Life Sciences

2 ‘Strong Buy’ Stocks That Are Too Cheap to Ignore

When stock prices fall, opportunities open up. That’s true whether we’re talking about a general market decline, or a slip in some individual stocks….

When stock prices fall, opportunities open up. That’s true whether we’re talking about a general market decline, or a slip in some individual stocks. However, it is crucial for investors to conduct due diligence and investigate the reasons behind the drop in price to ensure that they are making informed investment decisions. The key to success here is recognizing when a low-priced stock is fundamentally unsound or just facing tough trading conditions.

Fortunately, Wall Street’s equity analysts are doing the footwork on this, and their recommendations offer investors a solid guide to sound investments.

With this in mind, we’ve used the TipRanks database to pinpoint two stocks that fit this profile. Each of these stocks, despite its recent fall in share price, still boasts a Strong Buy consensus rating from the analysts, and potential for over 150% price appreciation in the coming months.

iTeos Therapeutics (ITOS)

The first beaten-down stock we’re looking at is iTeos, a clinical-stage biopharma working in the field of immune-oncology. This is a promising field for anti-cancer research, focused on the development of drug candidates that will stimulate or mimic the body’s own immunological system to fight the spread of cancerous tumors. iTeos currently has two drug candidates undergoing no fewer than eight active human clinical trials, and two additional trials are planned.

The company’s leading drug candidate, with six clinical trials underway is EOS-448, an anti-TIGIT monoclonal antibody designed to enhance anti-tumor responses through multifaceted mechanisms. The company is investigating this drug candidate in partnership with GSK, in multiple studies as a combination therapy with dostarlimab. These studies include a Phase 2 trial against advanced or metastatic non-small cell lung cancer and a Phase 2 trial against advanced or metastatic head and neck squamous cell carcinoma. iTeos also has a Phase 1/2 study in the dose escalation phase, testing the efficacy of EOS-448, as both a monotherapy and combo therapy with Bristol Myers Squibb’s iberdomide, in the treatment of multiple myeloma.

In addition to these more advanced studies, iTeos is investigating EOS-448 in triplet combinations in three Phase 1 trials against several advanced malignancies.

The company second clinical-stage program is inupadenant, a small molecule adenosine pathway antagonist. The company is studying this drug candidate in two ongoing Phase 2 trials, one investigating it as monotherapy and the other in combination with chemotherapy, in the treatment of advanced solid tumors and non-small cell lung cancer.

Finally, iTeos expects to initiate clinical trials on a third drug candidate, EOS-984, as a monotherapy against various advanced malignancies. A Phase 1 study is scheduled to begin in the middle of this year.

Despite the rich pipeline of promising therapeutic candidates, iTeos shares are down 59% over the past 12 months.

All of this translates, for Wedbush’s 5-star analyst David Nierengarten, into a stock that’s primed for growth.

“With broad-based progress across its pipeline, a strong balance sheet to fund multiple readouts through 2026, and with shares continuing to trade at less than cash, we continue to view ITOS as a low-risk investment with significant upside for the patient investor,” Nierengarten opined.

Looking ahead, the analyst sees reason to rate iTeos shares an Outperform (i.e. Buy), and sets a price target of $33, implying the stock will gain 154% in the next 12 months. (To watch Nierengarten’s track record, click here)

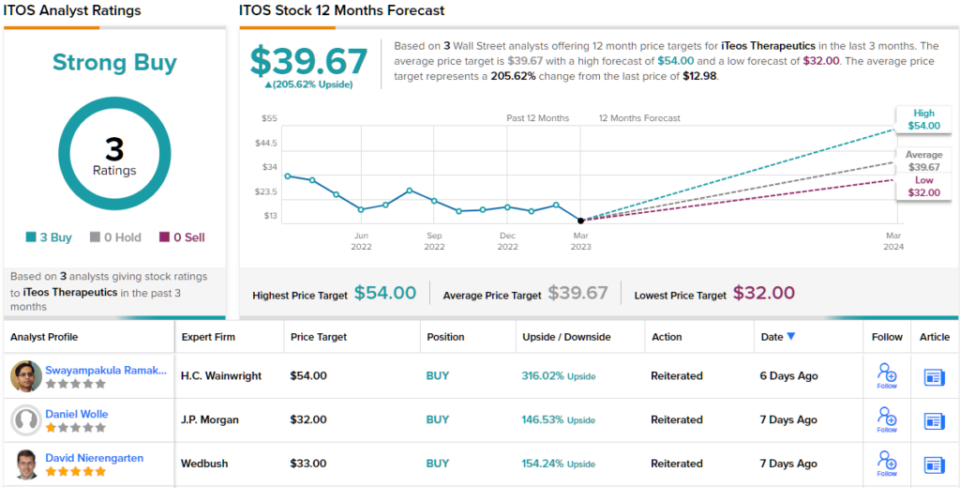

Overall, there are 3 recent analyst reviews on this stock, and they are all positive – to make for a unanimous Strong Buy consensus rating. The shares’ average price target of $39.67 suggests ~206% one-year share-price appreciation from the current trading price of $12.98. (See ITOS stock forecast)

GH Research (GHRS)

When it comes to bioscience and pharmaceutical research, there is no doubt that mental health is both one of the more difficult fields, and one with an enormous potential should a company successfully bring a drug candidate to market. GH Research is a clinical-state biopharma developing new treatments for depression, particularly treatment resistant depression, or TRD. This is a potentially rich field; market research has shown that the therapeutics market for TRD was worth as much as $1.55 billion last year.

GH Research currently has three research programs in the clinical stage, each a different formulation of mebufotenin, a proprietary 5-MeO-DMT therapy developed specifically for patients with treatment resistant depression.

The most advanced of the programs is GH001, a proprietary inhalation formulation. This formulation of mebufotenin has already completed two Phase 1 clinical trials with healthy volunteers and a Phase 1/2 in TRD patients. The Phase 2 segment of that trial showed highly positive results, with 87.5% of patients experiences a rapid remission in response to the individualized single-day dosing regimen. GH001 is currently undergoing a Phase 2b trial, a multi-center, randomized, double-blind, placebo-controlled study. So far, no adverse events have been reported in the GH001 programs.

The company has two additional research tracks, GH002 and GH003, based on different dosing formulations. GH002 uses an intravenous dosing approach, while GH003 uses a proprietary intranasal dosing. Currently, GH001 is undergoing a Phase 1 clinical trial, while GH003 is in preclinical development.

Shares of GH Research are down 62% over the last 12 months, but the company’s solid research program, with broadly positive results, in a field with a large TAM, offer investors reasons to take a bullish approach, according to Stifel analyst Paul Matteis.

“Excitement for GH comes on the back of promising ph1b data in treatment resistant depression, where GH001 produced three rapid and deep remissions across eight treated patients. The results are early, however, we believe a few factors support that they may be replicable across a larger sample: (1) there’s a growing body of evidence supporting the efficacy of psychedelics in neuropsychiatric disease, (2) prior anecdotal data for 5-MeO-DMT specifically suggests that the molecule has antidepressant and anxiolytic effects, (3) TRD patients rarely get better by chance, supporting that initial results for GH001 may be a true drug effect, and (4) GH was able to exceed initial remission results by leveraging an optimized dosing regimen in a second cohort,” Matteis opined.

“Meanwhile,” the analyst added, “from a commercial perspective, TRD represents a blockbuster opportunity, and, while this needs to be fully validated, the target product profile for GH001 is best-in-class among psychedelics.”

These bullish comments back up the analyst’s Buy rating on GHRS shares, while his $25 price target shows his confidence in a robust 288% upside on the one-year time horizon. (To watch Matteis’ track record, click here)

Overall, the Strong Buy analyst consensus rating here is unanimous, and supported by 5 recent positive reviews. The shares are trading at $6.45 and the average price target of $36.80 implies an impressive 470% upside potential for the rest of this year. (See GHRS stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

The post 2 ‘Strong Buy’ Stocks That Are Too Cheap to Ignore appeared first on REPORT DOOR.

therapeutics

psychedelics

dmt

therapy

depression

antidepressant

anxiolytic

stocks

shares

trading

fund

buy

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….