Government

10 Top Penny Stocks To Watch Under $1 This Week

Penny stocks under $1 to watch this week.

The post 10 Top Penny Stocks To Watch Under $1 This Week appeared first on Penny Stocks to Buy, Picks, News and…

Penny Stocks Under $1

It’s another choppy session in the stock market today, but penny stocks remain a shining light for day traders. Despite the S&P, Nasdaq, and Dow taking a hiatus from a two-day recession-fueled sell-off, traders are getting back in the saddle in preparation for another round of economic data set to report before December 15th.

This week will see the newest Producer Price Index or PPI data come out. Meanwhile, and what may be an even more significant catalyst, next week, we’ll get the latest Consumer Price Index or CPI data results. These figures come days before the conclusion of the final FOMC meeting & press conference of 2022. So you could say there’s a lot to cram into the next week.

At the top of mind, today are penny stocks under $1. One of the main reasons for this stems from sympathy sentiment. This morning shares of Transcode Therapeutics Inc. (NASDAQ: RNAZ) exploded higher. The company didn’t make any type of biotech breakthrough. But it did announce the withdrawal of a registration statement for up to 12.5 million shares.

Traders saw this as a positive and hopes that dilution wouldn’t become a factor to grapple with. The move also came about a week after the company filed an exploratory New Drug Application to the FDA for a first-in-human trial of its solid tumor treatment candidate. Thanks to this, traders have begun hunting for more penny stocks under $1 that might have potential catalysts to keep track of.

Penny Stocks To Watch Under $1

This article continues our list of penny stocks highlighted in Best Penny Stocks To Buy? 7 Under $1 To Watch Now. If 2022 has taught us anything, no company is immune to falling as far as the penny stock range. Just look at companies like Carvana (NYSE: CVNA), which we speculated on becoming a penny stock earlier this quarter. When the year began, CVNA stock was trading well above $200. Now the company is sitting at levels below $5.

The thing to remember about cheap stocks, let alone stocks under $1, is there is much higher risk based on price alone. A move of a few pennies can equate to a significant percentage change. Let’s see if any of the names on this list of penny stocks deserve a place on your watch list this week.

Tricida Inc. (TCDA)

Shares of Tricida have only recently traded in penny stock territory. Earlier this quarter, an abrupt drop in price stemmed from topline results in a Phase 3 study. Specifically, results from its veverimer didn’t meet its primary endpoint.

Shortly after the news, Tricida announced that it engaged Stifel to serve as an advisor on a review of, you guessed it, strategic alternatives to “maximize” shareholder value. The company put a reduction in force plan into place, which includes an approximate 57% reduction in its workforce. Tricida estimates aggregate costs of approximately $2.0 million, recorded primarily in November of 2022, related to one-time termination severance payments and other employee-related expenses. These will be paid this quarter and during the first quarter of 2023.

In addition, prominent insiders and funds exited positions since the stock dropped. Orbimed Advisors sold out of its ten million+ share stake along with Director Robert Alpern, who dumped over 150,000 shares at the end of November. Some presume now that with larger holders “out,” it could equate to less resistance in the market. Whether or not that holds true is to be seen; however, speculation has become a catalyst due to the unknown outcome of the strategic review process.

– 5 Penny Stocks To Buy According To Analysts, Price Targets Up To 919%

Akebia Therapeutics Inc. (AKBA)

Another one of the biotech penny stocks under $1 traders are watching this week is Akebia Therapeutics. Even though shares are trading well below the $1 level, they’re actually up over 24% since hitting 52-week lows in October.

A good amount of the most recent momentum has come from upbeat sentiment following earnings. In its Q3 update, Akebia reported that its net product revenue from its Aurycia platform increased by nearly 15% compared to Q3 2021. The company also affirmed its 2022 net product revenue guidance ($170M-$175M), while other companies have either canceled are guided lower this year.

“We act in the interest of patients impacted by kidney disease and believe in the favorable balance of the benefits and risks of vadadustat as a treatment for anemia due to chronic kidney disease,” said John P. Butler, Chief Executive Officer of Akebia in the third quarter business update. “To that end, we are continuing to pursue a path that could potentially lead to an approval of vadadustat for dialysis-dependent patients in the U.S.”

The company is also coming off of a presentation at the Piper Sandler Healthcare Conference last week. Akebia’s CEO participated in fireside chats.

Titan Medical Inc. (TMDI)

Shares of Titan Medical exploded over the last few weeks thanks to a string of news headlines. Initially, the company announced the commencement of a strategic review process. Its Board will look at a range of strategic alternatives to bring shareholder value back to its stakeholders. The other options include everything from a sale or merger to strategic investments or shedding some of its assets.

CEO Cary G. Vance explained, “We believe it is prudent to undertake a review of our strategic options to determine the best path forward to realize the value of our innovations in single-access robotic-assisted technologies to maximize shareholder value. Our Board and management team remain committed to our strategy of providing patients, surgeons, and hospitals with an innovative, improved surgical experience.”

– Penny Stocks & What To Watch In The Stock Market This Week Dec 5-Dec 9

The company also implemented cost-cutting measures to support this process. One of the latest catalysts helping TMDI stock rally is what came out this week. Titan said it suspended its special shareholder meeting due to the strategic review. Management noted that this allows Titan to focus on the review process, completing tasks toward an IDE filing with the FDA, and fulfilling “certain other contractual” obligations.

List Of Penny Stocks Under $1 To Watch

- Tricida Inc. (NASDAQ: TCDA)

- Akebia Therapeutics Inc. (NASDAQ: AKBA)

- Titan Medical Inc. (NASDAQ: TMDI)

- The Beachbody Company Inc. (NYSE: BODY)

- Statera Biopharma Inc. (NASDAQ: STAB)

- Sonim Technologies Inc. (NASDAQ: SONM)

- Rigel Pharmaceuticals Inc. (NASDAQ: RIGL)

- NYMOX Pharma Corp. (NASDAQ: NYMX)

- COMSovereign Holding (NASDAQ: COMS)

- Faraday Future Intelligence (NASDAQ: FFIE)

The post 10 Top Penny Stocks To Watch Under $1 This Week appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

therapeutics

pharmaceuticals

medical

biotech

pharma

healthcare

fda

stocks

shares

index

trading

nasdaq

buy

sell

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

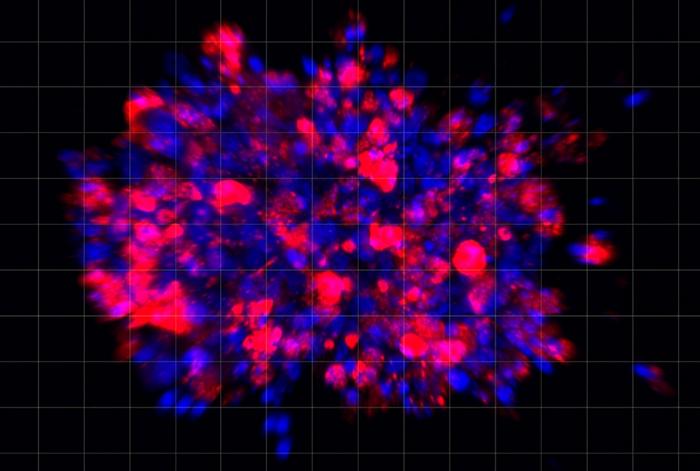

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…