Life Sciences

ASX Small Caps and IPO Weekly Wrap: Up days, down days = flat days; Medtech multiplies its mojo

At times it looked good but the benchmark finishes the week flat Once struggling Healthcare sector leads – up +5% … Read More

The post ASX Small…

- At times it looked good but the benchmark finishes the week flat

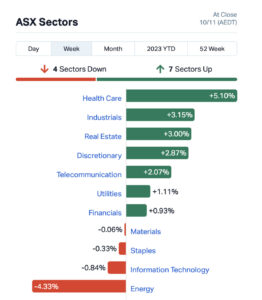

- Once struggling Healthcare sector leads – up +5%

- TechGen Metals soars 357% on positive gold, lithium updates

It’s been a topsy-turvy week on the Australian bourse, starting higher, finishing down with a mixture of higher and lower days in between. The result the benchmark S&P ASX 200 has finished flattish, just 0.2% up.

On Tuesday the Melbourne Cup was run and won by Without A Fight and the RBA resumed its tightening cycle, lifting the cash rate to 4.35%.

Odds were in favour of a hike after the central bank held rates steady for four consecutive months. It was the 13th rate hike since May last year, taking the cash rate to its highest level in more than a decade.

Then on Wednesday more than 10 million Optus customers woke into the dark ages – lost and bewildered – with a nationwide outage.

Lasting nearly 14 hours until full services were restored Optus says the longest and largest outage in recent times was caused by a “technical network fault”, but is yet to specify details.

The outage impacted businesses, hospitals, medical, education, transport and government services with many people used to constant internet and phone connection seen day-dreaming out the window on a train or bus.

There were even grumpy cats and dogs fed late because the wifi-connected pet feeder didn’t work. If we’ve learned anything from the Optus fiasco perhaps it’s we’ve become to reliant on electronics.

Go back to basics, relish some daydreaming time, ditch the wifi-connected pet feeder and just yell at the kids to go feed the damn dog!

On Friday Markets got spooked again after a hawkish US Federal Reserve chair Jerome Powell told the Monetary Fund conference in Washing DC “if it becomes appropriate to tighten policy further, we will not hesitate to do so”.

Healthcare out in front for week

The struggling healthcare found its mojo to led the winners this week, much to the delight of Morgan’s healthcare analyst Scott Power who has been hoping for a strong end to 2023.

Industrials and real estate were also leading the green, while energy and materials led the laggards.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks from November 6-10:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| TG1 | Techgen Metals Ltd | 0.105 | 357% | $2,083,544 |

| IMU | Imugene Limited | 0.105 | 144% | $788,147,234 |

| AZL | Arizona Lithium Ltd | 0.037 | 131% | $92,926,009 |

| WML | Woomera Mining Ltd | 0.026 | 117% | $23,873,891 |

| TG6 | TG Metals | 0.895 | 111% | $34,860,833 |

| NSM | Northstaw | 0.091 | 107% | $11,111,748 |

| AVW | Avira Resources Ltd | 0.002 | 100% | $4,267,580 |

| GRE | Greentechmetals | 0.82 | 100% | $42,621,666 |

| MHK | Metalhawk. | 0.195 | 95% | $15,360,347 |

| 8IH | 8I Holdings Ltd | 0.012 | 86% | $4,288,272 |

| NAG | Nagambie Resources | 0.035 | 75% | $19,778,695 |

| OZM | Ozaurum Resources | 0.145 | 69% | $24,606,250 |

| MCT | Metalicity Limited | 0.0025 | 67% | $10,627,715 |

| XGL | Xamble Group Limited | 0.075 | 67% | $21,311,718 |

| WSP | Whispir Limited | 0.485 | 62% | $63,591,141 |

| STK | Strickland Metals | 0.1675 | 52% | $281,268,068 |

| EFE | Eastern Resources | 0.012 | 50% | $13,661,411 |

| NIS | Nickel Search | 0.093 | 50% | $15,709,138 |

| ARV | Artemis Resources | 0.033 | 50% | $45,745,133 |

| PIM | Pinnacle Minerals | 0.275 | 49% | $7,416,750 |

| CHR | Charger Metals | 0.36 | 47% | $20,497,741 |

| PNR | Pantoro Limited | 0.047 | 47% | $202,957,190 |

| BYH | Bryah Resources Ltd | 0.019 | 46% | $5,737,685 |

| MXC | MGC Pharmaceuticals | 0.66 | 43% | $21,258,295 |

| AR9 | Archtis Limited | 0.14 | 40% | $39,981,246 |

| ALV | Alvomin | 0.305 | 39% | $24,679,533 |

| ECG | Ecargo Holdings | 0.054 | 38% | $33,223,500 |

| ZNC | Zenith Minerals Ltd | 0.165 | 38% | $58,142,846 |

| RDN | Raiden Resources Ltd | 0.048 | 37% | $116,793,258 |

| NAE | New Age Exploration | 0.0075 | 36% | $12,557,292 |

| BLU | Blue Energy Limited | 0.023 | 35% | $37,019,472 |

| KZR | Kalamazoo Resources | 0.115 | 35% | $20,564,337 |

| SLB | Stelar Metals | 0.35 | 35% | $19,205,932 |

| SUM | Summit Minerals | 0.125 | 34% | $5,718,855 |

| JAN | Janison Education Group | 0.315 | 34% | $72,433,317 |

| AHN | Athena Resources | 0.004 | 33% | $4,281,870 |

| AVE | Avecho Biotech Ltd | 0.004 | 33% | $10,793,168 |

| CT1 | Constellation Tech | 0.004 | 33% | $5,884,801 |

| CXU | Cauldron Energy Ltd | 0.012 | 33% | $13,585,961 |

| ENT | Enterprise Metals | 0.004 | 33% | $2,398,413 |

| EXL | Elixinol Wellness | 0.012 | 33% | $7,576,126 |

| GSN | Great Southern | 0.028 | 33% | $19,620,515 |

| HCD | Hydrocarbon Dynamic | 0.008 | 33% | $5,197,327 |

| KEY | KEY Petroleum | 0.002 | 33% | $3,935,856 |

| M4M | Macro Metals Limited | 0.004 | 33% | $7,948,311 |

| MTH | Mithril Resources | 0.002 | 33% | $6,737,609 |

| OAR | OAR Resources Ltd | 0.004 | 33% | $9,145,975 |

| PNX | PNX Metals Limited | 0.004 | 33% | $21,522,499 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| TZL | TZ Limited | 0.032 | 33% | $8,216,260 |

TechGen Metals (ASX:TG1) soared 357% this week after announcing stage-three drilling had been approved for its John Bull gold project in Glen Innes in NSW.

In a further positive for TGN pegmatite mapping will start at Ida Valley in WA, with historic data identifying lithium and caesium in soils up to 144.5ppm Li (311ppm Li2O) along the Ida Fault.

Clinical stage immuno-oncology small cap and Morgan’s analyst Iain Wilkie’s stock of the week Imugene (ASX:IMU) is up 144% in the past five days after releasing two good announcements.

On Monday IMU provided a positive clinical trial update of its Phase 1 MAST (Metastatic Advanced Solid Tumours) trial evaluating its novel cancer-killing virus, CF33-hNIS (VAXINIA).

Today IMU also announced dosing of the first patient in its Phase 1b clinical trial using Azer-cel(an allogeneic off-the-shelf CD19 CAR T, a type of cell therapy).

Adelaide-based small-capped explorer of gold, PGEs, nickel, copper, cobalt and lithium too Woomera Mining (ASX:WML) is up after announcing it had raised $2.1 million after issuing a total of 237,500,004 ordinary shares at $0.009/share to professional and sophisticated investors.

ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks from November 6-10:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| TMR | Tempus Resources Ltd | 0.007 | -50% | $2,400,460 |

| BOD | BOD Science Ltd | 0.031 | -45% | $6,029,509 |

| REM | Remsense Technologies | 0.035 | -40% | $3,244,233 |

| SRN | Surefire Rescs NL | 0.01 | -38% | $16,549,349 |

| BP8 | BPH Global Ltd | 0.001 | -33% | $2,423,345 |

| RBR | RBR Group Ltd | 0.002 | -33% | $3,236,809 |

| YPB | YPB Group Ltd | 0.002 | -33% | $1,560,923 |

| TGH | Terragen | 0.019 | -32% | $7,012,541 |

| IDX | Integral Diagnostics | 1.85 | -30% | $427,250,043 |

| FGL | Frugl Group Limited | 0.01 | -29% | $9,560,620 |

| MNS | Magnis Energy Tech | 0.052 | -29% | $97,159,350 |

| MPG | Many Peaks Gold | 0.22 | -27% | $8,002,386 |

| HOR | Horseshoe Metals | 0.008 | -27% | $5,147,829 |

| FLC | Fluence Corporation | 0.0905 | -26% | $83,570,471 |

| ADR | Adherium Ltd | 0.003 | -25% | $14,998,225 |

| AMD | Arrow Minerals | 0.0015 | -25% | $6,047,530 |

| DXN | DXN Limited | 0.0015 | -25% | $2,585,010 |

| HNR | Hannans Ltd | 0.006 | -25% | $16,385,129 |

| MTC | Metalstech Ltd | 0.12 | -25% | $22,632,551 |

| PVS | Pivotal Systems | 0.003 | -25% | $2,305,138 |

| SCT | Scout Security Ltd | 0.012 | -25% | $2,771,129 |

| SIH | Sihayo Gold Limited | 0.0015 | -25% | $18,306,384 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| MCL | Mighty Craft Ltd | 0.013 | -24% | $4,737,753 |

| GBZ | GBM Rsources Ltd | 0.016 | -24% | $9,304,827 |

| IAM | Income Asset | 0.08 | -24% | $24,949,916 |

| BVR | Bellavista Resources | 0.095 | -24% | $4,582,652 |

| DTC | Damstra Holdings | 0.185 | -24% | $60,602,292 |

| A1G | African Gold Ltd. | 0.031 | -23% | $6,095,204 |

| HPR | High Peak Royalties | 0.05 | -23% | $10,402,986 |

| VRX | VRX Silica Ltd | 0.1 | -23% | $64,171,640 |

| FBR | FBR Ltd | 0.018 | -22% | $75,523,638 |

| LVH | Livehire Limited | 0.042 | -22% | $15,378,015 |

| GBE | Globe Metals & Mining | 0.038 | -21% | $23,655,366 |

| AD1 | AD1 Holdings Limited | 0.004 | -20% | $3,290,276 |

| AJQ | Armour Energy Ltd | 0.1 | -20% | $10,312,011 |

| FAU | First Au Ltd | 0.002 | -20% | $2,903,987 |

| MHC | Manhattan Corp Ltd | 0.004 | -20% | $11,747,919 |

| MRQ | MRG Metals Limited | 0.002 | -20% | $4,411,837 |

| NGS | NGS Ltd | 0.008 | -20% | $2,261,047 |

| R3D | R3D Resources Ltd | 0.048 | -20% | $7,259,427 |

| RGS | Regeneus Ltd | 0.004 | -20% | $1,225,748 |

| ROO | Roots Sustainable | 0.004 | -20% | $613,250 |

| SIS | Simble Solutions | 0.004 | -20% | $2,411,803 |

| TMX | Terrain Minerals | 0.004 | -20% | $5,413,711 |

| OMX | Orange Minerals | 0.035 | -20% | $1,721,256 |

| OKJ | Oakajee Corp Ltd | 0.022 | -19% | $2,011,813 |

| LML | Lincoln Minerals | 0.0065 | -19% | $11,623,583 |

| CUS | Copper Search | 0.15 | -19% | $12,773,231 |

| BNZ | Benz Mining | 0.32 | -19% | $35,739,672 |

Who won the days?

Monday – Whispir (ASX:WSP) rose 61% after former Appen (ASX:APX) boss Mark Brayan run Soprano Design lobbed an off-market takeover play for all shares in the tech company for 48/cents or ~$64 million.

Tuesday –clinical stage immuno-oncology upstart, Imugene (ASX:IMU) rose 25% after releasing a promising clinical trial update of its Phase 1 MAST (Metastatic Advanced Solid Tumours) trial evaluating the safety and efficacy of novel cancer-killing virus CF33-hNIS (VAXINIA).

Wednesday – Magnetite miner Cyclone Metals (ASX:CLE) finished up 100% on no real news. Last week it announced it had appointed metallurgist Paul Vermeulen as general manager of technology and steel markets.

Thursday – Krakatoa Resources (ASX:KTA) was up 65% after completing drilling at its King Tamba project in WA’s Mid West region, which has been expanded after the intersection of a thick pegmatite with a width of up to 39m under the target area.

Friday – Rubix Resources (ASX:RB6)gained after announcing a cultural heritage survey will start on November 30 at its Lake Johnston lithium project in WA with a program of works for its maiden drilling program approved.

IPOs this week

Great Dirt Resources (ASX:GR8) listed today after raising $5 million at 20 cents. The battery-grade manganese explorer saw its shares rise 7.5% to 21.5 finishing the day with a market cap of $6,049,833.

GR8 is focused on exploration of battery-grade manganese in the Barraba region of New South Wales, with historical records showing mineral production in the area dating back to 1941.

Tempest Minerals – TEM backed Tolu Minerals (ASX:TOK) also listed today after raising $15 million at 50 cents. Tolu says its strategically positioned to participate in the renaissance of the PNG mining sector and saw its shares rise 10% to 55 cents finishing the day with a market cap of $32,318,464.

TEM invested $1 million in seed funding at and issue price of 37 cents to assist in its acquisition of the flagship Tolukuma Gold Mine.

According to the ASX website there are no scheduled IPO listings for next week.

At Stockhead, we tell it like it is. While Krakatoa Resources and Rubix Resources are Stockhead advertisers, they did not sponsor this article.

The post ASX Small Caps and IPO Weekly Wrap: Up days, down days = flat days; Medtech multiplies its mojo appeared first on Stockhead.

diagnostics

cell therapy

pharmaceuticals

medical

wellness

biotech

healthcare

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….