Life Sciences

7 Unicorns Arrived And 2 Exited In January 2023

In the first month of 2023, seven companies joined The Crunchbase Unicorn Board — the third month in a row for new unicorns to number in the single …

In the first month of 2023, seven companies joined The Crunchbase Unicorn Board — the third month in a row for new unicorns to number in the single digits.

Three of the new unicorns are U.S. startups, with two hailing from Dallas. China provided another three, and the final company is from Germany.

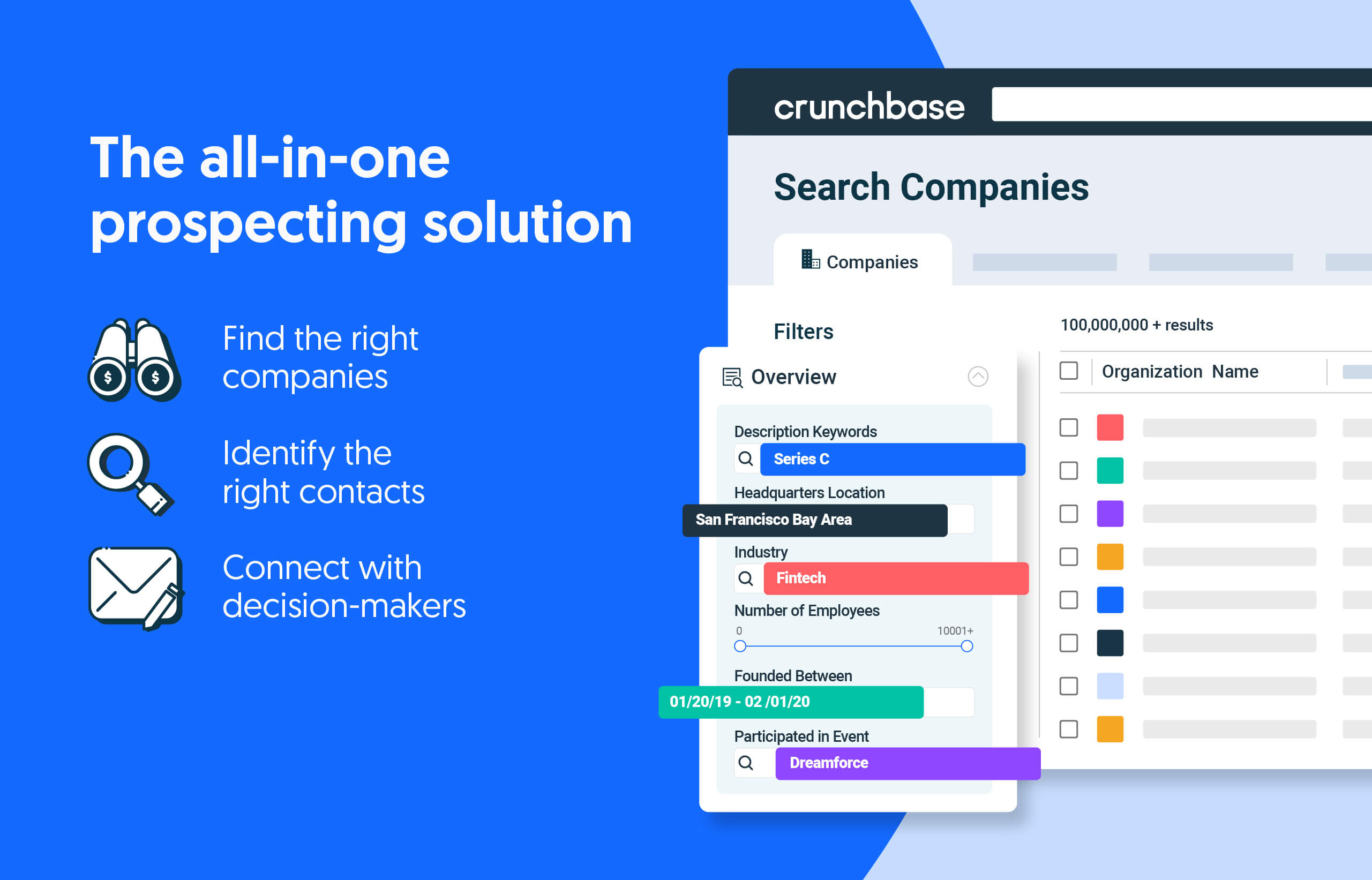

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Dallas-based genetic de-extinction startup Colossal Biosciences, founded in 2021, is the youngest in this new cohort. The oldest debut is by China’s solar science company Astronergy, founded in 2006. The sectors represented include energy, health care, semiconductor and artificial intelligence.

M&A transactions lead

Zero unicorn companies went public in January, but two companies were acquired. They include Shanghai-based electric-vehicle company WM Motor, acquired by Hong Kong-based public company Apollo for $2 billion. WM Motor was reportedly struggling, and had a $5 billion valuation in 2017.

Chicago-based property management company SMS Assist was acquired by Arizona-based Lessen for $950 million, close to its 2016 funding led by Goldman Sachs that valued the company at $1 billion.

Here are the companies that joined the board in January 2023.

Energy

- San Francisco-based Xpansiv, an energy infrastructure and commodities research platform, raised a $125 million round led by Bank of America and Goldman Sachs that valued the company at $2 billion. Xpansiv also announced the acquisition of New York state-based Evolution Markets for an undisclosed amount.

- Anhui, China-based Huasun Energy raised a $295 million Series B, valuing the company at $1.5 billion. The round was led by China National Building Material.

- Hangzhou, China-based Astronergy raised a $220 million Series B valued at $1 billion led by Yunhao Capital.

Biotech and health care

- Dallas-based ShiftKey, a scheduling and credentialing platform for health care workers, raised a $300 million funding at a $2 billion valuation led by Lorient Capital.

- Extinct species restoration company Colossal Biosciences, also based in Dallas, raised a Series B funding of $150 million led by US Innovative Technology Fund that valued the company at $1 billion. The company uses CRISPR technology and gene editing, which will have a broader impact around health and food production.

Semiconductor

- Yunnan, China-based Yuze Semiconductor raised a $178 million funding round, valuing it at $1.5 billion.

Artificial intelligence

- Cologne, Germany-based DeepL, an AI language translation company, raised $100 million at a $1.1 billion value, led by Silicon Valley-based IVP. Benchmark led its Series A in 2018 and Berlin-based btov Partners led its seed round in 2010.

Unicorn queries

- Unicorn leaderboard (1,436)

- Unicorns in the U.S. (715)

- Unicorns in Asia (450)

- European unicorns (192)

- Emerging unicorn leaderboard (366)

- Exited unicorns (418)

- Unicorn fundings in 2022 ($129B)

Methodology

The Crunchbase Unicorn Board is a curated list that includes private unicorn companies with post-money valuations of $1 billion or more and is based on Crunchbase data. New companies are added to the Unicorn Board as they reach the $1 billion valuation mark as part of a funding round.

The unicorn board does not reflect internal company valuations — such as those set via a 409a process for employee stock options — as these differ from, and are more likely to be lower than, a priced funding round. We also do not adjust valuations based on investor writedowns, which change quarterly, as different investors will not value the same company consistently within the same quarter.

Funding to unicorn companies includes all private financings to companies that are tagged as unicorns, as well as those that have since graduated to The Exited Unicorn Board.

Please note that all funding values are given in U.S. dollars unless otherwise noted. Crunchbase converts foreign currencies to U.S. dollars at the prevailing spot rate from the date funding rounds, acquisitions, IPOs and other financial events are reported. Even if those events were added to Crunchbase long after the event was announced, foreign currency transactions are converted at the historic spot price.

Illustration: Dom Guzman

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….