Government

Chasing elephants: How Volpara’s new CEO is making this cancer fighter profitable for future growth

Biotech Volpara (ASX:VHT) has seen its share price rise 44% YTD after positive announcements including first profitable quarter. … Read More

The post…

- Volpara share price has risen 44% YTD after positive announcements including first profitable quarter

- US FDA finalises new federal regulation on breast density language which could boost cancer-fighting stock

- Profitability and growth a priority for its new CEO, which will soon celebrate 12 months in the top job

It’s been a good start to 2023 for Volpara Health Technologies (ASX:VHT) and its new CEO Teri Thomas. VHT, which focuses on the early detection of breast cancer, has seen its share price soar ~44% YTD after several positive announcements.

VHT recorded its first net cash flow positive quarter and just today it was announced that the US FDA had finalised a new federal regulation requiring mammography facilities across the country to inform patients whether their breasts are composed of dense tissue.

The new ruling will significantly benefit VHT as nearly 40 million mammograms are performed each year in the US, of which its software is used to assess the breast density of more than 6 million annually.

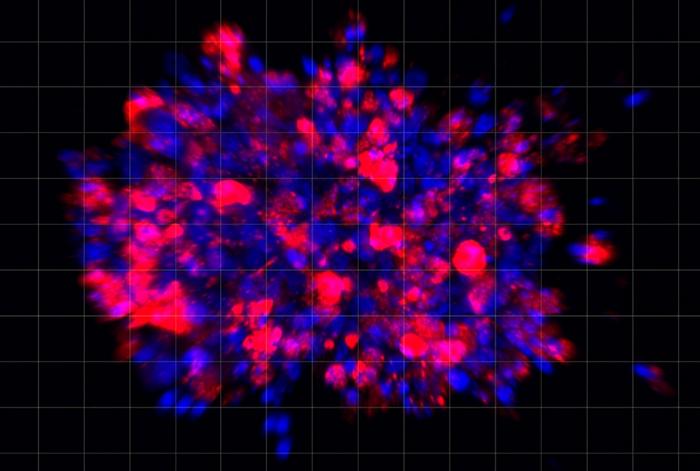

VHT’s proprietary technology, the Volpara TruDensity AI algorithm, has been cleared by the FDA, Health Canada, and the TGA (Australia), is CE-marked, and has been validated in more than 400 articles and research abstracts.

CEO Teri Thomas told Stockhead VHT had been waiting for the regulations since 2019 and will help save lives, decreasing interval cancers and detecting cancers earlier for thousands of women.

“It will have an impact in the US but I also believe it will have an impact in non-US markets,” she said.

“For the US to take such a strong stance about density validates the importance of density as a risk factor for breast cancer.”

Thomas’s journey to Volpara

Thomas became CEO of New Zealand-based VHT in April 2022, having come from a background in health technology in the US.

She started her career working for the electronic medical records giant Epic and with a background in zoology was considering becoming a doctor.

“I was recruited to work for Epic while I was in college and mentally thought I will take this job for a couple of years and put away some money and then go back to med school,” she said.

Thomas said two years became 20 and when she first joined Epic she was working as project manager helping to install electronic medical records, the first real system of its kind for doctors.

“A few people told me you impact a lot more patients by getting them off paper and leveraging the power of computers to improve their healthcare than you would seeing one patient at a time,” she said.

When Thomas started with Epic it was relatively unknown with fewer than 100 employees but she rose through the ranks and was heavily involved in building the company to its strong position today.

For her 20-year anniversary she was sent on a sabbatical with her family with the only criteria it had to be somewhere she hadn’t been before.

Having extensively travelled to up to 90 countries, she settled on New Zealand and along with her family fell in love with the culture and country’s natural beauty.

She ended up leaving Epic, got the necessary visas, went on to other work and studied for her masters in nursing.

“I did that to come back to really wanting to make an impact on patients and living my values of being a person that finds the science of healthcare fascinating – but also the caring of being a nurse and healthcare provider is fulfilling to me, too,” she said.

While doing her masters she received a call from someone at VHT after it had acquired breast cancer risk assessment company CRA Health in 2021, which had a large base of Epic clients.

“I did a consulting engagement, which I thought would last four to six weeks but really became enthralled with the purpose of the company and so many people I spoke with at Volpara were aligned with me on wanting to make a positive impact on patients and healthcare,” she said.

Thomas agreed to stay on as a consultant and, after graduating from nursing, did some COVID-19 nursing but as the pandemic became more manageable she did more work with VHT.

She was approached by the board of Volpara and former CEO Ralph Highnam, founding director and now chief science and innovation officer, to become their new CEO.

Profitability and growth becomes priority

Thomas said she is probably old school when it comes to business and when she was considering the role looked at the profitability of VHT after a discussion with a mentor.

“I was schooled at Epic that everything you do has an eye to profit. And it is a very profitable company, which grew bootstrapped without any venture capital funding and a lot of outside money,” she said.

“Everything we did we were thinking about ROI, what is the value proposition, how will it help customers and will they pay for it?”

Founded in 2009 and listed on the ASX in 2016, Thomas said she did an assessment of VHT and saw some fairly low hanging fruit opportunities to cut down some of its costs base and also boost growth.

“From the day I took the job I addressed profitability,” she said.

Elephant strategy to drive growth

Volpara has moved to securing agreements with several “elephant-sized” industry leaders for recurring revenue growth.

“Being a profitable, self-sustaining, strong company is not in opposition to its mission of saving families from cancer but supports it because when we’re spending less than bringing in, it enables us to grow in a really healthy way,” Thomas said.

Thomas implemented an elephant strategy, which is focusing on doing a really good job with large healthcare organisations.

“While it feels a little uncomfortable because you just want to love everyone the same from a financial health and profit-margin perspective it is much easier to get to that point of being consistently profitable if we focus our sales efforts on those that will provide the biggest return,” she said.

“We can save a heck of a lot more families from cancer by engaging really well and closely with 20 large organisations than with 200 small ones.”

Science, tech and innovation coming together

VHT is well known for its science with several staff holding PhDs, including founder Ralph Highnam. Thomas said the company is still focused on its science team doing discoveries but in a way now where it is not valued for the sake of a discovery like perhaps a university.

She said VHT is focusing its efforts now on developing innovations, which customers will be willing to pay for and in turn support its future financial health and fiduciary duties as a public company to return shareholder value.

“The software enabled us to do the science stuff but I see us a software company that the science enables, and we’ve got strategic assets that are valuable. And now we are looking at how we pull together this software, expertise and science to deliver new innovations.”

Cheque is in the mail

Thomas said she would love to see continual profitable quarters going forward but it’s a journey and the way VHT get paid in its biggest market of the US is still mostly by cheque.

“Literally we send people to our PO box to see what cheques are in the mail and I know it sounds so archaic but it’s still how business happens in the US and we haven’t been able to convert customers to paying electronically consistently,” she said.

“Quarter to quarter, whether we are profitable or not profitable may be a matter of did that $250,000 cheque come at the last day of the quarter or first day of the next quarter.”

Thomas said they also have one quarter where more incentives are paid and so is more expensive.

“I anticipate we will at least have one quarter because of those extra costs where we dip and then close to line for the others,” she said.

“In our guidance to the market this fiscal year starting in April we’re not committing this will be our breakeven year but the following year we expect to be consistently breakeven,” she said.

The VHT share price today:

The post Chasing elephants: How Volpara’s new CEO is making this cancer fighter profitable for future growth appeared first on Stockhead.

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…