Government

Best Penny Stocks To Buy? 3 To Watch Before Next Week

Are these top penny stocks to buy after recent milestones?

The post Best Penny Stocks To Buy? 3 To Watch Before Next Week appeared first on Penny Stocks…

When it comes to day trading, penny stocks have carved out a niche of their own. Defined as shares trading for less than $5, these stocks belong to companies that often fly under the radar. Yet, penny stocks can offer a world of potential for day traders willing to navigate the inherent risks. This potential stems from their volatility, the opportunity for significant returns, and the thrill of uncovering hidden gems in the market.

The Appeal of Penny Stocks for Day Traders

Penny stocks and their low price means that even small absolute changes can translate into significant percentage gains or losses. For instance, a $0.25 increase on a $0.50 stock equates to a 50% return. This potential for rapid and substantial gains is part of the allure of penny stocks for day traders.

For instance, look at one of the top penny stocks today, Advanced Health Intelligence Ltd. (NASDAQ: AHI). Shares exploded without warning, news headlines, or immediately apparent fundamental catalysts. Shares of AHI stock rallied from around $0.30 on Thursday to highs of over $1.67 Friday morning. This type of explosive action isn’t uncommon for stocks under $5.

However, it’s crucial to understand that trading penny stocks is not without risks. These stocks can be subject to price manipulation and lack the liquidity of larger, more established stocks. Furthermore, information about penny stock companies can be scarce, making it more challenging for traders to conduct thorough due diligence. As such, while penny stocks can offer substantial returns, they are also associated with a high risk of loss.

Strategies for Identifying Penny Stocks to Buy

Identifying potential penny stocks to buy is essential for any day trader. This process often involves combining technical analysis, fundamental analysis, and staying abreast of market news.

Technical analysis involves studying price patterns and trading volumes to predict future price movements. For instance, a sudden surge in trading volume could indicate increased investor interest and potentially precede a significant price movement.

Fundamental analysis, on the other hand, involves evaluating a company’s financial health, competitive position, and overall market conditions. This can help traders identify undervalued stocks with strong growth potential.

Finally, staying informed about market news can provide valuable insights. News of a new product launch, a strategic partnership, or a regulatory approval can lead to a surge in a penny stock’s price. Conversely, negative news can trigger a sharp decline.

Navigating the Risk/Reward Landscape of Penny Stocks

Trading penny stocks is a high-risk, high-reward endeavor. The risk of substantial losses often accompanies the potential for significant returns. This makes risk management a crucial aspect of trading, in general.

Day traders often use stop-loss orders to limit their potential losses. This involves setting a predetermined price at which the stock will be sold if the price starts to fall. This can help protect traders from significant losses if the price of a penny stock plummets.

While trading penny stocks offers the potential for significant returns, it also comes with a high level of risk. By understanding these risks and rewards and staying informed about market developments, day traders can navigate the penny stocks landscape more effectively.

Oatly Group (OTLY)

Shares of Oatly have taken off on Friday, which continues a multi-week move for the penny stock. The plant-based dairy company has announced several milestones over the last month. Its most recent update highlighted the launch of a new plant-based cream cheese in the US.

Commenting on the development, President Mike Messersmith said, “We’re extremely excited about the launch of our new cream cheese in the US, as it not only expands our mission to bring more plant-based consumption occasions to consumers but also continues to prove the versatility and opportunity for oat-based products.”

Mizuho Securities recently boosted its price target on OTLY stock. It increased the $6 target to $7. Mizuho also maintains a Buy rating on Oatly Group.

Grab Holdings Ltd. (GRAB)

The self-proclaimed “Super app company” targets the Southeast Asia market offering delivery, mobility, and digital financial services to its users. Grab began taking flight last month, thanks to more headlines from the company.

It announced a target to reach “zero packaging waste” by 2040. Many companies are working toward a more Environmental, Social & Governance (ESG) focus on appealing to specific groups of investors. To reach carbon neutrality, Grab reduced 48,000 tons of emissions in 2022. It also said that roughly 50% of its deliveries in Singapore are made via zero-emission modes of transport.

Despite a drop following earnings, GRAB stock has done nothing but climb since the beginning of June. Part of the excitement seems to have stemmed from a few different tailwinds, including strength in Asia-Pacific stocks. In addition, Grab also announced that its co-founder Tan Hooi Ling intends to step down this year. With the anticipation of fresh leadership, some speculatively bullish sentiment has grown in the stock market this month.

Ardelyx Inc. (ARDX)

Ardelyx has surged for most of the year. A recent bout of selling pressure took shares back into the penny stock range. The company reported an FDA committee backed its kidney disease drug candidate and recommended its approval. The FDA also granted Ardelyx an appeal for its treatment candidate, Xphozah, and a Complete Response letter for a New Drug Application.

The FDA accepted its resubmission of a New Drug Application for XPHOZAH, which helped lift ARDX stock. A recent presentation at the Jefferies Healthcare Conference this week and a current push to raise the company’s common share count have breathed some new life back into the market.

A mix of solid performance from these milestones may have also led to a bullish outlook from analysts. Wedbush, for example, upgraded the penny stock to Outperform and raised its price target to $6. While recent earnings results and the accompanying business update helped bring more upward momentum for the stock, something could be stoking speculation.

List Of Penny Stocks

- Oatly Group (NASDAQ: OTLY)

- Grab Holdings Ltd. (NASDAQ: GRAB)

- Ardelyx Inc. (NASDAQ: ARDX)

The post Best Penny Stocks To Buy? 3 To Watch Before Next Week appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

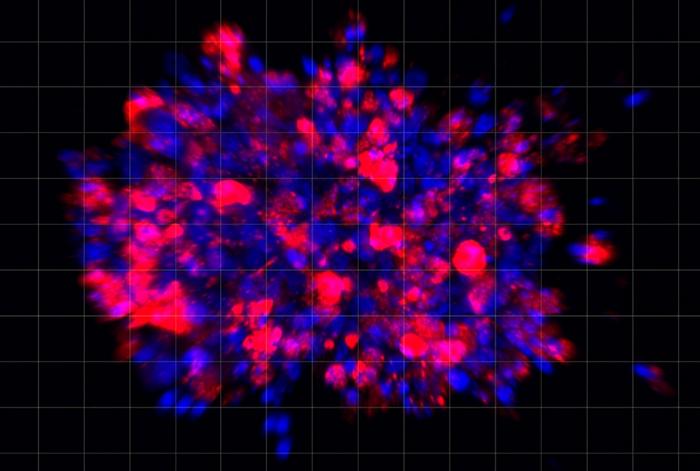

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…