Digital Health

Will CBDC FedNow Put Regional and Smaller Banks Out of Business this Summer?

The failures of Silvergate Bank, Silicon Valley Bank, Signature Bank, and the current struggles of First Republic and Pacific West Bank have seen bank…

Will FedNow Enable Greater Deposit Flight From Troubled Banks?

by Brian Clark

ZeroHedge News

The failures of Silvergate Bank, Silicon Valley Bank, Signature Bank, and the current struggles of First Republic and Pacific West Bank have seen bank deposits flee to the perceived safety of large banks.

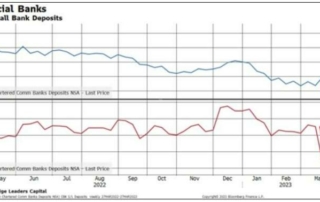

In the chart below, one can see the flight of deposits from small banks into large.

To make matters worse for banks, rising interest rates and easily accessible higher yielding alternatives exist like money market funds (MMF) or US Treasury ETFs.

These alternatives are now a few thumb taps and swipes away from depositors, making the near-zero rate of return on bank deposits much less attractive for many consumers and businesses.

In the chart below one can see the drop in bank deposits and increase in MMFs.

Here we can see the significant premium 3-month US Treasury yields command over bank certificates of deposit (CDs).

These issues, plus the new FedNow service which is set to begin trial runs in July, could represent an uphill battle for banks to retain deposits.

The Federal Reserve’s new FedNow program will allow bank customers at 10,000 financial institutions to instantaneously transfer funds in and out of bank accounts on a 24/7/365 basis. This is probably the biggest innovation since mobile banking and investment apps and will allow customers greater access to their money than ever before.

“We reiterate our view that FedNow will represent a material change in how consumers use electronic money,” said TD Cowen analyst Jaret Seiberg in a recent Marketwatch report.

FedNow may accelerate the ability of depositors to remove money from banks accounts and reroute it to higher yield alternatives.

With banks under increasing pressure to stem outflows, these trends could add to their troubles, especially if banks are forced to sell even more assets which currently have unrealized losses.

Comment on this article at HealthImpactNews.com.

See Also:

Understand the Times We are Currently Living Through

The God of All Comfort

Year 2023: Will America Fulfill Its Destiny? Jesus Christ is the Only “Transhuman” the World Has Ever Seen or Will Ever See

An Invitation to the Technologists to Join the Winning Side

Synagogue of Satan: Why It’s Time to Leave the Corporate Christian Church

How to Determine if you are a Disciple of Jesus Christ or Not

Epigenetics Exposes Darwinian Biology as a Religion – Your DNA Does NOT Determine Your Health!

What Happens When a Holy and Righteous God Gets Angry? Lessons from History and the Prophet Jeremiah

Insider Exposes Freemasonry as the World’s Oldest Secret Religion and the Luciferian Plans for The New World Order

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

Fact Check: “Christianity” and the Christian Religion is NOT Found in the Bible – The Person Jesus Christ Is

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Mark of the Beast?

Medicine: Idolatry in the Twenty First Century – 7-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

The post Will CBDC FedNow Put Regional and Smaller Banks Out of Business this Summer? first appeared on Vaccine Impact.

Keep it Short

By KIM BELLARD OK, I admit it: I’m on Facebook. I still use Twitter – whoops, I mean X. I have an Instagram account but don’t think I’ve ever posted….

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….

Seattle startup Olamedi building platform to automate health clinic communications

A new Seattle startup led by co-founders with experience in health tech is aiming to automate communication processes for healthcare clinics with its software…