Government

Verily hooks $1B round amid C-suite shuffle

Verily, Alphabet’s rather secretive life sciences outfit, is riding a $1 billion cash infusion to its “next phase of growth” — and that necessitates…

Verily, Alphabet’s rather secretive life sciences outfit, is riding a $1 billion cash infusion to its “next phase of growth” — and that necessitates a C-suite shuffle.

Stephen Gillett

Stephen GillettAfter “thoughtful succession planning,” founder Andy Conrad will step into the executive chairman role in January, handing the reins to current president Stephen Gillett, according to a Friday announcement.

Conrad helped set up Verily when it spun out of Google X back in 2015, but the chief executive quickly found himself at the center of controversy. Unnamed sources accused Conrad in a 2016 STAT piece of repelling talent and making rash decisions. Another group of unidentified staffers criticized Verily for signing headline-grabbing deals instead of focusing on its own services, according to a Reuters report last January.

When asked for additional information on Conrad’s decision to step aside, a spokesperson said in an email:

At this juncture Andy wishes to contribute in a different way as Executive Chairman and hand the reins to a proven leader who shares his vision, is equally invested in the success of Verily and well suited to lead the company in its next phase of development to commercial success.

Verily declined an interview request on Monday, but said in a news release that the decision comes as Verily “becomes a more operationally and commercially focused company executing on its precision health strategy.”

Gillett is up for the task, and he has an influx of cash to get things started. Alphabet led a $1 billion investment round, Verily revealed on Friday, which will fund the company’s work in real-world evidence, healthcare data platforms and other research. That could mean acquisitions, Verily said, adding that the company will also consider new partnerships.

Deepak Ahuja

Deepak AhujaCFO Deepak Ahuja, however, isn’t sticking around for the ride. The former Tesla CFO said he’s leaving at the end of this month after two years at Verily “for another opportunity.” He’s still listed as Verily’s CFO on LinkedIn, and the company is immediately beginning a search for his successor. Verily also saw its former health policy leader Rob Califf return to FDA as commissioner last year.

Earlier this year, Verily inked a new deal with consumer healthcare company L’Oréal, best known for its hair and skincare products. While the partners didn’t disclose the financials, the alliance is primarily focused on understanding how hair and skin age, they announced.

It also linked up with Sosei Heptares on GPCR drugs in immunology, gastroenterology and immuno-oncology back in January, and last August bought out SignalPath to build on its clinical trial system and evidence generation platform called Baseline. Amy Abernathy is overseeing those efforts as president of clinical studies platforms, after leaving a top leadership position at the FDA.

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

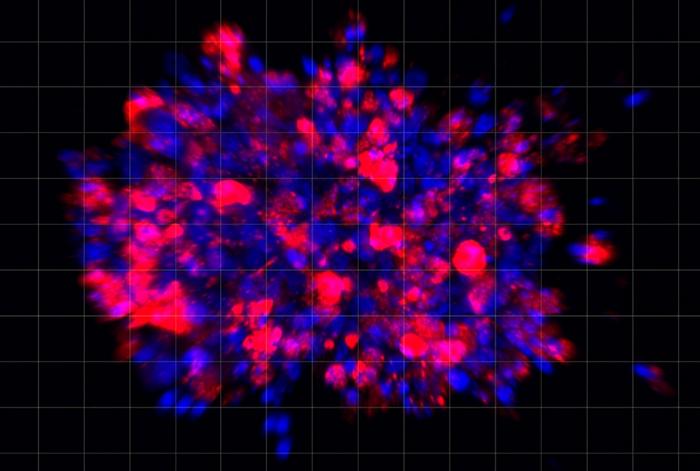

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…