Government

4 Penny Stocks To Watch Under $5 With Big News This Week

Penny stocks with big news traders are watching this week.

The post 4 Penny Stocks To Watch Under $5 With Big News This Week appeared first on Penny Stocks…

Everyone is looking for an edge to find penny stocks to buy before the masses. The difficult part is that many of these cheap stocks lack liquidity. So, outside of all other risks, liquidity risk presents a significant hurdle.

For those unfamiliar, liquidity or volume and the frequency of that volume allow you to enter and exit trades more efficiently. The higher the liquidity and the more frequent that liquidity is at those levels, the easier it is to get the prices you want. Lower liquidity is, of course, the opposite. So what can you do?

For the average trader and seasoned professionals, taking a more reactive approach than a predictive style can help. This can make it more efficient to trade penny stocks based on real-time catalysts. Your ability to be proactive when headlines come out, or the latest public filing gets reported can be that “edge” you’re looking for.

In this article, we look at a handful of penny stocks with big news this week, which has helped prompt a surge of activity in the stock market. We peel back the details and look for any upcoming events that may play their role down the road. Then you can decide if they’re worth adding to your list of penny stocks to watch.

Penny Stocks To Watch

Sonnet Biotherapeutics (SONN)

Penny stocks under $1 have become a hot topic amid the latest stock market volatility. In light of the wild market swings, some are taking an even greater risk-on approach and focusing on the cheapest stocks. Sonnet has been on the radar for several weeks as the penny stock attempts to reclaim losses from earlier in the year.

– Top Strategies for Trading Options With Penny Stocks

The biotech company has been under pressure all year, but the last few weeks have seen some breathing room as shares steadily rebound. Whether or not this is “the bottom” is to be seen. However, some analysts appear optimistic about its prospects. Chardan Capital maintains a Buy on the penny stock with a $14 target set. Though this is lower than the previous $17 target, it’s still considerably higher than the penny stock’s $0.27 price point. EF Hutton analysts also recently picked up coverage on the company giving a Buy rating and a $6.70 target.

In its first-quarter update, Pankaj Mohan, Ph.D., Sonnet Founder and CEO, said, “We remain incredibly enthusiastic about the best-in-class potential of our proprietary IL-12 therapeutic candidate, SON-1010, where our recent presentation at the 2023 American Association for Cancer Research Annual Meeting supported the consistency of the compound’s data and reiterated the robustness of its overall profile. Additionally, we are very excited about the non-human primate data that we have generated with SON-1210, our proprietary bifunctional version of human Interleukins 12 (IL-12) and 15 (IL-15), that we believe will help propel the compound into clinical development. We are looking forward to continuing this forward momentum over the balance of 2023.”

Meanwhile, CEO Mohan, Ph.D., picked up 371,600 shares at an average of $0.22 earlier this month.

Verastem Inc. (VSTM)

Shares of Verastem exploded on Friday as the sub-$1 stock broke back above the threshold for the first time all year. The company develops medicines for cancer patients and has been under pressure since the beginning of February.

This week VSTM stock surged on the back of its latest update. The company highlighted data from Par A of its RAMP 201 trial. This trial studies the safety and efficacy of Verastem’s avutometinib (VS-6766) alone and in combination with defactinib in patients with recurrent low-grade serous ovarian cancer (LGSOC).

– 5 Penny Stocks To Watch Before Next Week; Time To Buy?

Looking ahead, the data will be presented at the American Society of Clinical Oncology Annual Meeting. Meanwhile, Verastem plans to include mature data from RAMP 201 and the investigator-sponsored FRAME study to support filing for faster approval. The company said it’s finalizing the design of a randomized confirmatory trial with the FDA, planned to begin during the back half of 2023.

Qurate Retail Inc. (QRTEA)

The retail brand company Qurate Retail owns brands like QVC, HSN, Zulily, Ballard Designs, Frontgate, Garnet Hill, and Grandin Road. Its video commerce – Commerce – is relatively uncontested based on the brands it owns. The retailer reaches more than 200 million homes across multiple TV channels via social media & live-streaming platforms.

This week momentum is building after Qurate sold off one of its brands, Zulily. Qurate, called Liberty Interactive Corp. at the time, bought Zulily in 2015 for about $2.4 billion. The company announced that Regent purchased the online retail brand this week.

Michael Reinstein, Chairman of Regent, explained, “Zulily has been a trailblazer in using technology to create a compelling online customer experience. Their revolutionary logistics and fulfillment network has also set a new industry standard, and we are excited to leverage its immense potential to grow the Zulily business in new markets.”

8X8 Inc. (EGHT)

Some stocks are on the move for other developments that may not be formal press releases. In this case, 8X8 is part of the niche. The cloud communications technology company reported first-quarter earnings earlier this month. It beat earnings per share estimates but missed sales expectations.

The company’s solutions were recently chosen by Jackson Lewis to improve engagement and improve IT support. The law firm isn’t the only company to act as a source of milestones this month. 8X8 was also awarded a TrustRadius 2023 Top Rated Award in the VoIP and Unified Communications as a Service (UCaaS) categories.

But what may have turned heads more significantly is institutional activity in the stock. Sylebra Capital reported a 12.37% stake in the company. It also filed a statement showing an 8.68% stake in RingCentral (NYSE: RNG). In a statement, Sylebra said it intends to hold discussions with the two companies for a potential strategic deal. Though, at this point, no such deal has been struck or announced. 8X8 will also participate in several upcoming investor conferences, including Baird’s 2023 Global Consumer, Technology, and Services Conferences on May 31st and BofA’s Global Tech Conference on June 7th.

List Of Penny Stocks

- Sonnet Biotherapeutics (NASDAQ: SONN)

- Verastem Inc. (NASDAQ: VSTM)

- Qurate Retail Inc. (NASDAQ: QRTEA)

- 8X8 Inc. (NASDAQ: EGHT)

The post 4 Penny Stocks To Watch Under $5 With Big News This Week appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

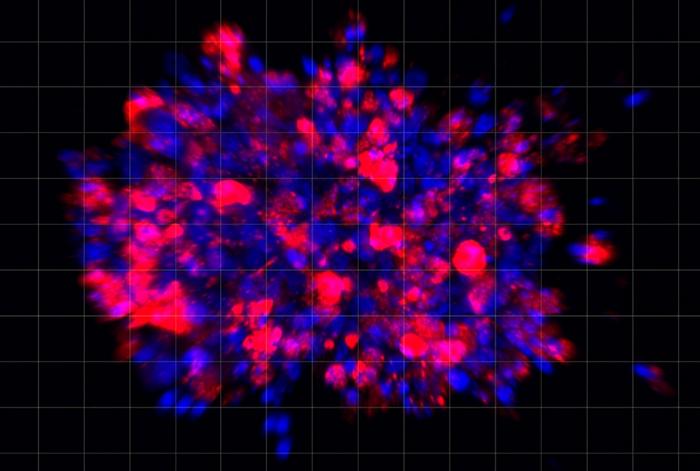

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…