Life Sciences

5 Top Penny Stocks To Buy In March According To Insiders

Insiders are buying these penny stocks but are they worth the risk?

The post 5 Top Penny Stocks To Buy In March According To Insiders appeared first on…

Penny stocks have long been a popular option for retail traders looking to make a quick buck. These are low-priced shares that small or newly established companies often offer. While investing in penny stocks can be highly risky, there is always the potential for high rewards. However, when making investment decisions, one of the things that retail traders look for is insider buying activity.

What Is “Insider” Buying?

Insider buying activity refers to the purchase of stocks by people connected to the company. These could be executives, directors, or other key employees. When insiders buy company stocks, it is usually seen as a positive sign. Some presume that those who know the company best are confident in its prospects.

Retail traders often track insider buying activity to identify penny stocks to watch closely. When insiders buy stocks, it can signal that they expect the company to perform well. Obviously, that can increase investor confidence in the stock.

Penny Stocks & Insider Trading: Does It Matter?

There are several reasons why insider buying activity is important when putting a list of penny stocks together. First, it can provide insight into the health of the company. If insiders buy stocks, it can signal that they believe the company is on the right track. This can be a positive sign for investors who are looking for penny stocks to buy.

Second, insider buying activity can serve as a bullish indicator for the stock. When insiders buy, it can suggest that they expect the company’s stock price to increase in the future. This can attract other investors who are also bullish on the stock.

Third, insider buying activity can provide a sense of confidence to other investors. When insiders buy stocks, it can signal that they have high confidence in the company. This can make other investors more confident in the stock and more likely to purchase shares.

Risks Involved: Not The Only Metric To Rely On

However, it is worth noting that insider buying activity should not be the only factor considered when looking at penny stocks. Several other factors can impact a stock’s performance, including the company’s financials, industry trends, and overall market conditions. In addition, insider buying activity can sometimes be misleading. Insiders may buy stocks for reasons other than their confidence in the company’s future.

Despite these caveats, insider buying activity remains an important factor for retail traders to consider. By tracking insider buying activity, traders can gain valuable insights into the health of the company and its potential. While investing in penny stocks can be risky, tracking insider buying activity can help traders gain insight into management’s outlook. This article looks at a handful of penny stocks with insider buying in March. Are they worth the risk? I’ll leave that up to you to decide.

Penny Stocks To Buy In March According To Insiders

ThredUp (TDUP)

We discussed ThredUp most recently in the article 5 Penny Stocks To Buy According To Analysts, Targets Up To 952%. At the time, we discussed how analysts at Needham set a $5 target and Buy rating on TDUP stock. Considering the move it made after earnings, retail traders have begun following the company closer.

ThredUp beat EPS and sales estimates for the fourth quarter. The company brought in more than $71 million and guides in a range of $71-$73 million for Q1 of this year. The consensus was $69 million. As far as full-year guidance for 2023 goes, ThredUp expects to do anywhere from $310 to $320 million, which was also higher than the street’s $300 million expectation.

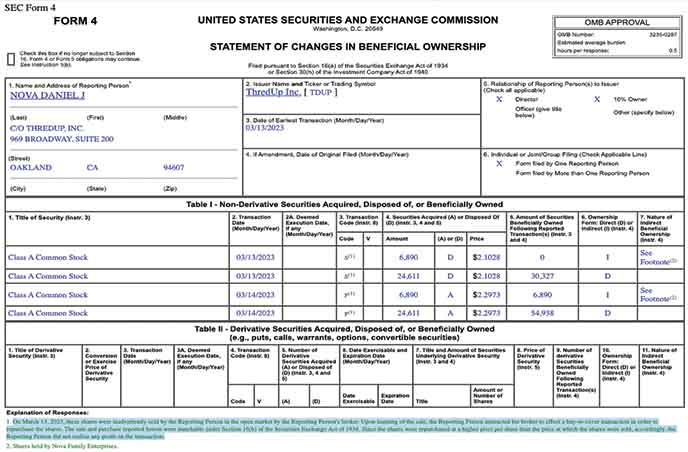

ThredUp might have hit a few watch lists based on recent Form 4 filings. But as discussed above, insider activity should be looked at more closely for further details. That is something you’ll find looking in the footnotes of the filings. In this case, Director Daniel Nova’s filing states, “On March 13, 2023, these shares were inadvertently sold by the Reporting Person in the open market by the Reporting Person’s broker. Upon learning of the sale, the Reporting Person instructed his broker to effect a buy-to-cover transaction in order to repurchase the shares. The sale and purchase reported herein were matchable under Section 16(b) of the Securities Exchange Act of 1934. Since the shares were repurchased at a higher price per share than the price at which the shares were sold, accordingly, the Reporting Person did not realize any profit on the transaction.”

So while there was some insider buying (technically), it was done to cover an inadvertent error by Nova’s broker. A day after this was revealed, TDUP stock continued higher.

Jounce Therapeutics (JNCE)

Biotech stocks, including Jounce Therapeutics, have caught some attention in the stock market this month. The company develops targeted cancer therapies as well as predictive biomarkers. Earlier this year, the company announced plans to restructure, which included a workforce reduction of roughly 57%. The company also said it would seek business development opportunities for its JTX-8064 and vopratelimab programs.

– Best Penny Stocks To Buy Now: 3 To Watch Before Next Week

Fast-forward a few weeks, and Jounce announced receiving an unsolicited acquisition offer for 100% of the company. The deal outlined a buyout at $1.80 per share and other contingencies to complete the arrangement. This comes in addition to events from February 23, 2023. The company announced a recommended business combination with Redx Pharma via an all-share merger transaction. The transaction is anticipated to be completed during the second quarter of 2023, subject to necessary regulatory and shareholder approvals. Shareholders were advised that no action was required at the time.

Needless to say, “big money” is moving in JNCE stock. In particular, a new SCHEDULE 13D filing from Tang Capital Partners showed the fund took a 10.2% stake in Jounce. Moreover, the controlling shareholder of Concentra Biosciences, LLC, who made the offer to Jounce, is also Tang Capital Partners, LP. As this story develops, we’ll make sure to report more details.

Solid Power Inc. (SLDP)

Shares of Solid Power Inc. caught a much-welcomed boost of bullish momentum on Thursday. The move comes after weeks of selling pressure took its share price back below the $3 level. Despite general market trends regarding growth stocks, Solid Power’s latest earnings results have come back into focus.

The company beat Q4 sales expectations for 2022 and discussed its action plans for the new year. In a business update, company interim-CEO Dave Jansen explained, “2023 will be an important development year for us as we begin scaling production of our electrolyte powder and look to deliver our A-sample EV cells to our joint development partners. Meeting those objectives will better position us to achieve our ultimate goal of becoming a leading supplier of sulfide-based electrolyte material.”

As far as 2023 revenue is concerned, Solid Power expects $15-$20 million. There are plans to deliver EV cells to its joint development partners and enter the automotive qualification process. With regard to insider activity, this month, Director John Joseph Stephens picked up 214,500 shares of SLDP stock at an average price of $2.919. The insider purchase brought his total indirect holding to more than 300,000.

Energy Vault Holdings Inc. (NRGV)

Like Solid Power, Energy Vault Holdings is another energy-related name seeing a welcomed surge of bullishness this week. The move comes just a few days after NRGV stock hit fresh 52-week lows of $1.95. Mixed reactions from its latest earnings results seem to have led to the selling pressure this month.

Energy Vault Holdings develops sustainable, grid-scale energy storage solutions for its customers. One statement some traders have focused on from the March financial update is what management said regarding near-term events.

“While revenue will be growing from two to three times 2022 levels, we are holding our operating expense flat from our Q4 2022 annualized run rate…investors can expect an aggressive quarterly 2023 revenue ramp starting from low double-digit revenues in Q1 to high double-digit revenue in Q2 and into triple-digit revenue in the second half of the year.”

With an optimistic outlook for the start of 2023, NRGV has caught some attention recently. That has also included interest from insiders. CEO Robert Piconi bought 66,000 shares of NRGV stock this month at an average price of $2.2681.

– Penny Stocks To Buy? 4 To Watch Now After Big News

comScore Inc. (SCOR)

Like some other names on this list of penny stocks, comScore has experienced a welcome wave of bullish sentiment in the stock market today. It comes one day after shares of SCOR stock tapped fresh 52-week lows of $0.92. Most of the recent pressure came after the company’s latest round of financial results. Despite reporting a beat on earnings per share and sales for the fourth quarter, the 2023 financial outlook seems to have been a sticking point.

CEO Jon Carpenter explained in response, “As I’ve mentioned, our focus has been on speed, execution, and profitability. In 2022 we launched Comscore TV Pulse, which delivers local TV data within 48 hours, and we introduced our new Total Digital user interface that provides a combined view of our digital and social data. We also made strategic decisions related to our cost structure that enabled us to achieve adjusted EBITDA of $37 million, the highest we’ve had in many years. We did what we said we were going to do, and that has given us momentum as we head into 2023. As the company that provides the most complete view of audiences for both content and ads, I believe we are well positioned for continued success.”

This week, Director Bill Livek reported purchasing more than $250,000 worth of SCOR stock. Purchases were made on March 13th and 14th at average prices ranging between $1 and $1.02.

List Of Penny Stocks To Watch

- ThredUp (NASDAQ: TDUP)

- Jounce Therapeutics (NASDAQ: JNCE)

- Solid Power Inc. (NASDAQ: SLDP)

- Energy Vault Holdings Inc. (NASDAQ: NRGV)

- comScore Inc. (NASDAQ: SCOR)

The post 5 Top Penny Stocks To Buy In March According To Insiders appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

therapeutics

biomarkers

biotech

pharma

stocks

shares

trading

fund

nasdaq

buy

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….