Government

CMS to work closely with FDA on accelerated approval payment reforms

The FDA has historically not dealt with drug pricing, unless it’s related to savings from generic drug competition.

But that’s slowly changing now,…

The FDA has historically not dealt with drug pricing, unless it’s related to savings from generic drug competition.

But that’s slowly changing now, with CMS saying it will work closely with the US drug regulator on both a new pilot project to try to save the federal government on accelerated approval drugs, and on implementing the Inflation Reduction Act, which will establish new government price negotiations.

“CMS is still exploring the specific approaches to payment adjustments in the Accelerating Clinical Evidence Model, and any approach will be developed in close coordination with the Food and Drug Administration,” a CMS spokesperson told Endpoints News via email.

That close coordination between FDA and CMS on the accelerated approval pilot will be key, as industry insiders predict drugmakers will pull out all the stops to dodge what may be a major impediment to a big source of industry revenue, especially for smaller companies with only a few assets.

The move to engage the pilot represents a big shift in CMS and the federal government’s thinking.

Pharma companies sometimes drag their feet on these confirmatory trials, required as part of the accelerated approvals, knowing that patients and payers are still paying full price even without the complete set of clinical evidence the agency typically requires for a full approval. But Congress and President Joe Biden recently signed off on new authority for the FDA to begin requiring these confirmatory trials prior to the approval.

The question that CMS’ Innovation Center now needs to answer with its pilot is: Do reduced payments for accelerated approvals actually speed up confirmatory trials, facilitate earlier withdrawals of drugs that don’t prove to work, or lead to fewer payments from CMS for drugs that end up not working?

HHS’ inspector general said in a September report that Medicare and Medicaid spent more than $18 billion from 2018 to 2021 for 18 drugs (or 35 drug applications granted accelerated approval) with incomplete confirmatory trials that are past their original planned completion dates.

And what’s to stop pharma companies from just factoring in this reduced payment into the initial launch price? Not much, experts say.

Anna Kaltenboeck, who leads the prescription drug reimbursement group at health research firm ATI Advisory, explained via email that how pharma tries to game the system “will depend on the price benchmark that determines payment under the demo,” adding:

If the model applies a discount to that amount, then manufacturers could certainly factor that into launch prices for products that haven’t come to the market yet. (Drugs that are already on the market and reimbursed under Part B may find it harder to raise list prices dramatically on short notice. It takes 6 months for higher prices to be reflected in Medicare’s payment rate to physicians, who often still have to pay the higher price at acquisition in the meantime.)

Anna Kaltenboeck

Anna KaltenboeckBut there are other ways CMS could position the accelerated approval pilot so higher launch prices won’t help.

For instance, if CMS uses a benchmark for payment that manufacturers don’t control, Kaltenboeck notes, then “a high launch price strategy won’t work. There are several ways to do that. For example, CMS could use an average of payments for other drugs in a given therapeutic class, known as ‘therapeutic reference pricing.’ Another example is what the Trump administration proposed a much broader demo in Part B, which was to make use of international prices.”

Whatever the solution, it may be more complicated than it seems, particularly as CMS has already raised concerns about changing differing prices for drugs that have won accelerated approvals for certain indications but full approvals for others.

Rachel Sachs

Rachel SachsRachel Sachs, a law professor at Washington University in St. Louis, pointed out to Endpoints that CMS won’t be “forcing companies to charge less — this is a change in reimbursement to providers. Companies can charge what they want. Providers may not be willing to prescribe.”

But as to concerns that prices for some of these accelerated approvals would potentially fall so low that some physicians will stop using these Part B drugs, Kaltenboeck said she thinks “that is avoidable,” adding:

The report stated clearly that any model would seek to avoid penalizing patients and providers. Past demos have experimented with ways to make providers whole without relying on markups; MedPac has pointed to ways to do this as well.

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

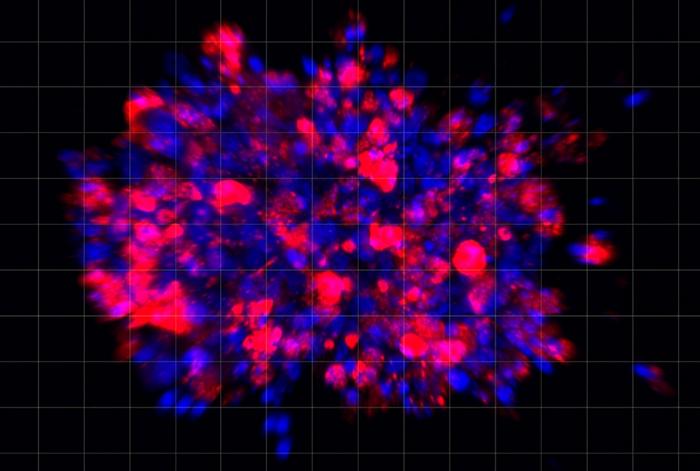

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…