Government

ScoPo’s Powerplays: ASX health stocks fall but don’t throw the baby out with the bathwater

ASX health stocks down for the past five days but Morgans’ Scott Power reckons some major companies are now trading … Read More

The post ScoPo’s Powerplays:…

- ASX health stocks fall in past five days with Power noting larger names trading on attractive valuations

- Neuren Pharmaceuticals has expanded its current licensing agreement with Acadia Pharmaceuticals

- Pharmaxis reports positive results from Phase 2 trial showing its bone marrow cancer drug is effective

Healthcare and life sciences expert Scott Power, who has been a senior analyst with Morgans Financial for 26 years, is back after a holiday to explain what the movers and shakers have been doing in health and gives his ASX Powerplay.

Do you exercise? How about get enough sleep? Do you focus more on ensuring you get in your exercise and not as much on getting enough sleep?

University College London researchers conducted a study in England, focusing on the cognitive function of 8,958 individuals aged 50 and above over a span of 10 years.

The UCL researchers aimed to investigate how combinations of physical activity and sleep patterns influence cognitive function over an extended period.

The findings of the study, published in The Lancet Healthy Longevity revealed a correlation between optimal cognitive function and individuals who slept between 6 and 8 hours per night while engaging in higher levels of physical activity.

Conversely, those who slept fewer than six hours per night, despite being physically active, experienced a more rapid decline in cognitive abilities over the ten-year period.

Notably, among participants aged 70 and older, the benefits of increased physical activity on cognitive function seemed to persist regardless of hours slept.

The study concluded sleep habits should also be considered to maximise benefits of physical activity for long-term cognitive health.

To markets…

And ASX Health stocks look like they could do with a rest after another tough week of trade. At 11:50am (AEST) on Friday the S&P/ASX 200 Healthcare index (ASX:XHJ) was down 2% for the past five days, while the benchmark S&P/ASX 200 (ASX:XJO) was up 1.5% for the same period.

“The major health names are down and it’s just showing it has been a tough 12 months for the sector but they’re now trading on very attractive valuations compared to their historic levels,” Power said.

“What we’ve seen is a rotation out of those healthcare names into other parts of the market so at some point that rotation returns.”

Power said it has been a positive first half of 2023 for the smaller end of the Healthcare sector with companies achieving key catalysts like breakeven or hitting major milestones like Neuren Pharmaceuticals (ASX:NEU).

In March NEU announced its North American partner Acadia Pharma received a historic US FDA approval of trofinetide, marketed as DAYBUE, making the drug the first and only approved treatment for Rett syndrome in the world.

“We are feeling pretty buoyant but recognising the healthcare market as a whole has really underperformed this year so far,” Power said.

“We continue to look for opportunities and a lot of them are catalyst type opportunities or these quarterly reports which are demonstrating good strong operating performance.”

Furthermore, Power said there have been more companies topping up their cash positions through capital raises.

Re-anchoring point for CSL

Power said there has been a re-anchoring point for healthcare giant CSL (ASX:CSL) which has dropped ~9% in the past month after announcing it now expects a negative foreign currency impact of around US$230 million to US$250 million, up from US$175 million anticipated at the time of the half-year result.

“There was a downgrade to consensus numbers which we’ve referred to as a re-anchoring point to get the market back in line with a range where consensus was sitting,” Power said.

“That was the start of the slide in the CSL share price but operationally it’s going very well and they’ve done that big Vifor acquisition, which over the long-term will add significantly to the business.

“The core plasma business has certainly returned to strength after a pretty big downturn during the Covid-19 period when donations were right down.”

Neuren expands Acadia pharmaceuticals deal

The 2023 market darling of the biotech sector has expanded its current licensing agreement with Acadia Pharmaceuticals.

Acadia’s exclusive licence for trofinetide has been expanded from North America to a worldwide licence.

Existing milestone payments and royalties to NEU for trofinetide in North America are unchanged, with additional payments related to development and commercialisation outside North America.

NEU will receive US$100 million up-front, plus additional potential milestone payments of up to US$427 million and royalties on net sales of trofinetide outside North America.

The company said Acadia also provided very encouraging early insights into the US launch of DAYBUE, expecting net sales of $21-23 million in Q2 2023 and $45-55 million in Q3 2023.

Neuren has also granted to Acadia an exclusive worldwide licence to develop and commercialise NNZ2591 for Rett syndrome and Fragile X syndrome only.

The company said this enables coordinated global development, replacing the restrictions in the existing agreement on use by NEU in those two indications.

Potential milestone payments and royalties payable to NEU for NNZ-2591 in Rett and Fragile X are identical to the trofinetide milestone payments and royalties in each of North America and other regions.

NEU retains worldwide rights to NNZ-2591 in all other indications and is currently advancing Phase 2 trials in each of Phelan-McDermid, Pitt Hopkins, Angelman and Prader-Willi syndromes, with first results expected in December 2023.

“The terms look very attractive to us,” Power said.

“Importantly the rights to NZ2591 remain with NEU and clinical readouts starting at the end of CY23 will be closely watched by the market.

“The share price has responded positively this morning and will likely attract US buying interest over the next few days.”

Pharmaxis reports positive Phase 2 results

Pharmaxis (ASX:PXS) has disclosed findings of a final interim analysis involving 10 patients who underwent a six-month treatment of PXS-5505 for myelofibrosis, a type of bone marrow cancer.

The objective of the Phase 2 trial was to establish the safety and efficacy of PXS-5505, an inhibitor of all lysyl oxidase enzymes (LOX), as a standalone treatment for myelofibrosis patients who cannot tolerate, do not respond to, or are ineligible for other treatments.

A total of 21 patients were enrolled in the study, and 10 patients successfully completed the 24-week treatment.

The results indicate that PXS-5505 was well-tolerated, and no serious adverse events related to the treatment were reported.

The data also reveals encouraging signs of clinical effectiveness, such as improved symptom scores, stable or enhanced hematological parameters, and reduced bone marrow fibrosis.

Out of the 10 patients who completed six months of treatment, nine patients were assessable. Among them, five patients exhibited an improvement of ≥1 grade in bone marrow fibrosis scores.

Furthermore, four out of the five patients who responded to fibrosis treatment showed stable hematological parameters, and three out of five patients reported a reduction in symptoms.

The final outcomes from this particular group of patients will be submitted for presentation at the upcoming American Society of Hematology conference later this year.

“That was a good response for Pharmaxis,” he said.

The NEU, CSL & PXS share price today:

ScoPo’s Powerplay – Volpara due to release Q1 results

Medical imaging stock Volpara Health Technologies (ASX:VHT) is Power’s stock of the week and is due to report Q1 FY24 results next week.

VHT specialises in the early detection of breast cancer. Under the guidance of CEO Teri Thomas, who started in April 2022, VHT has been working on increasing its number of larger ‘elephant’ clients and improving average revenue per account in line with its revised strategy to target higher value, and more profitable products and clients.

“They have told the market cash receipts have been solid for the quarter which seasonally is a weaker period,” Power said.

“So that all goes well as the company continues to deliver on its strategy of moving into profitability, targeting larger clients and growing sales by at least 20% pa.”

VHT delivered its second consecutive quarter of positive net operating cashflow in Q4 FY23. Power said in a conference call in May management said it anticipates cashflow profitability in FY25 but see themselves as ~6 months ahead of schedule.

Morgans has a 12-month target price of $1.20 and Add rating on VHT.

The VHT share price today:

Disclosure: The author held shares in CSL at the time of writing this article.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article

The post ScoPo’s Powerplays: ASX health stocks fall but don’t throw the baby out with the bathwater appeared first on Stockhead.

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

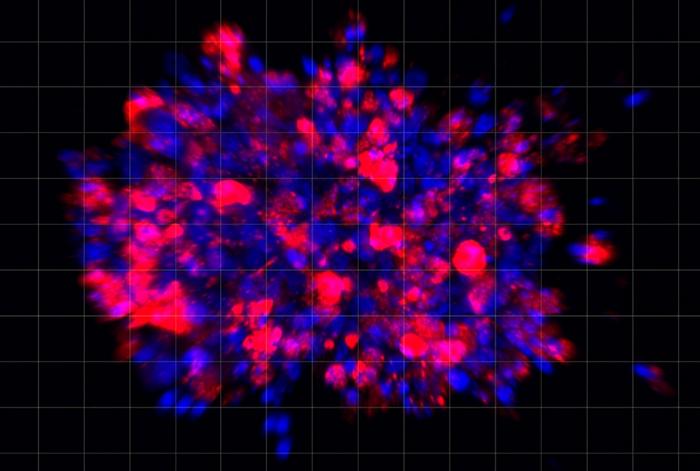

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…