Government

Updated: Catalent and activist investor Elliott agree to new board seats, strategic review amid sales decline

As it deals with major declines in revenue, the replacement of top managers and issues with its manufacturing facilities, Catalent said it has reached…

As it deals with major declines in revenue, the replacement of top managers and issues with its manufacturing facilities, Catalent said it has reached an agreement with activist investor Elliott Investment Management.

The contract manufacturer announced the deal with Elliott in conjunction with its full-year results on Tuesday.

It said that total revenue decreased 17% to $1.07 billion in the fourth quarter, down from $1.29 billion in the same three months of last year. The company’s revenue from its biologics business fell even more, down 37% to $406 million.

Catalent’s revenue tumbled 11% to $4.27 billion for the fiscal year, down from $4.80 billion in 2022.

Alessandro Maselli

Alessandro Maselli“This fiscal year was very disappointing, largely as a result of the COVID revenue and operational cliffs we have discussed,” Catalent CEO Alessandro Maselli told investors during the analyst call.

Elliott took a stake in Catalent earlier this year after a period of post-pandemic turmoil at the contract manufacturer. Under their agreement, Elliott agreed to “customary standstill, voting, confidentiality, and other provisions,” and Catalent will add four new independent directors to its board, growing it from 12 to 16 members.

The new directors are Frank D’Amelio, former CFO of Pfizer; Stephanie Okey, a former leader in the rare disease business at Sanofi’s Genzyme; Michelle Ryan, a former treasurer at Johnson & Johnson; and Steven Barg, global head of engagement at Elliott and one of Catalent’s largest shareholders.

The expanded board will also launch a strategic review led by new chairman, John Greisch, the former CEO of Hill-Rom Holdings and former CFO of Baxter, to examine “the company’s business, strategy and operations, as well as the company’s capital-allocation priorities, in order to maximize the long-term value of the company.”

Greisch told investors that the strategic review committee is to meet in September.

John Greisch

John GreischCatalent shares were up 5% in trading on Tuesday morning after the news was announced.

Ahead of the announcement, Reuters reported that the review could include a potential sale of the company, citing sources familiar with the matter.

Catalent disclosed earlier this year that it had productivity and cost issues at three of its locations, including “productivity challenges” and higher-than-expected costs at its facility in Bloomington, IN, and that it couldn’t hit its productivity and revenue goals because it had to “enhance its operational and engineering controls” after an inspection.

The company’s thrice-delayed Q3 results, finally released in June, also showed financial difficulties: its biologics manufacturing business tumbled 32%, driven by the drop-off in sales of Covid-19 vaccines.

The FDA’s inspection report showed issues with maintenance and cleaning at the Bloomington manufacturing facility responsible for the FDA rejection of a new version of Regeneron’s blockbuster drug, Eylea. The therapy was approved earlier this month.

“We prioritized everything needed to bring the FDA inspection that occurred in May to a successful closure,” Maselli said.

Catalent has made several changes over the last year to right the ship, including the departures of CFO Thomas Castellano; Mario Gargiulo, head of global operations for biologics; Mike Riley, division head for bio product delivery; and Manja Boerman, division head for bioModalities.

“We see fiscal ‘23 as a year of transition and fiscal ‘24 is a year of improvement that will create the foundation for long-term sustainable value creation,” Maselli said.

As part of that rebuilding process, the company recently installed a new general manager at the Bloomington facility, and Maselli said the search for a new biologics president, which is nearing completion, is his top priority.

The manufacturer posted a loss of $227 million, starkly contrasting the $141 million it earned a year ago. It also issued updated guidance for the year, saying it now expects revenue of $4.2 billion and $4.3 billion in 2023, compared with previous guidance from February of $4.6 billion to $4.8 billion.

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

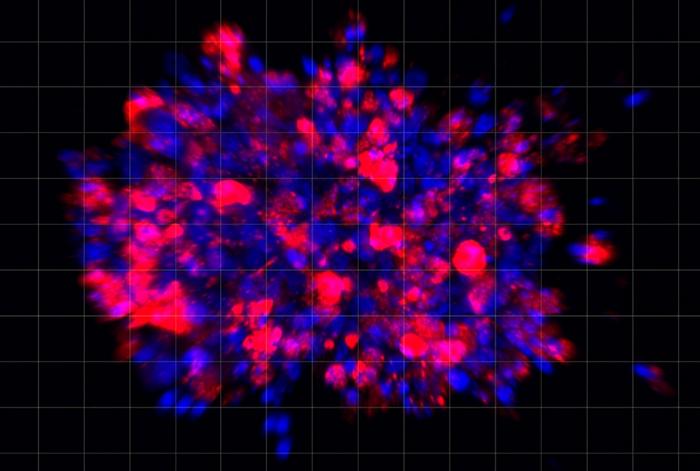

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…