyalty, operations, product, relationship, and value.

Key insights are as follows:

Infor Cloud Customers Have Strongest Adoption across ERP Module

Infor’s solution is the most broadly adopted cloud platform among respondents in this report. Customers note that over the last few years, the executives have listened more carefully to customers and addressed problems. System configuration is a challenge for many respondents, who point to the system’s complexity and nonintuitive user interface. To address these challenges, interviewed customers would like best practices training to be included in their contract at no additional cost. Customers’ go-live experiences are improving, though some still say they encountered issues during the initial implementation.

SAP has a very small US customer base, and of the limited number of respondents, all but one have been live for over five years. Interviewed customers report broad module adoption, with 100% adopting the financials and supply chain management modules. Overall, SAP respondents say the system is reliable and stable. The solution hasn’t evolved as expected to meet organizations’ HR and reporting needs, and some wonder whether healthcare-specific product development is a priority for SAP.

Satisfaction with Workday’s Supply Chain Functionality Increases; Customers Highlight Recent Enhancements and Compelling Road Map

Workday and Oracle respondents are the most satisfied with their respective supply chain functionality, with module adoption at roughly 60% for Workday respondents and 75% for Oracle’s. While Workday customers have generally been satisfied with the vendor’s HCM and financials modules, the supply chain management module has historically been perceived as a weak spot. However, recent product enhancements and a compelling road map have bolstered satisfaction and generated excitement among users.

Some would like better functionality for inventory, turnover rates, supplier lead time, and reporting. Respondents appreciate that Workday is transparent about the solution’s gaps and has plans to address them in their road map. Regarding Oracle (limited data), customer respondents generally see the supply chain module as one of Cloud ERP ’s strengths, saying it is straightforward and sophisticated for viewing and editing historical pricing information. Some feel the usability and functionality could be improved in areas such as contract management, bidding, price-capturing tools, and par level management.

Across Vendors, Variability in Go-Live Experience Hinders Usability; Oracle and Infor Customers Report Most Challenges

Even as more healthcare organizations move to updated cloud technology from their ERP vendor, challenges remain. Across all vendors in this report, respondents’ experience with both the implementation (i.e., vendor involvement, guidance, training) and the initial product greatly influences their ability to drive outcomes. Oracle respondents would like more involvement and critical guidance from the vendor during implementations, especially because Oracle has historically used third- 6.0 party service firms to manage implementations. Newly live respondents report the most challenges, while those who have more years of experience with the system are the most satisfied with its ability to drive outcomes.

Infor respondents say rocky implementations combined with a clunky interface make it difficult to achieve promised outcomes. For some, processes have become more inefficient and there is a need for more FTEs. Additionally, several of Oracle’s and Infor’s least satisfied respondents often struggle with the support and training, noting that they pay for a lower tier of support and don’t receive the help they need. While interviewed Workday customers—particularly those who have gone live in the past two years—say implementations can be bumpy because some of Workday’s implementation partners lack expertise, the vendor is highlighted for proactively addressing needs and having strong communication. Further, customers report high satisfaction with Workday’s modern, user-friendly interface.

Workday and Oracle Customers Most Optimistic about Future; Infor Customers’ Increasing Optimism Driven by Executive Engagement

The majority of Workday respondents are very optimistic about the future, citing the vendor’s performance, strong track record of valuable enhancements, and clear communication around future developments. A few who don’t express optimism say they have functionality needs that haven’t yet been addressed, and they worry Workday won’t meet those needs in a timely manner. Oracle’s customer optimism is driven by upgrades and enhancements that meet user needs. Additionally, the executives’ communication reassures respondents that the vendor is invested in improving the customer experience (e.g., improving implementations, enhancing functionality).

Pessimistic respondents experienced rough implementations and say they struggle to achieve outcomes. These respondents also note the support they pay for doesn’t include special training or guidance. The strong optimism of Infor respondents is driven by the executive team’s vision and focus on customer success and their genuine efforts to use feedback to address concerns and improve outcomes. Infor’s two least satisfied respondents are somewhat pessimistic due to bugs that they believe should have been resolved prior to release, usability challenges, poor outcomes, and low confidence in the vendor’s understanding of and ability to make necessary improvements.

Keep it Short

By KIM BELLARD OK, I admit it: I’m on Facebook. I still use Twitter – whoops, I mean X. I have an Instagram account but don’t think I’ve ever posted….

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….

Seattle startup Olamedi building platform to automate health clinic communications

A new Seattle startup led by co-founders with experience in health tech is aiming to automate communication processes for healthcare clinics with its software…