Life Sciences

5 Interesting Startup Deals You May Have Missed In May: Brain-Boosting Nutrients And Fintech For Retirees

The last full month of spring saw some big fundraising announcements, but bigger doesn’t always mean better, as some smaller raises certainly are worth…

This is a monthly column that runs down five interesting deals every month that may have flown under the radar. Check out last month’s entry here.

The last full month of spring saw some big fundraising announcements.

However, bigger doesn’t always mean better, as some smaller raises certainly are worth noting due to uniqueness, cool technology or tackling ideas outside the norm.

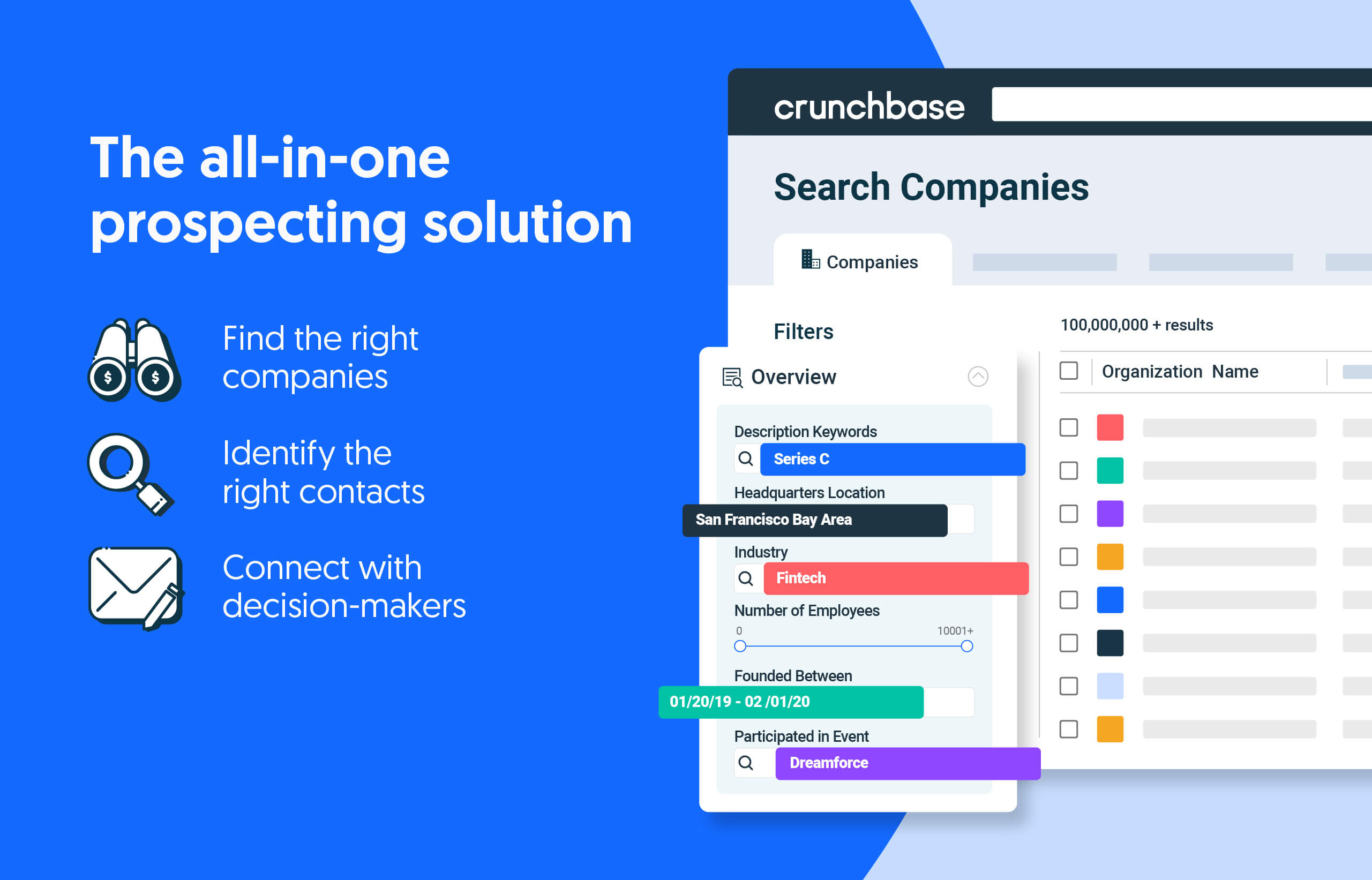

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Let’s take a look at some of those deals in May you may have missed — and we’ll try not to even mention AI.

Not every brain is the same

Everyone wants to get the most out of whatever they are doing, but some days you just don’t as your brain remains in a fog.

New York-based Thesis closed an $8.4 million Series A last month to help with that. The startup not only offers nutrient compounds formulated to increase mental performance, but bases them off your unique brain chemistry and the actual cognitive state you are striving for — like energy, clarity, motivation, etc.

The startup also offers coaching so users can find the right blend to optimize their monthly supplement subscription.

The new round included not just firms such as Unilever Ventures and Redo Ventures, but also well-known celebs like NBA player Kevin Love and model Kate Bock. The company had previously raised $5.1 million in an undisclosed seed round.

The company plans to use the new cash to expand its product selection and undergo clinical trials.

A cleaner clean

We all remember 2020 and the pandemic — when we disinfected everything, everywhere, all at once.

But truth be told, we likely missed some spots — because we always do.

New York-based Kinnos is trying to make cleaning a little clearer. The startup — which locked up a $15 million round from investors that include Pioneer Healthcare Partners and Kapor Center for Social Impact — has developed Highlight, a solution that colorizes disinfectants.

The idea is to help people see exactly what they cleaned and what they didn’t, especially in places where cleanliness is of the utmost importance, such as hospitals.

According to Kinnos, studies have shown that less than 50% of high-touch surfaces in health care settings are adequately disinfected, which results in health care-associated infections that impact 1 out of every 31 patients.

Now perhaps getting that perfect level of clean will be easier.

Geriatric fintech

There are dozens of fintech platforms that teach kids to save or adults how to finance a home purchase.

But there aren’t a lot of platforms dedicated to the generation entering their golden years on a set income.

Enter Los Angeles-based Charlie, which launched last month with a $7.5 million round from investors that include Better Tomorrow Ventures and Expa.

Charlie is aiming to help the 50% of older Americans who say they do not feel ready for retirement.

The platform is designed to assist those 62 years old and older prepare for retirement and adjust to the fact they are no longer adding financial assets continuously, but rather entering “deaccumulation mode” with their retirement savings and perhaps Social Security as main sources of income.

The platform allows for early Social Security withdrawal with no fees, as well as interest on balances, fraud prevention and other streamlined features focused on older adults.

It is not the typical market for fintech, but it is certainly a large one.

Fighting fire through funding

Living in California — or really anywhere out West — wildfire has become a very real concern that has touched many of us.

San Francisco-based Frontline Wildfire Defense raised a $6.4 million seed round led by Echelon last month to help defend homes and commercial structures against what has become an annual threat.

The startup — founded in 2017 around the time such fires became regular news — allows home and property owners to monitor fires near their home on its app. It also lets users protect their home during wildfire events with its exterior sprinkler solution (which includes biodegradable firefighting foam), while also providing safety info and evacuation notifications.

The company’s newest defense system combines wildfire tracking software, satellite connectivity and onsite sprinkler hardware to protect any home or building.

Even though some spots in the West had a wet winter and the fire season wasn’t as bad as in the past, wildfires are not going away, so any tech to protect property — and perhaps life — is worth a look.

Carbon removing concrete

Rick Fox once made a living in the NBA by breaking down defenses.

Now he is breaking down climate change.

The former Los Angeles Lakers forward is co-founder of Partanna, which locked up a $12 million pre-seed investment from Cherubic Ventures in May. The startup uses a special mixture of natural and recycled ingredients which are then cured to create its own type of cement, without polluting the air.

In addition, the reaction during the curing process, called carbonation, actually removes CO2 from the air — similar to a tree.

While regular cement also does that, Partanna’s process takes more CO2 out of the air — and 100x faster than regular cement, per the company. The company also can offer carbon credits.

According to the cement industry, its manufacturing process is responsible for emitting 8% of the total carbon footprint, so a startup that slices into that number could be building something special.

Illustration: Dom Guzman

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….