Government

Galapagos seeks ‘strategic options’ for Jyseleca as JAK inhibitor sales disappoint again

Galapagos is assessing “various strategic options” with Jyseleca, the JAK inhibitor that once inspired blockbuster projections but repeatedly disappointed.

The…

Galapagos is assessing “various strategic options” with Jyseleca, the JAK inhibitor that once inspired blockbuster projections but repeatedly disappointed.

The Belgian biotech attributed the move to the EU’s recent recommendations to limit the use of JAK inhibitors, noting major side effects such as malignancy, major adverse cardiovascular events, serious infections, venous thromboembolism and even death in some patients.

Thad Huston

Thad Huston“The market and competitive landscape for the JAK class in Europe has changed significantly over the past six months, negatively impacting net sales of Jyseleca and leading us to revise our 2023 net sales guidance for Jyseleca in rheumatoid arthritis and ulcerative colitis from €140-€160 million to €100-€120 million,” CFO and COO Thad Huston said in a second quarter update. “In response to that, we are in the process of evaluating various strategic options for Jyseleca.”

It marks a new low for prospects of Jyseleca, also known by its experimental name filgotinib. Gilead once paid Galapagos $725 million in cash to partner on the drug and analysts forecast peak sales of more than $1 billion. But following a surprise FDA rejection, Gilead eventually gave up on US approval and handed back most of the rights.

Even though Galapagos did secure approval in Europe and Japan in rheumatoid arthritis and ulcerative colitis, it gradually tapered expectations for Jyseleca, which remains the only commercial drug in its portfolio. Earlier this year, the biotech axed filing plans for Crohn’s disease in the wake of a negative Phase III readout.

Under CEO Paul Stoffels, Galapagos has continued to build on its small molecule work in immunology while adding a CAR-T unit to tackle oncology. With cash and current financial investments of €3.9 billion (near $4.3 billion), it reiterated plans to seek deals around those areas.

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

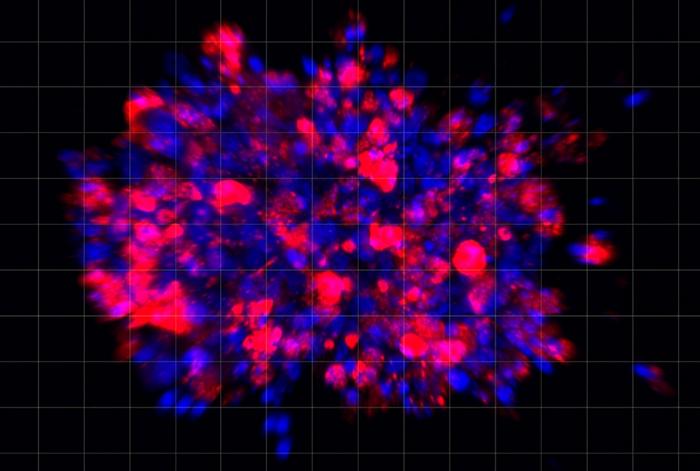

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…