Government

Turning Point Nets $9.9M in Q2 Revenue Beat

The Zig-Zag maker is riding legal industry tailwinds as more state markets open. Still, debt lingers.

The post Turning Point Nets $9.9M in Q2 Revenue Beat…

Smoking accessories dealer Turning Point Brands Inc. (NYSE: TPB) saw better-than-expected second-quarter financial results ending June 30, 2023, buoyed by rising legal consumption as more state markets open.

The company reported a 2.6% year-over-year increase in total consolidated net sales, bringing in $105.6 million in revenue, up from the same period in 2022. That eked past Yahoo analyst average estimate of $104.22 million. Net income saw a nice surge, increasing by 83% year-over-year to $9.9 million. Adjusted net income also saw a rise of 8.4% to reach $15.3 million.

Turning Points pocketed $52.5 million in gross profit, which is 2% more than the same time last year. Consolidated net sales from its Zig-Zag and Stoker’s product lines saw lifts worth 1.1% and 7.3%, respectively. However, sales from Creative Distribution Solutions, another segment of the company’s business, fell by 1.3%.

“We are seeing positive trends, with our second quarter results demonstrating continued progress against our plan,” CEO and president Graham Purdy said in a statement Wednesday. “Given our solid first half performance, we are raising our guidance for the full year.”

He added, “The Zig-Zag segment grew double-digits sequentially from the first quarter as trade inventory normalized. Stoker’s had another solid quarter of performance led by double-digit growth in Stoker’s MST.”

Total gross debt at the end of the period was $383.5 million. But after factoring in the company’s available cash, the net debt was $283 million.

The company also mentioned a few different costs it had in the second quarter. These include expenses related to systems, stock options, FDA expenses, transaction expenses, and restructuring costs.

The company also bought back some of its own debt — $15.1 million of its 2.50% convertible senior notes due July 2024. Additionally, an impairment charge of $4.1 million was recorded relating to historical minority investments in development stage ventures that didn’t work out.

In terms of outlook, the company updated its forecast for the full year 2023. It now expects an adjusted EBITDA ranging from $90 to $95 million, up from its previous outlook of $88 to $94 million.

The post Turning Point Nets $9.9M in Q2 Revenue Beat appeared first on Green Market Report.

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

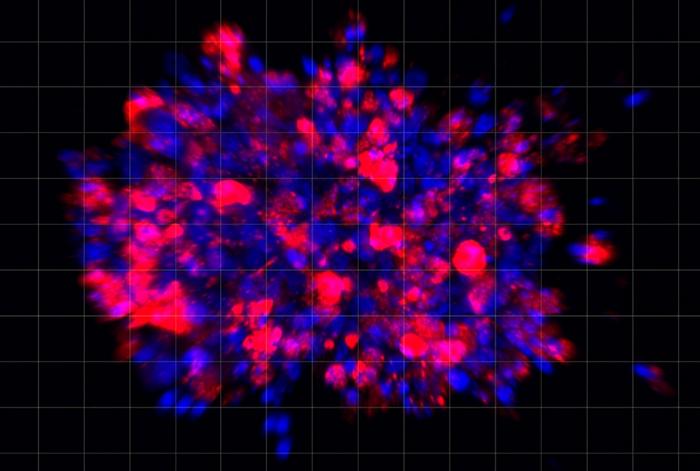

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…