Government

ASX Small Cap Lunch Wrap: Who needs to stop before they make themselves sick today?

Markets in Australia opened today with more than a small sense of trepidation – partially because of what looks and … Read More

The post ASX Small…

Markets in Australia opened today with more than a small sense of trepidation – partially because of what looks and smells like The Beginning of the End of Days in the United States.

And partially because at 8:00am this morning, an old gypsy woman calling herself “March Futures” was seen rambling about a bunch of weird stuff and pointing ominously at a crudely-drawn cardboard sign that said “1.85% lower”.

And so it was. The bell rang to start the day, and the benchmark immediately plummeted 1.4%, and by 10.30am, the hideous old crone’s grisly fortunetelling had come true – the benchmark was down 1.85%, and I did meet my soulmate in the cafe across the street.

She just doesn’t know it yet.

Anyhoo… it’s been a bit of a stinker, so if you’re feeling the need to transport yourself mentally to another plane of existence (like, a plane to Fiji for two weeks while this whole thing blows over), it might be heartening to know that you’re not alone.

And we have some Top Shelf research from the University of Birmingham, which makes this claim: “Great apes deliberately spin themselves in order to make themselves dizzy and the discovery could provide clues about humans’ drive to seek altered mental states.”

Please note – the research is specifically about Great apes. Apes ranked Mediocre or lower don’t like getting high, and will just hang around harshing everyone else’s mellow.

The research kicked off when a scientist somewhere saw a video on the internet of a gorilla spinning around in a pool – probably this one.

That’s Zola, a gorilla at Dallas Zoo in a video that has been seen by millions of people, and which sparked a phenomenal wave of emotional responses, including this comment from YouTube user “eggy Eck”.

“Truly a masterpiece I have cried over 1,000,000,000,000,000,000,000,000,000,000 times watching this.”

We reached out to eggy Eck for comment, but – sadly – we learned that eggy died of chronic dehydration four years ago, leaving behind a desiccated husk and a string of equally stupid YouTube comments for posterity.

But I digress.

Dr Marcus Perlman – a Lecturer in the Department of English Language and Linguistics of the University of Birmingham, and clearly an academic in desperate need of getting published even if it is in a field that is waaaaay outside of their field of expertise – was intrigued, and went in search of more Funny Monkey videos to share with colleagues.

What they found was a series of videos showing apes spinning around, and came up with the idea that they do that because they like “altering their mental states” by twirling until they are dizzy.

By making several massive assumptive leaps, the researchers decided that the Great Apes are doing this in order to change their mental states just like humans do.

Notable examples of this include Dervish Muslims – who take part in whirling ceremonies to achieve a spiritual trance – and Kylie Minogue.

So, there you have it. Research dollars at work, bringing you news that Great Apes like to get high. But as pointless as that sounds, it does give all of us some hope for when the market’s in the sh-tter.

You can simply spin around and around and around in your office chair, until you get dizzy, black out and hit your head – you’ll barely even notice how bad the following market news is if you’re unconscious.

TO MARKETS

The ASX has opened lower this morning, thanks to unbridled panic-selling of bank and financial stocks in the US overnight.

That’s happening because the US Number of Failed Banks This Week Index (NFBTW) is pointing at “3”, which is substantially higher than the optimal figure of “0” – but we’ll get into those details later.

The Aussie benchmark sank like a stone at open, falling as low as 2.1% late in the morning to be sitting at -1.9% when the lunch bell rang.

A look at the sector performance reveals that it’s a bad day to be a tech stock, or a bank stock, or – heaven forfend – both.

InfoTech has been savaged like a doberman’s chew-toy (-3.77%), and the Energy sector’s taken a massive hit (-3.35%) after falling bond yield kicked oil prices in the nards.

Financials is doing about as well as you’d expect in the wake of every bank in the US having their teeth kicked in – it’s down 2.58%.

The only ‘winner’ of sorts is Utilities, and that’s only because it’s only fallen 0.28% this morning, while the Materials sector – which got a boost yesterday when investors beat the well-worn path to the relative safety of anything gold related – has given any gains it made back today, dropping 1.39%.

Still enjoying a solid run at the top end of town, Large Capper Neuren Pharmaceuticals (ASX:NEU) is up another 9.35% this morning, thanks to its position as one of the most visible winners in a difficult market after announcing a big win with the US FDA on the weekend.

Newcrest Mining (ASX:NCM) has managed to beat the odds with a 3.6% rise on news that it has boosted its Exploration Target for East Ridge to between approximately 400Mt @ 0.42g/t Au & 0.49% Cu for 5.4Moz Au & 1.9Mt Cu and approximately 500Mt @ 0.39g/t Au & 0.47% Cu for 6.1Moz Au & 2.3Mt Cu.

Now, it’s time to cast some serious side-eye at the morons who made today the way it is.

NOT THE ASX

Like every tinpot dictator from Abu Dhabi to Azerbaijan, I’d like to take this opportunity to blame the Decadent Free Market of the United States for all of our woes today, as lawmakers there hold emergency sessions to try to understand how wholesale deregulation of a famously ultra-greedy and not-very-bright banking sector could possibly lead to catastrophe.

Even though the US Fed has stepped in to guarantee all deposits at Silicon Valley Bank and New York’s Signature Bank, and even though Joe Biden went on the telly to reassure taxpayers that it wasn’t their money being used to cover the collapse, bank stocks in the US got rekt.

As Earlybird Eddy reported this morning, The KBW Nasdaq Bank Index fell nearly 12%, with all major banks’ shares trading down.

Regional bank stock First Republic Bank fell over 60%. PacWest Bancorp, Zions Bancorporation and Western Alliance Bancorporation fell by 20%, 26% and 47% respectively.

It was nothing short of brutal.

The rout was, however, reasonably well-contained – by the close of day, the S&P 500 closed 0.15% lower, the Dow fell by 0.28%, and Nasdaq rose 0.45%.

What did take a hit, though, were bond yields – Aussie government bond yield tumbled overnight, with the benchmark 10-year down 17bp to 3.36%. The 2-year yield was down 27bp to 3.11%.

That, in turn, hit oil prices hard. WTI was trading 2.6% lower at US$74.79 a barrel this morning.

In Japan, the Nikkei has tumbled 2.35% partly because “banks”, and partly because someone looked at existing pillow technology, decided it was “far too basic” and came up with a monstrosity called the Practical Model Pendulum Neck Stretcher Comfortable Sleep Pillow.

While it’s clearly not a pillow, and could more accurately be described as a tiny gross sex harness for your head, it is a very real product that is weirdly popular in Japan, because… Japan.

In Hong Kong, the Hang Seng is down 0.62%, while in Shanghai the market’s down 0.46% in very early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 14 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MEB | Medibio Limited | 0.0015 | 50% | 1,913,085 | $4,150,594 |

| INP | Incentia Pay Ltd | 0.004 | 33% | 302,579 | $3,795,191 |

| ADG | Adelong Gold Limited | 0.009 | 29% | 3,290,743 | $3,736,756 |

| EMU | EMU NL | 0.0025 | 25% | 12,075,588 | $2,900,043 |

| RR1 | Reach Resources Ltd | 0.005 | 25% | 130,197 | $9,510,203 |

| PNM | Pacific Nickel Mines | 0.08 | 21% | 255,080 | $24,820,048 |

| NC6 | Nanollose Limited | 0.048 | 20% | 55,000 | $5,955,455 |

| POL | Polymetals Resources | 0.22 | 19% | 8,000 | $8,358,798 |

| IS3 | I Synergy Group Ltd | 0.019 | 19% | 3,000 | $4,625,286 |

| FIJ | Fiji Kava Limited | 0.007 | 17% | 1,789,515 | $2,186,876 |

| TYM | Tymlez Group | 0.014 | 17% | 72,945 | $13,106,344 |

| BUX | Buxton Resources Ltd | 0.205 | 14% | 169,348 | $28,006,842 |

| IVR | Investigator Res Ltd | 0.041 | 14% | 12,834,357 | $51,737,892 |

| TI1 | Tombador Iron | 0.025 | 14% | 403,759 | $47,013,612 |

| RXL | Rox Resources | 0.295 | 13% | 1,555,665 | $58,332,108 |

| AVE | Avecho Biotech Ltd | 0.009 | 13% | 1,142,896 | $14,702,955 |

| GFN | Gefen Int | 0.055 | 12% | 50,000 | $3,336,906 |

| NEU | Neuren Pharmaceuticals | 10.13 | 11% | 1,443,065 | $1,147,754,995 |

| SPD | Southern Palladium | 0.525 | 11% | 46,661 | $20,354,510 |

| CAI | Calidus Resources | 0.25 | 11% | 1,223,676 | $98,898,939 |

| TNY | Tinybeans Group Ltd | 0.3 | 11% | 71,517 | $16,574,073 |

| LSR | Lodestar Minerals | 0.005 | 11% | 1,000,000 | $7,822,968 |

| KNG | Kingsland Minerals | 0.16 | 10% | 147,498 | $3,978,777 |

| AGD | Austral Gold | 0.044 | 10% | 74,116 | $24,492,454 |

| EMC | Everest Metals Corp | 0.0825 | 10% | 144,482 | $7,982,483 |

In Small Caps, Pacific Nickel Mines (ASX:PNM) is winning the day so far, up 21.2% on news that approval has been granted for the issue of an Export Permit for its 80% owned Kolosori Nickel Project on Isabel Island in the Solomon Islands.

“The granting of approval for an Export Permit for the Kolosori Nickel Project is a major achievement for the Company and is significant as we advance works for the development of the Project,” Pacific Nickel CEO Geoff Hiller said, capitalising several words that really don’t need to be.

Pacific Nickel will now proceed with the finalisation of financing facilities being offered by Glencore with the aim of drawing down development funds at the earliest opportunity, on the belief that “the project holds relatively low technical risk and that capital payback will be achieved in under 12 months.”

A huge no-news spike in volume for Investigator Resources (ASX:IVR) has its price up 13.8%, and (probably) a speeding ticket from the ASX in the mail.

Rox Resources (ASX:RXL) has climbed 13.4% on no fresh news, but it’s bonanza grade find from earlier in the month looks like it’s made the company an attractive target for gold-hungry investors in these uncertain times.

And finally, Kingsgate Consolidated (ASX:KCN) has surged 9.93% on news that the Department of Primary Industries and Mines has completed the final re-opening inspections of the Chatree Gold Mine.

Chatree had been placed on Care and Maintenance on 1 January 2017, after the Thai government decreed that all gold mining activity would cease by 31 December 2016 for some stupid reason.

But, common sense has apparently prevailed, and Chatree – which produced more than 1.8 million ounces of gold and more than 10 million ounces of silver before it was closed – is set to get restarted in the near future.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for March 14 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| C29 | C29 Metals | 0.13 | -40% | 1,659,165 | $8,893,885 |

| MCT | Metalicity Limited | 0.002 | -33% | 4,000,000 | $10,513,618 |

| PHL | Propell Holdings Ltd | 0.032 | -29% | 73,781 | $4,775,995 |

| ODE | Odessa Minerals Ltd | 0.008 | -27% | 1,245,988 | $7,776,506 |

| SIX | Sprintex Ltd | 0.03 | -23% | 50,000 | $9,919,819 |

| AUK | Aumake Limited | 0.004 | -20% | 4,658,392 | $4,372,235 |

| MTL | Mantle Minerals Ltd | 0.002 | -20% | 1,438 | $13,364,013 |

| ROG | Red Sky Energy | 0.004 | -20% | 784,611 | $26,511,136 |

| MYG | Mayfield Group Ltd | 0.275 | -19% | 325 | $30,799,204 |

| OLI | Oliver’S Real Food | 0.019 | -17% | 885,324 | $10,136,834 |

| NES | Nelson Resources | 0.005 | -17% | 6,351,538 | $3,531,566 |

| A8G | Australasian Metals | 0.135 | -16% | 76,644 | $6,587,279 |

| BEX | Bikeexchange Ltd | 0.011 | -15% | 367,300 | $12,113,961 |

| PXX | Polarx Limited | 0.011 | -15% | 4,210,685 | $17,588,310 |

| BYH | Bryah Resources Ltd | 0.017 | -15% | 829,685 | $5,625,069 |

| AKM | Aspire Mining Ltd | 0.052 | -15% | 183,500 | $30,965,856 |

| CPT | Cipherpoint Limited | 0.006 | -14% | 437,164 | $8,005,717 |

| CXU | Cauldron Energy Ltd | 0.006 | -14% | 2,392,038 | $6,520,976 |

| YAL | Yancoal Aust Ltd | 5.89 | -14% | 4,260,604 | $9,058,214,538 |

| PSC | Prospect Res Ltd | 0.195 | -13% | 2,421,793 | $104,008,379 |

| CG1 | Carbonxt Group | 0.052 | -13% | 139,833 | $16,517,932 |

| WR1 | Winsome Resources | 1.66 | -13% | 1,856,250 | $310,292,270 |

| BTE | Botala Energy | 0.1 | -13% | 20,000 | $6,131,417 |

| M24 | Mamba Exploration | 0.1 | -13% | 161,805 | $7,013,084 |

The post ASX Small Cap Lunch Wrap: Who needs to stop before they make themselves sick today? appeared first on Stockhead.

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

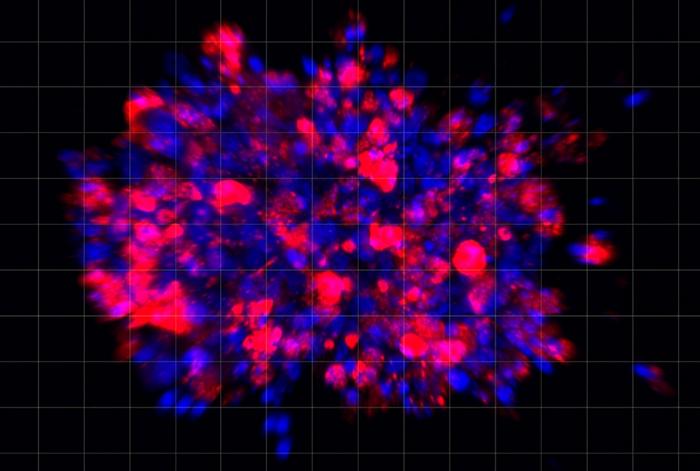

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…