Life Sciences

As Wall Street crumbled, India’s top 2 markets hit all time highs. That was 30 days ago. This is their story.

Considering that sometime this year, there’ll suddenly be more people in India than neighbouring China, it’s fair to say not … Read More

The post…

Considering that sometime this year, there’ll suddenly be more people in India than neighbouring China, it’s fair to say not very many people know what an incredible year 2022 has been for Indian stocks.

At a bit over 1.39 billion people, India’s younger and surging population should overtake China’s older and comparatively stagnant 1.4 billion any day now, giving the world’s best cricket team the most world’s most populous advantage.

But it’s far from the only historic Indian record not being talked about.

While the world’s major markets stumbled from bad to worse in ‘22, India’s twin major indices – the Sensex and the NIFTY 50 outperfomed themselves, the pundits and everyone else in between.

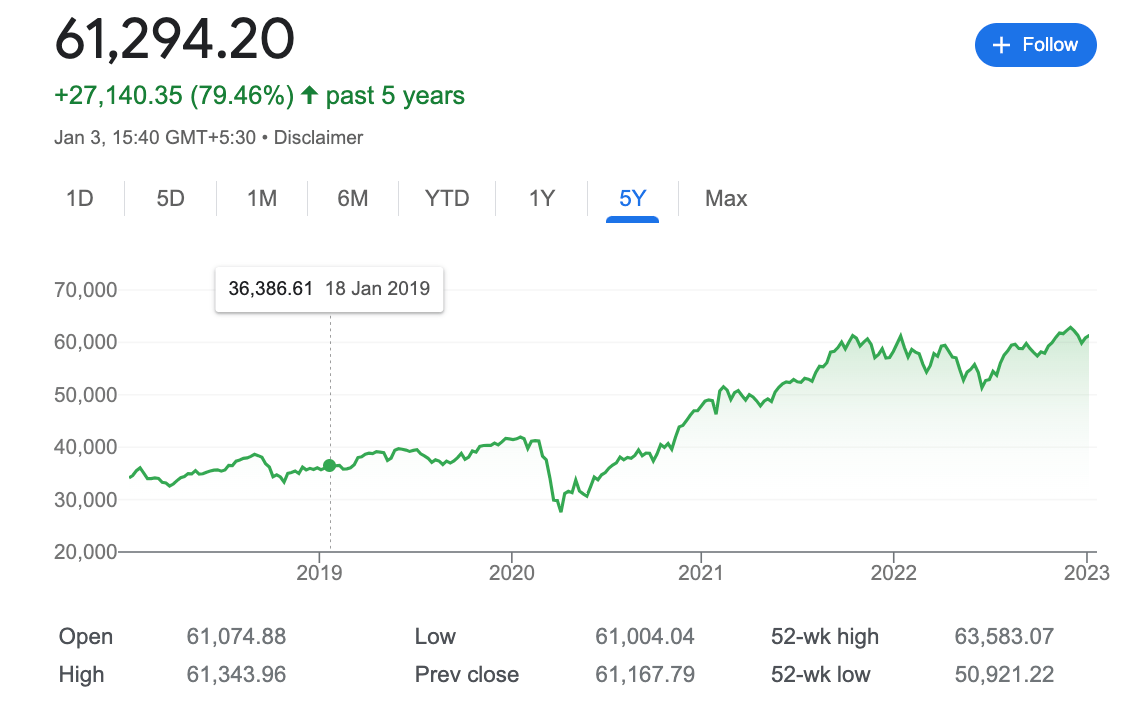

The SENSEX, 5 years

Indian stock markets whacked world markets over the last 12 months, making a lot of people richer, in terms of market-cap, by more than ₹16.5 lakh crore (which is a rough way to say about $US200 billion) this year.

And they did it in the face of ludicrous odds.

A global energy crisis, a divisive global conflict upon which razor’s edge the Indian government has chosen to balance, inflation running riot and supply lines in stasis. And a Reserve Bank of India caught between it all.

It’s a recipe for disaster, served hot and steaming to almost every other major market across the year.

Whatever.

In Delhi, stock prices have gone nuts, and they appear to be staying nuts into the new year, according to the people on the ground, running the books.

On the first day of a calamitous December for Wall Street, both the NIFTY 50 and Sensex closed at record highs clocking 18,887.60 and 63,583.07 respectively.

The “incomprehensible disconnect” (as one baffled journo observed) with the Sensex and the Nifty (they’re still loitering just under those marks ) compared to how the rest of the world is coping with the fallout from 2022 is a joy to observe.

Of course the multi-billion rupee question is will there be more of the same out of Indian equities this year and from where will the big returns come?

The answer, well, it’s anyone’s guess in the face of the current firestorm of global macro headwinds.

What we do know is this:

That’s some fine returns there.

2022 had 3 major Indian stocks (with market-cap values of over Rs 500 crore (or circa $Au90k) which jumped more than 1,000%.

Smallcap Rajnish Wellness, which sells personal care and ayurvedic products, turned out to be a 20-bagger. SEL Manufacturing Company rallied 1,550% while SG Finserve found almost 1,100%.

Now the local market regulator The Securities and Exchange Board of India (SEBI) puts all listed companies starting from 251st and below in terms of market-cap, as small caps.

There’s a lot of them, but for our purposes today, let’s not over do it.

Here’s the NIFTY Smallcap 100 vs the NIFTY 50 over the last 12 months.

The Index above does a pretty good job at reflecting the tone, the behaviour and OFC tracks the performance of the broad small cap segment of the Indian financial market.

The NIFTY Smallcap 100 represents circa 4% of the free float market cap of the stocks listed on the The National Stock Exchange (NSE)

Alongside the Bombay Stock Exchange (BSE) both have a benchmark smallcap index tracking these bad boys – one’s the NIFTY Smallcap 100 and the other’s the BSE Smallcap index. (It’s hard to beat the NIFTY 50 for coolest market name.)

But, just like the ASX, every large or mid-cap stock in India was also once a fumbling, feisty little battler punching their way to the top.

Just like on the ASX Emerging Companies (XEC) Index, the vast majority of Indian small-cap companies carry the burden of iffy revenues, tight cap-ex, a small pool of talent and a boisterous competition.

But companies with high growth potential often do well in times of plenty, when risk is all about reward. For almost every other global market that particular equation is out the window.

The tech-heavy Nasdaq gave away 40% this year, and one might not think of Apple (APPL) as a small cap growth stock.

Be that as it may, there’s legs in the small end of town too for India in 2023 and it might be time to start writing some of these names down.

Samco, India’s market library: The 10 small caps to watch in 2023

Really gross domestic product

Right now, India is already the fastest-growing economy in the world, having clocked 5.5% average GDP growth over the last decade.

And as my Man in Mosman, Eddy Sunarto wrote ahead of Christmas, by 2031, India’s GDP could detonate from 2022’s $3.5 trillion to surpass $7.5 trillion, while its sharemarket could grow by 11% per year to reach a market cap of US$10 trillion.

And according to the Morgan Stanley there are all kinds of megatrends capable of driving India’s growth over the next decade.

“India is also gaining power in the world order, and in our opinion these idiosyncratic changes imply a once-in-a-generation shift and an opportunity for investors and companies,” said Ridham Desai, Morgan Stanley’s chief equity strategist for India.

Maharashtra Seamless (BSE:MAHSEAMLES)

With construction and infrastructure still a governmental priority analysts at Samco have the “steel behemoth” Maharashtra Seemless, a No. #2 pick for this year – a company where stakeholders have kept reinvesting into the business – lifting ownership over the previous 15 quarters, to control almost two-thirds as of Sept’22.

MAHSEAMLES has lifted both sales and profits over the past 5 years with a CAGR of 24% and 30% respectively.

The company is cash rich and has a very low debt to equity at 0.16.

The price-to-book value (P/B) at 1.10x is lower than the industry’s P/B of 1.67x. Further, the stock has a price-to-earnings (P/E) ratio of 8.41x, which is lower than the industry’s P/E ratio of 17.5x.

While the firm is exposed to the volatile oil and gas sector, the small capo indices have a fair bit of buy-the-dip about them, considering the run the broader markets have had.

Up 4.5% today, punters still look like there’s legs in it yet.

Trading Indian stocks through US exchanges

The problem for now, OFC is that it’s a tricky thing to invest directly into India and its many opportunities.

For the majors, most leading Indian stocks are dual listed on US exchanges.

Tata Motors (NYSE:TTM), Infosys (NYSE:INFY), Reliance Group (NASDAQ:RELI), Sify Technologies (NASDAQ:SIFY) and Wipro (NYSE:WIT) are some of household names listed in the US.

For more on how to right this wrong from Australia, we’ll get on the blower and put it to India Avenue’s Mugunthan Siva.

So… I don’t know – go for a jog, talk quietly amongst yourselves?

The post As Wall Street crumbled, India’s top 2 markets hit all time highs. That was 30 days ago. This is their story. appeared first on Stockhead.

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….