Government

ObsEva makes cuts to leadership team, board of directors in another attempt to stay afloat

Women’s health biotech ObsEva is downsizing its US-based executive team and board of directors, the company announced Friday, the latest in a series…

Women’s health biotech ObsEva is downsizing its US-based executive team and board of directors, the company announced Friday, the latest in a series of austerity measures.

Brian O’Callaghan

Brian O’CallaghanBrian O’Callaghan stepped down as CEO on Feb. 23. The chief commercial officer, chief clinical officer and chief transformation officer also left ObsEva on Thursday. The current CFO, Will Brown, will take on a second role as interim CEO while the company searches for a permanent leader.

As for the board, ObsEva founder Ernest Loumaye will be nominated for chairman while five other members won’t look for reelection at this year’s meeting, including O’Callaghan.

The leadership cuts will give the company a bit more cash, with annual compensation savings of approximately $3.5 million.

ObsEva is also retiring $6.5 million of convertible debt, will likely be delisted from Nasdaq and intends to deregister from the US SEC. The company will still be listed on the SIX Swiss Exchange. The debt is owed to “certain funds and accounts” managed by JGB Management.

Will Brown

Will BrownBut the Swiss-based company isn’t giving up yet. It still has nolasiban, an oral oxytocin receptor antagonist the company in-licensed from Merck KGaA, designed to improve pregnancy and live birth rates in women following in vitro fertilization.

“We intend to initiate a Phase 1b trial for nolasiban in the second half of 2023 as we remain committed to our mandate of improving women’s health,” Annette Clancy, chairwoman of the board of directors, said in a statement. Clancy is one of the board members who will not seek reelection this year.

Last November, the company sold all its rights to ebopiprant, a PGF2α receptor antagonist being tested in Phase II for preterm labor, to XOMA for $15 million upfront, plus $98 million in milestones for a total of $113 million.

At the time, O’Callaghan said the sale would give the biotech more than a year of runway after the FDA raised an issue with certain deficiencies in ObsEva’s NDA for then-lead drug linzagolix for uterine fibroids. ObsEva had in-licensed the drug from Kissei.

ObsEva eventually gave linzagolix back to Kissei after the FDA setback, setting off a massive stock sell-off and layoffs.

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

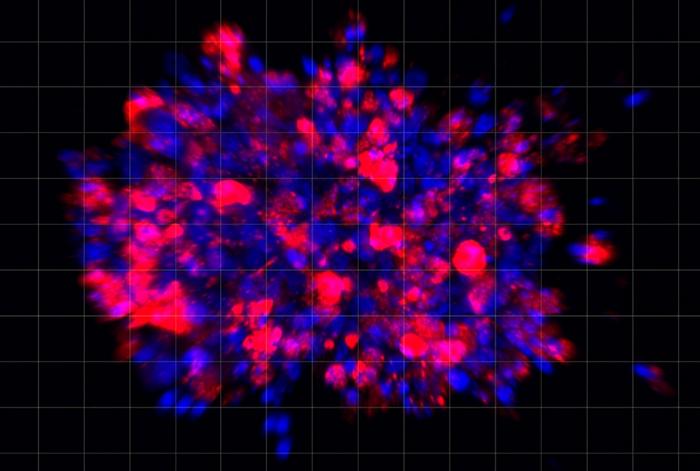

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…