Government

Idorsia announces few details on potential $440.8M Asia licensing deal

Swiss biopharma Idorsia gave out few details Tuesday about a potential $440.8 million (400 million CHF) deal with an unnamed company that would include…

Swiss biopharma Idorsia gave out few details Tuesday about a potential $440.8 million (400 million CHF) deal with an unnamed company that would include licensing rights to some of Idorsia’s products in the Asia-Pacific region, excluding China.

Idorsia CFO André Muller said in a statement that the “strategic transaction” would extend the company’s cash runway and is expected to be completed in July. The company’s most recent financial results from the first quarter of 2023 showed cash and cash equivalents of $233.5 million (CHF 212 million) with a total indebtedness of $1.4 billion (CHF 1.292 billion).

At the time, Idorsia said it was considering non-equity dilutive funding avenues and an equity raise should it be needed to extend the cash runway due to “the slower than expected speed of payer coverage” of its insomnia drug Quviviq and resulting uncertainties on revenue.

On top of the rollout challenges, Idorsia has been hit with several recent trial fails with other programs. Its stock has also declined since February, going from around $16 to floating around $8 and $9 in May and June.

In February, Idorsia ended a program for its brain bleed drug clazosentan after it flunked a Phase III trial when it did not meet the main goal of the late-stage REACT study, conducted in the US, Canada and Europe since early 2019. Idorsia had been working on the drug for about two decades, in part via its founder’s previous company, Actelion, bought out by Johnson & Johnson.

Two months before the clazosentan flop, another Idorsia drug, licensed to Neurocrine Biosciences, flunked a Phase II trial in epilepsy.

André Muller

André Muller“This prospective strategic transaction would allow Idorsia to realize the significant value we have created in the region, and would extend our cash runway, while maintaining relationships for the future development and commercialization of our pipeline programs in the region,” Muller said in a statement.

Jefferies analysts said in a note Tuesday morning that they estimate it extends the cash runway out to the first quarter of 2024. Analysts added that one of the products this deal could cover is Idorsia’s selatogrel, which is currently in Phase III trials for the treatment of suspected acute myocardial infarction – and makes up a “lion’s share” of the company’s annual R&D spending. A readout is expected in 2025.

This isn’t Idorsia’s first foray into Asia. In 2022, Chinese biopharma Simcere picked up regional rights to its insomnia drug for $30 million upfront. Simcere got the rights in China, Hong Kong and Macau.

The drug is known as Quviviq in the US and Europe after it snagged an FDA approval early in 2022, followed by EU approval.

In addition, Idorsia will get another $20 million from Simcere if the Chinese regulatory agency approves the drug, followed by payments in “low double-digit” tiered royalties and other commercial milestones.

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

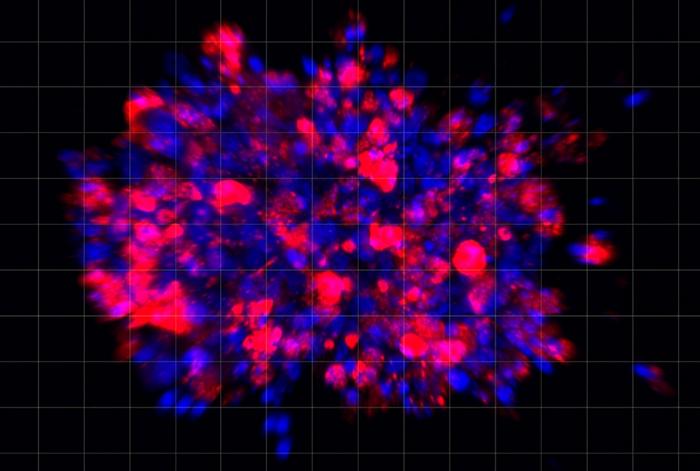

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…