Life Sciences

ASX Large Caps: Shares slump over 1pc on thin trading as banks, coal and lithium miners tumble

The ASX tumbled over 1% in the first trading day of 2023 Stocks were sold across all sectors, with some … Read More

The post ASX Large Caps: Shares slump…

- The ASX tumbled over 1% in the first trading day of 2023

- Stocks were sold across all sectors, with some blaming lack of liqudity

- Properties across all Australia fell again in December

It wasn’t the start of year investors had wanted to see as the ASX crumbled in a broad-based selloff.

At the close of Tuesday, the benchmark ASX 200 index was down by 1.4% as all 11 sectors fell.

Bank, healthcare and mining stocks were the worst performers with the lack of liquidity being blamed for exaggerating the losses (Japan and New Zealand markets are still closed today).

Coal miners were also getting hammered with Whitehaven (ASX:WHC) and New Hope (ASX:NHC) falling by more 7% each.

Lithium miners also lagged, with Pilbara Minerals (ASX:PLS) down 4% while iron ore giant Fortescue Metals (ASX:FMG) fell just over 1%.

Earlier, data provider CoreLogic reported that home values in Australia finished the year lower for the first time since 2018.

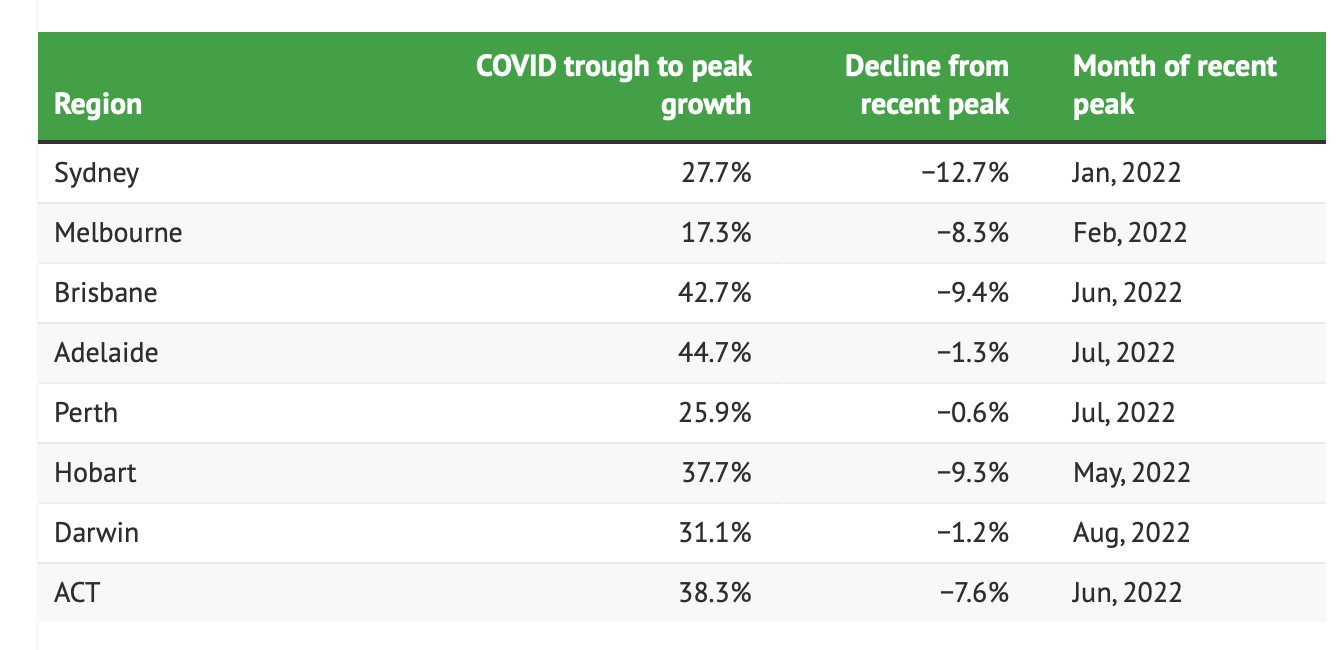

Sydney homes fell another 1.4% in December, and are almost 13% lower than their peak in January of last year.

Melbourne has wiped out all of its pandemic gains, down 1.2% in December and 8.3% from its peak in February of 2022.

In other news today, Tesla was fined US$2.2 million in Korea for violating advertising laws.

Korea’s Fair Trade Commission said that Tesla had exaggerated driving range and charging speed of its electric cars, as well as the estimated savings on fuel costs.

Meanwhile, official data from China shows the country’s manufacturing activities declined in December.

According to Bloomberg, a private survey of businesses also suggests the economy contracted in the fourth quarter from a year earlier.

Looking ahead to tonight’s first trading session on Wall Street, stock markets are awaiting direction from the Markit US Manufacturing PMI index due for release.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Security | Description | Last | % | Volume | MktCap |

| NEU | Neuren Pharmaceut. | 8.65 | 8.81 | 437,565 | $1,001,427,124 |

| DEG | De Grey Mining | 1.36 | 5.45 | 4,438,130 | $2,006,099,486 |

| ZIM | Zimplats Holding Ltd | 26.85 | 4.39 | 3,585 | $2,768,440,332 |

| APM | APM Human Services | 2.46 | 3.36 | 289,778 | $2,182,893,031 |

| OCL | Objective Corp | 13.53 | 3.20 | 6,300 | $1,246,395,467 |

| SGR | The Star Ent Grp | 1.82 | 2.68 | 4,990,410 | $1,685,065,152 |

| TAH | TABCORP | 1.10 | 2.56 | 4,007,662 | $2,450,437,724 |

| GOR | Gold Road Res Ltd | 1.73 | 2.37 | 1,200,886 | $1,818,325,584 |

| EVN | Evolution Mining Ltd | 3.05 | 2.18 | 4,150,213 | $5,468,348,631 |

| NST | Northern Star | 11.14 | 2.11 | 2,029,674 | $12,647,932,103 |

| BGL | Bellevue Gold Ltd | 1.15 | 1.99 | 1,462,357 | $1,248,277,340 |

| PNV | Polynovo Limited | 2.06 | 1.98 | 586,543 | $1,389,767,682 |

| BRG | Breville Group Ltd | 18.70 | 1.88 | 134,345 | $2,620,038,048 |

| PWH | Pwr Holdings Limited | 10.96 | 1.76 | 60,464 | $1,081,096,262 |

| TLC | The Lottery Corp | 4.56 | 1.67 | 1,798,713 | $9,971,457,229 |

Neuren Pharma (ASX:NEU) raced 8% on no specific news.

On December 23rd, the company did announce the submission of an Investigational New Drug (IND) application for NNZ-2591 in Prader-Willi syndrome to the US FDA.

Neuren’s drug NNZ-2591 is being developed for four serious neurological disorders that emerge in early childhood and for which there are no approved medicines.

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Security | Description | Last | % | Volume | MktCap |

| NHC | New Hope Corporation | 5.82 | -8.49 | 5,816,048 | $5,609,755,066 |

| LNK | Link Admin Hldg | 1.84 | -6.84 | 1,811,428 | $1,013,150,275 |

| LKE | Lake Resources | 0.75 | -5.94 | 4,993,055 | $1,113,336,437 |

| WHC | Whitehaven Coal | 8.87 | -5.89 | 10,508,525 | $8,496,814,199 |

| LTR | Liontown Resources | 1.25 | -5.68 | 12,407,472 | $2,899,294,662 |

| PDN | Paladin Energy Ltd | 0.66 | -5.36 | 12,407,965 | $2,085,979,581 |

| YAL | Yancoal Aust Ltd | 5.79 | -4.46 | 2,730,518 | $8,001,862,988 |

| CRN | Coronado Global Res | 1.91 | -4.15 | 1,548,665 | $3,336,142,923 |

| JLG | Johns Lyng Group | 5.96 | -3.72 | 300,299 | $1,616,886,211 |

| ARF | Arena REIT. | 3.69 | -3.66 | 122,000 | $1,335,580,082 |

| TWE | Treasury Wine Estate | 13.13 | -3.53 | 1,408,786 | $9,824,353,675 |

| PLS | Pilbara Min Ltd | 3.62 | -3.47 | 21,555,136 | $11,242,385,588 |

| TLX | Telix Pharmaceutical | 7.02 | -3.44 | 224,644 | $2,299,811,938 |

| SMR | Stanmore Resources | 2.86 | -3.22 | 610,076 | $2,659,076,009 |

Treasury Wines (ASX:TWE) slipped 5% on the broad based selloff.

The post ASX Large Caps: Shares slump over 1pc on thin trading as banks, coal and lithium miners tumble appeared first on Stockhead.

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….