Government

3 Penny Stocks To Buy According To Analysts, Targets Up To 1,494%

Analysts say these are penny stocks to buy but are they worth the risk?

The post 3 Penny Stocks To Buy According To Analysts, Targets Up To 1,494% appeared…

If you’re looking to gain an edge in the stock market today, you’ve got to have more than a list of penny stocks to watch. You need to understand how to use the wild volatility that has been created this year to your advantage. Whether there’s a new trend in AI stocks or the latest IPO to experience a mega short squeeze, understanding the “tricks of the trade,” has its advantages.

What are some ways to find penny stocks to buy? You could make a scanner to find your own penny stock picks based on different criteria. You might want to look for stocks with unusual trading volume or momentum.

There are also SEC filings like Form 4s or Schedule 13s to sift through if you’re hunting for insider activity. But what if you’re looking for additional insight? Where can you find alternative views on certain stocks?

Penny Stocks To Buy: Where To Look First

You might head over to Twitter or Reddit. Penny stocks discussed on these forums tend to have more speculative views than anything. While speculation may play a part in analyst reports, however, it isn’t the only thing the firms base their outlook on.

They typically gauge the industry and other competitors and, in the case of penny stocks, take the temperature of companies with similar frameworks. There aren’t any guarantees that bullish analysts equate to stocks rising. But if you’re on the lookout for information, it may be another data point to consider in your overall diligence process.

– Best Penny Stocks To Buy Now? 10 Under $1 To Watch

Taking all things into consideration, you’ll have more to go off of. Then you can decide if they deserve a place on your list of penny stocks to watch or not. In this article, we look at a handful of names that have gained interest from analysts. Some have been given relatively hefty price targets as well.

Penny Stocks To Watch

- Akebia (NASDAQ: AKBA)

- Esperion Therapeutics Inc. (NASDAQ: ESPR)

- Xeris Biopharma Holdings Inc. (NASDAQ: XERS)

Akebia (AKBA)

Akebia Therapeutics has been a focal point for investors over the past few months, largely due to its significant jump in April and May, then again in July. The company’s appeal to the FDA concerning its anemia treatment, vadadustat, has been a key driver of this interest.

Akebia engaged in discussions with the FDA about the future course of action following an interim response to its Formal Dispute Resolution Request. This was initiated in response to a Complete Response Letter received in March. The market sentiment was further buoyed by a positive opinion from the Committee for Medicinal Products for Human Use (CHMP) in Europe regarding the drug candidate.

Fast forward to the end of May, and Akebia received marketing authorization for vadadustat, now branded as “Vafseo®,” from the UK Medicines and Healthcare Products Regulatory Agency. Swissmedic also approved Vafseo for symptomatic anemia, bringing the treatment’s approval to 34 countries.

In its most recent quarterly update, CEO John P. Butler explained, “This past quarter alone we made remarkable progress by gaining approval for vadadustat in 33 additional countries, securing Medice as our partner to bring Vafseo to patients in Europe in 2024 and clarifying the path to resubmission of the vadadustat NDA in the U.S. These impactful milestones mark significant progress toward our purpose to better the lives of people impacted by kidney disease.”

The company has seen a surge in analyst interest, with firms such as HC Wainwright. It recently set its target at $3.75. Based on its previous close of $1.15 on August 25, that target is 226% higher. The firm also has a Buy rating.

Esperion Therapeutics Inc. (ESPR)

Despite the heavy sell-off earlier this year, traders have started paying attention to Esperion Therapeutics in recent weeks. The company develops innovative medicines for cardiovascular and cardiometabolic diseases.

One of the more recent catalysts sparking interest is a presentation at the European Society of Cardiology Congress this month. The company gave two CLEAR outcomes study presentations with an optimal response from the market.

– 7 Best Penny Stocks To Buy Under $1 in 2023: Big Risk, Big Return?

Sheldon Koenig, President and CEO of Esperion explained, “These prespecified analyses further reinforce the cardiovascular risk reduction benefits of bempedoic acid in high-risk patients, not only upon an initial cardiovascular event as described in the NEJM publication, but also in those who experience more than one cardiovascular event and in patients with diabetes. Importantly, bempedoic acid use was not associated with an increased rate of new onset diabetes, which is a key differentiating feature compared to statins.”

Esperion is going to present at the HC Wainwright Global Investment Conference next month, which could have its own implications. In the mean time, HC is also helping to prompt attention for ESPR stock. The firm recently reiterated its Buy rating on the penny stock. It also has a price target of $22. Based on the last closing price on Friday of $1.38, HC’s ESPR stock forecast price is 1,494% higher.

Xeris Biopharma Holdings Inc. (XERS)

As biotech penny stocks seem to be a trend in this article, Xeris continues that with its own bout of attention in the stock market today. Following a recent pullback, XERS stock made a rebound after some news and insider buying has alerted traders.

Xeris reported mixed earnings after missing EPS estimates while beating sales expectations for the quarter. Paul R. Edick, Chairman and CEO of Xeris Biopharma commented on the results saying, “Our differentiated business model, exceptional year-to-date performance, and expectations for the remainder of the year gives us the confidence to tighten our 2023 guidance by raising the low end of the total revenue range to $145 to $165 million from $135 to $165 million; reducing cash utilization range to $57 to $67 million from $57 to $77 million; improving year-end cash range to $55 to $65 million. And, we expect to be at the cash flow breakeven point in the fourth quarter and continue being a self-sustaining enterprise.”

At the same time, Edick also purchased 10,000 shares of XERS stock this month. The trades were made at prices ranging from $2.365 to $2.3899. This brought his total direct holdings to more than 2.288 million shares. But where do analysts sit? Craig Hallum analysts have a Buy rating and a $4.50 price target, which sits a little over 100% above the Friday close of $2.15.

The post 3 Penny Stocks To Buy According To Analysts, Targets Up To 1,494% appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

therapeutics

biotech

healthcare

ai

authorization

fda

stocks

shares

trading

nasdaq

buy

sell

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

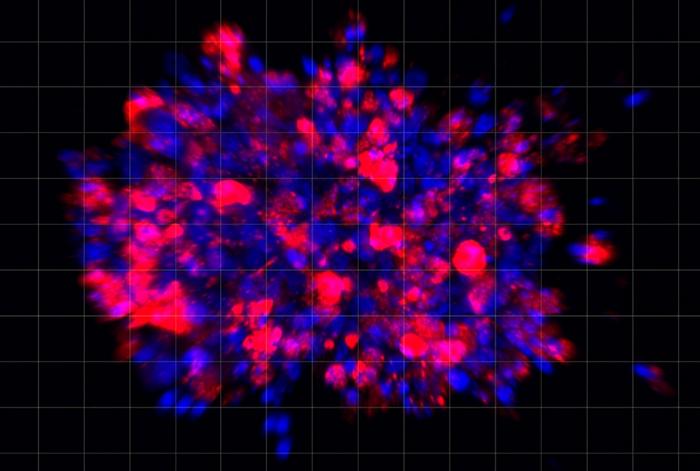

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…