Government

Friends, Foes and Frenemies

The foundation for any relationship is trust. Yet, we live in a world where deception reigns supreme. The Food and Drug Administration (FDA) pushes risky…

The foundation for any relationship is trust.

Yet, we live in a world where deception reigns supreme.

- The Food and Drug Administration (FDA) pushes risky drugs on us that can make us sicker.

- Social media companies censor those they disagree with.

- Last month, the world’s elite gathered to discuss climate change at Davos, Switzerland. However, they used 1,040 private jets, emitting as much CO2 in a week as 350,000 cars.

- Corporate chief executive officers (CEOs) tell us everything is hunky dory. Meanwhile, they’re laying off employees by the droves.

- Gov. Gavin Newsom told 40 million California residents to stay home during COVID. Yet, he galloped to restaurants maskless.

Wokeism has poisoned the mainstream media into us not believing anything they say.

We’ve already lost faith in our politicians.

And we’ve known for years now we can’t trust Wall Street.

But the stock market is a necessary evil.

Our government’s reckless spending habits have crushed the dollar. Inflation is eating away at our savings and diminishing our purchasing power to smithereens.

If you want any chance at retiring comfortably, you must put your money to work in the stock market.

That’s why it’s critical that you know who the key players are and whether or not they’re friends, foes or frenemies.

Foes

The Federal Reserve Bank.

In the summer of 2005, Federal Reserve Bank Chairman Ben Bernanke was asked by an interviewer if we were in a housing bubble. He said the economy was growing, mortgage rates were low and the demographics supported housing growth.

When he was asked about a worst-case scenario, Bernanke confidently told the interviewer that the bank regulators would pay close attention to the kinds of loans being made and ensure that underwriting is done right. Moreover, it wasn’t something that would affect the national economy.

What’s even more impressive … in the summer of 2007, he told the American people that the economy was likely to expand at a moderate pace over the second half of 2007, with growth then strengthening a bit in 2008 to a rate close to the economy’s underlying trend.

YIKES.

But in all fairness, Bernanke shouldn’t get all the credit or the blame — since the Federal Reserve Board employs just over 400 Ph.D. economists.

Somehow, Bernanke’s team failed to foresee one of the worst financial crises the world has ever experienced… wiping out more than $2 trillion from the global economy.

Fast-forward to the present.

You’ll see “Helicopter Ben” criticizing the Fed, saying the U.S. central bank was slow to respond to inflation.

Pot, meet kettle.

Bernanke is a tough act to follow. But that doesn’t mean current Fed Chairman Jerome Powell isn’t trying. In 2021, he told us that inflation was “transitory” and that high prices were just temporary.

He said that inflation would come down to 3% in 2022 and 2% in 2023.

OOPS.

Two-year Treasury Notes reached their highest yield level since November last week.

Can we really trust the Fed this time around?

If you’re skeptical like us, you may want to look at one recommendation Mark Skousen has.

Frenemies

Wall Street Analysts

Sentiment plays a pivotal role in how stocks perform. All you have to do is look back to last year when the sentiment shifted from high-growth stocks to value.

One of the key drivers of sentiment is the analysts on Wall Street. They’re great when they’re bullish on one of your holdings.

It’s okay to sip the Kool-Aid… just don’t chug it.

In 2021, five analysts gave Carvana (CVNA) a price target of $400 or higher. JMP Securities was the most bullish, giving the struggling online car dealer a price target of $470 in August of 2021.

The problem with analysts is that they’re sheep. And in this game, sheep get slaughtered.

Last month, JMP Securities downgraded CVNA from $25 to $15.

This points to another problem with analysts. They are often late to the party.

On April 21, 2022, Wedbush lowered its price target on CVNA from $160 to $120. Less than eight months later, Wedbush lowered its price target on CVNA to $1.

Yes, the price target became one stinking dollar!

How can you be so wrong yet still have a job?

But the beauty of Wall Street is that if everyone is wrong, you all get to keep your jobs. That’s why it’s so risky for them to go against the grain.

Analysts quickly downgraded the stock when blood was on the street on Tesla (TSLA).

While most Wall Street firms were downgrading TSLA in January, Mark Skousen saw it as an opportunity. He recommended to Fast Money Alert subscribers to get long at $125. And despite all the choppy price action in the market, TSLA is still trading comfortably above $200 per share.

Don’t let analysts’ upgrades or downgrades influence your decision-making, as they are often late and wrong.

In addition, they are usually biased. For example, if the company does business with the bank, does it make sense for the bank’s research department to speak negatively about the company?

On the other hand, analysts have direct lines to corporate insiders. Their research can be valuable at times. But take it with a grain of salt.

Friends

Independent Financial Research

While Wall Street firms have access… it’s hard not to believe they don’t act with a conflict of interest.

That’s why it’s essential to conduct your own due diligence. And if you need help, make sure it’s coming from an independent source, not from a party that’s in bed with Wall Street.

You can rest assured our team doesn’t have any conflicts of interest. And that our goals are aligned with yours.

We also understand that not every individual is at the same point in their journey and has the same goals or appetite for risk.

If you’re someone who is looking for ways to generate income, few do it better than Bryan Perry and his Premium Income Pro trading service.

On the other hand, if you have a higher-risk appetite and are seeking extraordinary returns, you’ll want to check out Jim Woods’ High-Velocity Options and Mark Skousen’s Fast Money Alert services.

For those who already have their nest egg and now want to protect it by taking advantage of money-saving tax strategies and estate planning loopholes, there’s no one better to learn from than Bob Carlson and what he offers to his Retirement Watch subscribers.

Wherever you are in your journey, know we’re here to help. The stock market is a necessary evil. Stay safe, and don’t forget who your friends, foes and frenemies are.

The post Friends, Foes and Frenemies appeared first on Stock Investor.

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

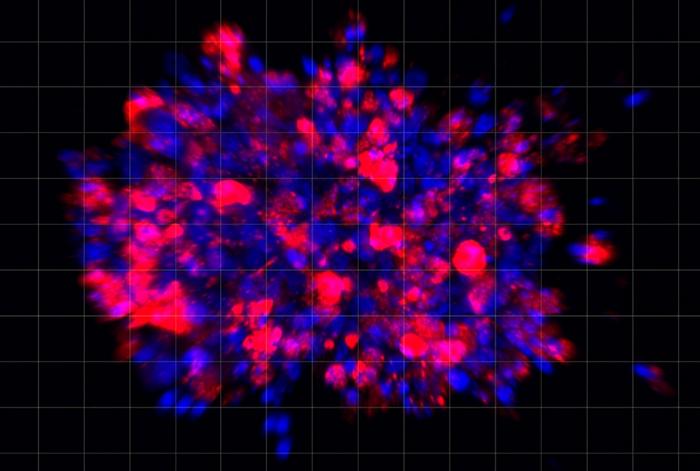

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…