Life Sciences

Cancer-Focused Abdera Therapeutics Launches with $142M In Funding

Abdera Therapeutics, a newly formed cancer therapeutics upstart, has emerged out of stealth armed with $142 million in a combined Series A and Series B…

Abdera Therapeutics, a newly formed cancer therapeutics upstart, emerged out of stealth on Thursday armed with $142 million in a combined Series A and Series B funding.

The Series A round was led by Versant Ventures and Amplitude Venture Capital, while the Series B round was led by venBio Partners.

Abdera Therapeutics aims to develop a slew of radiopharmaceuticals, some of which are in the process of advancing to human clinical trials in 2024.

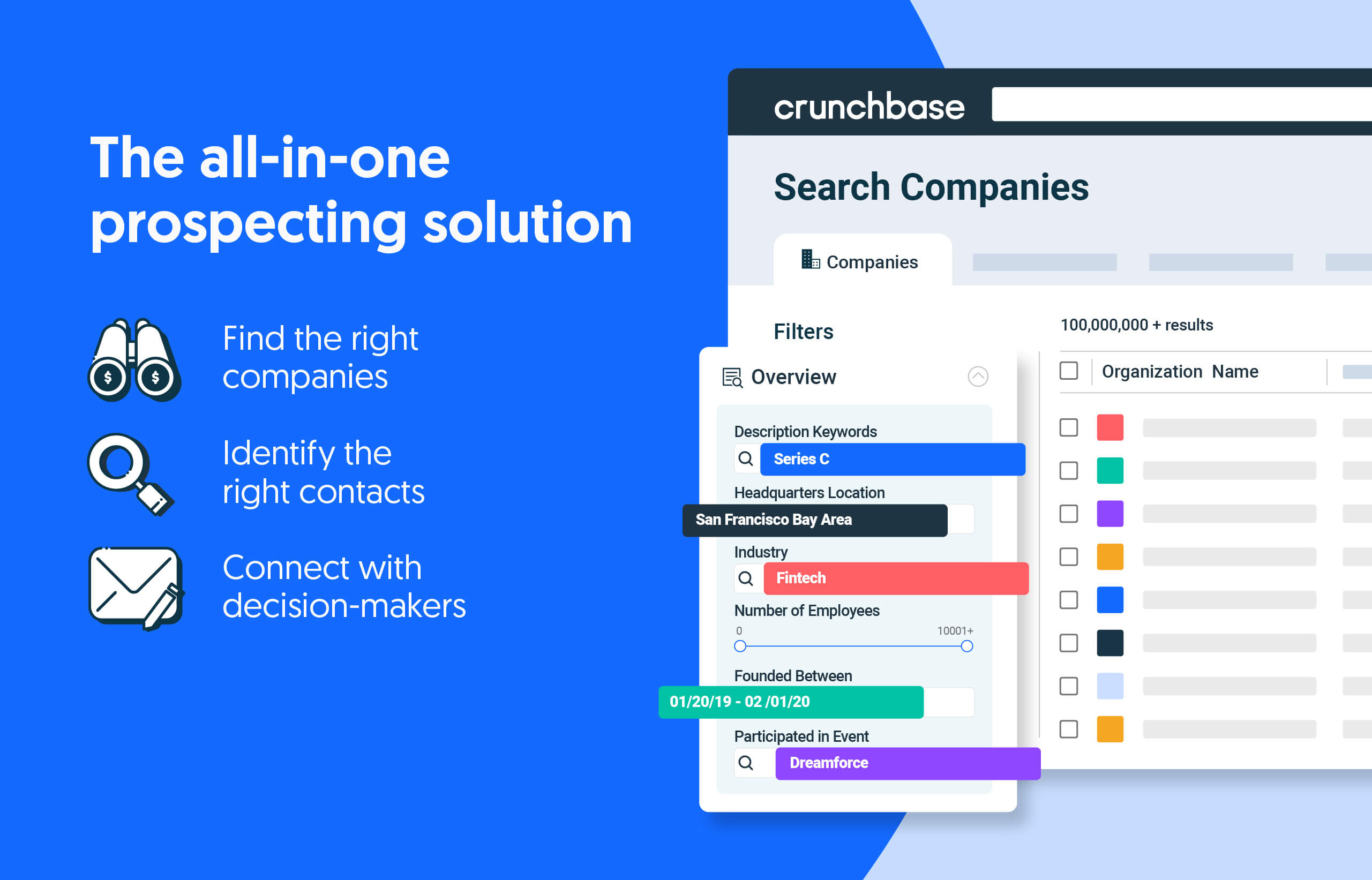

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

It’s a daunting task: Radiopharmaceuticals can infuse toxicity in the body as a result of trying to kill cancerous cells, but that often affects surrounding tissue. But the company hopes to create therapeutics that will target only the specific cancer cells without touching the rest of the body.

“Radiopharmaceuticals hold the potential to transform the treatment of cancer, but the ability to finely tune radioisotope delivery to the tumor, while sparing healthy tissue, remains a major challenge for this class of drugs,” said Lori Lyons-Williams, CEO of Abdera Therapeutics, in a statement.

The power of a platform-based drug

Abdera Therapeutics is a platform that can develop a series of therapeutics using the same base mechanics. Among biotech venture firms, platforms are one of the gold-star investments in that category. Rather than spend a billion dollars creating a single drug in hopes that it reaches the market in 10 years, platforms can quickly whip up a handful of drugs faster and at a relatively lower cost.

“We believe that Abdera’s approach represents a new wave of innovation in this space to address important cancer targets that may be intractable to other approaches,” Versant Ventures principal Joel Drewry said in a statement.

Platforms also have an advantage because they’re not reliant on a single drug — which can take up to 10 years to make — for revenue. Startups armed with a biotech platform often partner with larger pharmaceutical companies to create therapeutics or other assets as those platforms grow their own portfolio of drugs. This, ultimately, is what makes them a darling in the venture world.

Illustration: Dom Guzman

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….