Life Sciences

A Package from India: Why Indian Pharma could be a handy vaccine during a global recession

Indian pharmaceuticals are bringing new meaning to the idea of ‘big pharma,’ and these names could be the right vaccine … Read More

The post A Package…

Meanwhile, the Prime Minister of Marrickville, Anthony Albanese has set up a quick visit to India in March next year.

The breezy announcement – made a week or so ago in Bali – was largely overshadowed by some glad-handing with China’s President Xi Jinping following an ice age of cold shouldering.

India, on the other hand, is a regular reliable neighbour who are not only a whisper or two from signing a final trade deal (an interim deal got signed in April, BTFW), one unlikely to stop talking to us, stiff us on tariffs or condemn us no matter how awful our cricketers behave in defeat (or victory).

Albo announced the key visit when he shook the hand of Indian Prime Minister Narendra Modi on the final day of the G20 Summit in Bali, and over the weekend Mugunthan Siva MD at India Avenue told me the lure of a signed-off Aussie-India Comprehensive Economic Cooperation and Trade Agreement would be a huge win for the Inner West …and other bits of Australia.

“India’s underlying fundamentals are unquestionable and astounding, (especially for Australians) given the sheer scale and size of the economic potential and unlimited compounding earnings opportunity available to well managed corporations operating in the ecosystem. Over the next two decades India’s GDP is likely to scale to between US$10-15 trillion within the next 17 years.”

The numbers are China-like in their size. Indian GDP growth alone will represent some 10% of total global GDP. If there’s a G3 meet coming up in Tahiti sometime around 2040, India’s going to be a lock.

“As a result there will be significant opportunity for Indian companies to win market share from their global peers due to initially a structural labour cost advantage which will give way to scale and size of the employment pie,” Siva says.

According to the Confederation of Indian Industry (CII), India’s Gross Domestic Product (GDP) can grow from the current $3 trillion to $9 trillion by 2030, and $40 trillion by 2047, if the country’s working-age population — which is expected to increase by over 100 million people between 2020-30 – is productively employed.

That means almost one out of every four people around the world, of incremental global employment, is likely to be of Indian origin.

“Conversation around investing in India always revolves around Consumption, Financials and Technology. We have taken a different angle in our focus. Increasingly India is slowly but surely becoming a pharmaceutical powerhouse.”

India Avenue’s bullish pharma-stance is despite the sector’s prolonged underperformance over the four or five years leading up to the pandemic.

Indian pharma stocks have in fact staged a (wait for it) healthy post-COVID return to form, but the steam has come off again and it’s been a volatile run, in a volatile environment for much of 2022.

But while sentiment might be off the boil, the correction across many of the big name pharma stocks suggests opportunity. For example, Mugunthan points out that the BSE Healthcare Index (total return) fell 5.5% year-to-date, while India’s Nifty 50 TRI found 6%.

This doesn’t correlate with what’s been happening in one of the world’s unsung homes of pharmaceutical innovation.

A few lesser-known Indian pharma facts:

-

India is the world’s leading vaccine manufacturer

- Indian Pharma plays an “outsized and prominent role” in the global pharmaceuticals industry

-

It ranks No 3 worldwide for production by volume

-

And 14th by value

-

India’s the largest provider of generic medicines globally, occupying a 20% share in global supply by volume

-

India also has the highest number of US-FDA compliant pharma plants (outside of the states)

-

It’s home to more than 3,000 pharma companies

-

A mind-boggling network of over 10,500 manufacturing facilities

-

A highly-skilled, highly-educated resource pool

-

As of 2021, the industry in India offers 60,000 generic brands across 60 therapeutic categories

The Pharmacy of the World

Mugunthan says the Indian government knows it’s on a good thing, backing the sector to the hilt and focusing investment on major segments which include: Generic drugs; OTC Medicines; API/Bulk Drugs; Vaccines; Contract Research & Manufacturing; Biosimilars and; Biologics.

“Over the past few decades, the medical, biotech and scientific communities acrossIndia and the diaspora have come together in a startling way.

“Very few might’ve imagined India would emerge from nowhere to become the thirrd third largest drug maker in the world in terms of volume… the outward looking market now supplies Indian pharma products worth just shy of US$25bn (FY22), which generates an annual net trade surplus of US$17 billion.

“The country’s a major exporter of generic medicines and vaccines – a fact made painfully acute during the intitial stages of the hunt for a vaccine – and the equally nervous search for the capacity to manufacture them.”

He says price competitiveness, tight supply chains and reliable quality have seen 60% of the world’s vaccines and 20% of generic medicines coming out of India.

Indian pharma into the future

-

Incentives worth US$3bn are approved

-

Market size expected to reach US$130bn by 2030

-

Expected growth rate of 11-12% over the current decade

-

Cost of manufacturing is circa 33% lower than Western markets

India is now exporting to more than 200 countries and more than half of Africa’s total annual generic medcines demand, circa 40% of generic demand in the US and around 25% of all medicines moving in to the UK are India-originated.

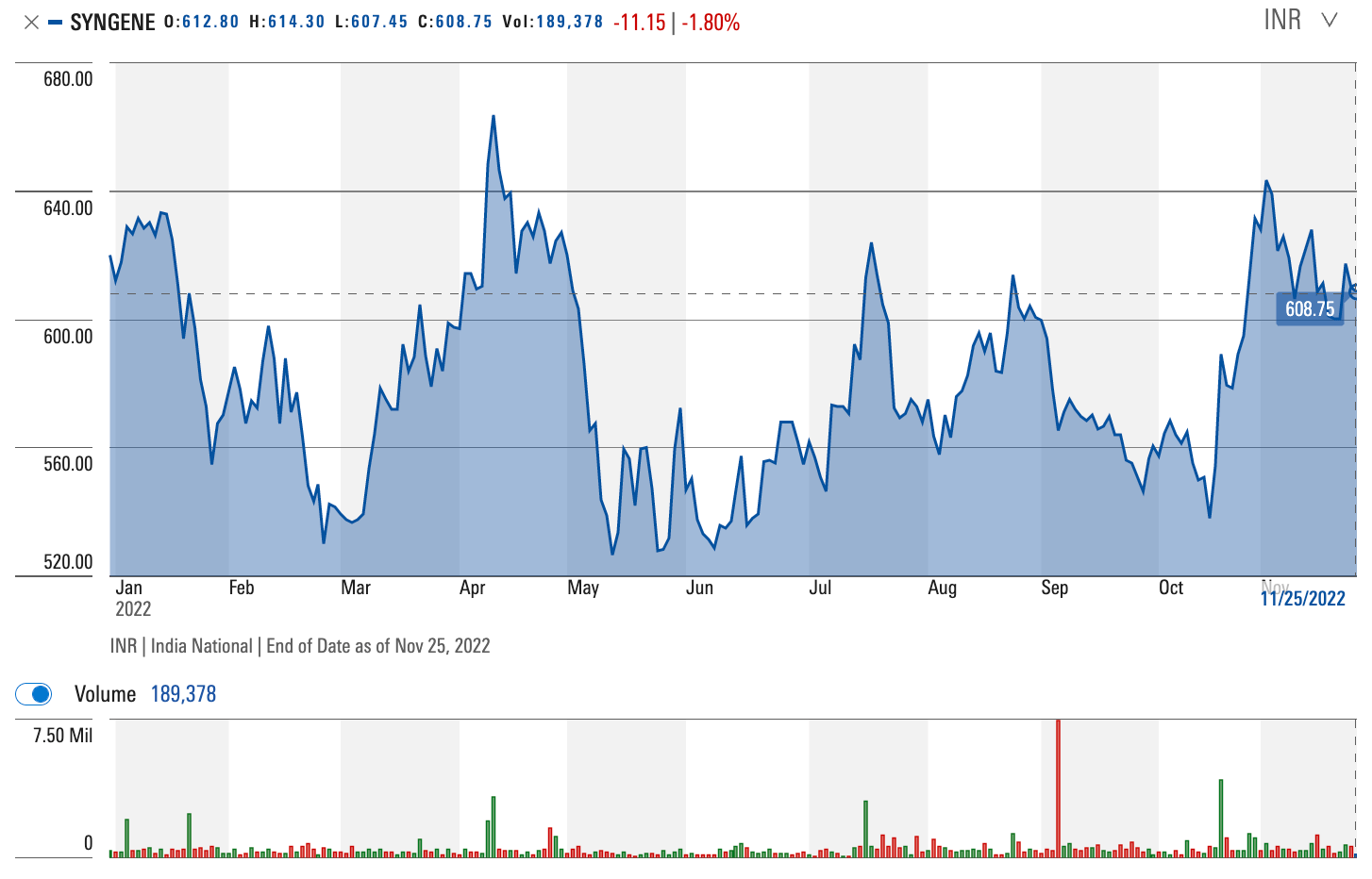

Syngene International

Mugunthan says he likes this is integrated research, development and manufacturing services giant for its solid bones.

“Scientific research is part of the company’s DNA, from the earliest stages of discovery through the development process into scale-up and commercial manufacturing. For more than 25 years, the company has partnered with clients to find solutions through science. Every project has specific requirements and the solutions and services provided range from specialist, stand-alone activities to longer term, integrated programs spanning the discovery, development and manufacturing value chain.”

He says many of Syngene’s clients are world leaders (96% based offshore) in their fields ranging from leading global multinationals to small and medium-sized start-ups, non-profit institutions, academic institutes and government organisations.

“The company through its business divisions is playing to the thematic of being a low cost research hub which is benefitting from themes like increasing global outsourcing, significant scale, expertise and infrastructure,” Siva says.

Many companies around the world are outsourcing to the likes of Syngene – names like Bristol Myers, Johnson & Johnson, Merck, Sanofi, GSK, Bayer, Unilever and Pharm Aust.

Syngene is divvied up into five business divisions: Discovery Services, Development Services, Manufacturing Services, Dedicated R&D Centres.

The business has generated revenue growth of 16% over 2018-2022, EBITDA growth of 13% and maintained margins above 30%.

“We also like that the company is debt free and generates significant cash flow. COVID-19 has actually generated further opportunities and as businesses continue to reduce costs and diversify supply chains, then companies like Syngene are likely to benefit substantially.”

“The business has invested significantly in capacity (capex + plants) and employees over the last five years using cash flows. It had a healthy balance sheet and is well placed to absorb capacity and win market share through its comparative advantages. In this way India’s growth story is different as the growth is likely to come from value-added exports and services rather, whilst leveraging on scale and cost advantages.

“While Syngene trades at above 50x earnings at present, the company’s valuation is quickly justified given its advantages, significant growing addressable market and business opportunity ahead of it. Companies like Syngene International are likely to be winners in the current decade.”

Other Indian pharma stocks worth checking out:

Dr Reddy’s Laboratories (NSE: DRREDDY)

With a name you can trust (who the hell is Dr Reddy and has anyone read Judge Dredd lately?) and a leading position among the Indian generic players, Dr R enjoys a prominent position right through the lucrative US market.

Actually, from December 19, when DRREDDY is getting tossed from the SENSEX, the benchmark index of the BSE in India featuring a basket of 30 stocks representing the country’s largest, financially-sound companies listed on the BSE.

After Dr Reddy’s exit, Sun Pharma will be the only healthcare stock in the Sensex. The healthcare sector weightage in the Sensex is less relative to the sector’s weight in the overall market.

A new leadership team is making the most of a targeted, global growth strategy, taking care to drive into key priority markets including the giant domestic Indian market, as well as Russia and China, with whom the government has kept open ties during the recent conflicts.

This alongside already-existing non-core assets has increased profitability. With increased US launch size and speedier execution of multiple medications in emerging markets, profits are anticipated to increase.

Sun Pharma (NSE: SUNPHARMA)

As the blurb says, Sun Pharma has grown to become one of the largest generic pharmaceutical companies worldwide, and the No 4 largest specialty generic pharmaceutical company globally.

“We are the largest pharmaceutical company in India. In the US, we are among the top 10 generic pharmaceutical companies and are ranked second by prescriptions in the generic dermatology market.”

And it’s still growing a like a beast. With global revenues of over US$4.5bn, Sun Pharma’s global specialty business grew 27.5% year-on-year in Q2, driven by products as Ilumya, used to treat psoriasis; Cequa, an ophthalmology product; and Winlevi, a dermatology product.

Cipla (NSE: CIPLA)

In India’s home market, which is pretty much the largest growing market demographically in the world, Cipla remains a central, dominant player.

The business is well-established and sees high revenue from a focus in the chronic market and has market dominance in certain chronic therapies including inhalation and respiration.

Cipla is already establishing a US brand, focusing on complicated generics for sustained growth.

Additionally, it has moved its attention to India, which will quicken the trend of domestic demand. Given the US respiratory medicine scarcity brought on by COVID-19, the approval of albuterol would guarantee an increase in US growth and profits over the medium term.

Biocon (NSE:BIOCON)

Biocon is an Indian biopharma, based out of Bangalore and founded by Kiran Mazumdar-Shaw back in 1978.

Biocon manufactures generic active pharmaceutical ingredients that are sold in approximately 120 countries, including the States and the EU where there’s good money to be had and good margins.

With a portfolio of biosimilars like Mylan (I know that one!), Biocon – an unfortunate name but there you have it – also boasts a steady relationship a relationship with Sandoz. Over the next two to three years, it is anticipated that the monetisation of Glargine and other biosimilar pipeline products, the scaling up of Peg-filgrastim and Trastuzumab, and the value unlocking through the IPO of Biocon Biologics’ biosimilar business will increase sales of biologics.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

The post A Package from India: Why Indian Pharma could be a handy vaccine during a global recession appeared first on Stockhead.

contract research

manufacturing

biosimilars

generics

vaccines

biologics

pharmaceuticals

medical

biotech

pharma

healthcare

fda

research

stocks

index

markets

otc

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….