Life Sciences

Check Up: As the pandemic winds down, what’s happening with Covid focused biotechs?

Winter’s nearly over and the Covid surge in Australia has slowed down dramatically. New cases are now rapidly declining. … Read More

The post Check…

- New Covid cases are declining across the world

- Some big pharmas have lost over half their value this year

- Best and worst ASX stocks in the past month

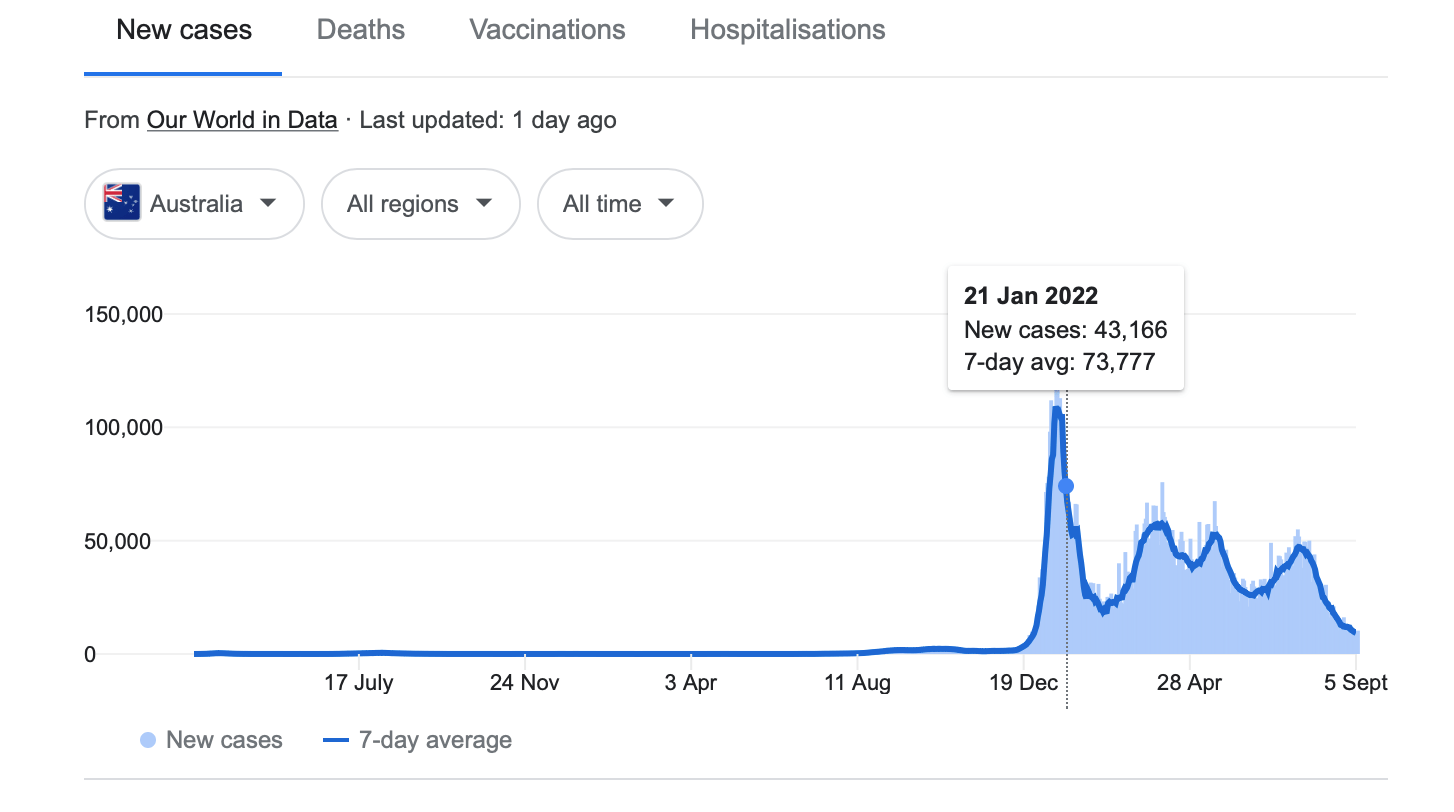

Winter’s nearly over and the Covid surge in Australia has slowed down dramatically. Apart from the spike in January, new cases are now rapidly declining.

In the US, the situation looks similar as Americans go back to their daily lives.

The US government has even decided to put an end to public financial support for both Covid-19 vaccines and treatments.

And just last week, the White House signalled that healthy people will only need to get one booster vaccine shot per year.

So with the pandemic seemingly in check, what’s happening with Covid focused healthcare companies?

Moderna has pulled back almost 50% this year as its once blockbuster Spikevax vaccine now faces a much less lucrative market.

Pfizer/BioNTech are facing the same headwinds and they’re set to lock horns in the courtroom after Moderna sued Pfizer and BioNTech over alleged infringement of the mRNA vaccine technology patents.

Novavax, which has lost 80% of its market value this year, has slashed its revenue guidance further. The company’s Nuvaxovid vaccine never really got off the ground after failing to overcome various regulatory hurdles.

Unfortunately, those failures are not confined to the US and Europe.

In Australia, Brisbane-based biotech Ellume has gone into administration just two years after making international headlines.

In 2020, Ellume shot into the public spotlight when it secured a US$300m deal with the US government to supply Covid RAT kits to Americans.

According to the latest filings, the company has lost $100m since then due to various reasons or other – not least being the significant decline of Covid cases in the US.

Still plenty of opportunities

Despite these setbacks, experts believe there are still plenty of opportunities in developing non-preventative Covid treatments – for example, treating Long Covid.

Some of the ASX companies in this space include MGC Pharma (ASX:MXC), Immuron (ASX:IMC), Clarity Pharma (ASX:CU6), Dimerix (ASX:DXB), and Antisense Therapuetics (ASX:ANP).

And elsewhere, China and India are still betting big on vaccines.

China has become the first country to approve a needle-free, inhaled version of a Covid-19 vaccine.

It’s made by Tianjin-based CanSino Biologics Inc., which is listed on the Hong Kong stock market.

According to Chinese health officials guidelines, the approved CanSino’s Ad5-nCoV vaccine can be used for emergency use or as a booster vaccine.

India has also approved a locally developed, needle-free and nasally administered Covid-19 vaccine for emergency use.

The vaccine was developed by Bharat Biotech, the makers of another intravenous vaccine that was approved by the WHO last year.

Biggest ASX healthcare winners and losers for the month

Here’s a table showing how ASX-listed healthcare stocks have been performing.

| CODE | COMPANY | PRICE | 1 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|

| LCT | Living Cell Tech. | 0.013 | 44% | 5% | $ 85,824,970.77 |

| CMP | Compumedics Limited | 0.27 | 38% | -40% | $ 63,743,305.93 |

| MEB | Medibio Limited | 0.002 | 33% | -71% | $ 434,289,766.24 |

| IVX | Invion Ltd | 0.012 | 33% | 0% | $ 107,466,636.91 |

| MDC | Medlab Clinical Ltd | 13 | 29% | -52% | $ 34,070,761.64 |

| OSX | Osteopore Limited | 0.245 | 26% | -29% | $ 7,774,223.76 |

| PGC | Paragon Care Limited | 0.4 | 25% | 33% | $ 105,383,784.10 |

| ACR | Acrux Limited | 0.068 | 24% | -43% | $ 124,088,685.75 |

| ANP | Antisense Therapeut. | 0.105 | 17% | -42% | $ 211,782,444.08 |

| HXL | Hexima | 0.014 | 17% | -96% | $ 562,840,080.46 |

| JTL | Jayex Technology Ltd | 0.007 | 17% | -67% | $ 424,670,745.10 |

| NEU | Neuren Pharmaceut. | 6.34 | 16% | 170% | $ 664,690,401.65 |

| BXN | Bioxyne Ltd | 0.016 | 14% | -53% | $ 111,050,421.00 |

| CAJ | Capitol Health | 0.32 | 14% | -18% | $ 244,041,406.81 |

| EYE | Nova EYE Medical Ltd | 0.24 | 14% | -45% | $ 65,279,742.31 |

| CU6 | Clarity Pharma | 0.67 | 14% | -54% | $ 68,772,765.12 |

| IBX | Imagion Biosys Ltd | 0.037 | 12% | -49% | $ 63,322,865.20 |

| PTX | Prescient Ltd | 0.19 | 12% | -19% | $ 14,753,661.65 |

| NOX | Noxopharm Limited | 0.265 | 10% | -48% | $ 134,746,786.52 |

| SHG | Singular Health | 0.11 | 10% | -48% | $ 414,961,104.60 |

| BNO | Bionomics Limited | 0.057 | 10% | -69% | $ 21,720,255.54 |

| AHC | Austco Healthcare | 0.125 | 9% | -17% | $ 324,909,891.74 |

| LBT | LBT Innovations | 0.079 | 8% | -39% | $ 121,233,241.16 |

| PYC | PYC Therapeutics | 0.067 | 8% | -55% | $ 74,042,010.32 |

| TRP | Tissue Repair | 0.335 | 8% | 0% | $ 105,821,507.30 |

| CTE | Cryosite Limited | 0.71 | 8% | 58% | $ 445,233,607.02 |

| ACW | Actinogen Medical | 0.069 | 6% | -37% | $ 45,121,675.21 |

| LDX | Lumos Diagnostics | 0.055 | 6% | -95% | $ 49,497,716.84 |

| RAP | Resapp Health Ltd | 0.2 | 5% | 233% | $ 7,052,862.98 |

| HCT | Holista CollTech Ltd | 0.041 | 5% | -32% | $ 746,520,890.72 |

| PIQ | Proteomics Int Lab | 0.93 | 4% | -16% | $ 42,628,342.65 |

| PAB | Patrys Limited | 0.026 | 4% | -38% | $ 23,655,453.25 |

| SOM | SomnoMed Limited | 1.3 | 4% | -43% | $ 71,859,135.29 |

| SDI | SDI Limited | 0.86 | 3% | -17% | $ 45,078,216.87 |

| EXL | Elixinol Wellness | 0.036 | 3% | -67% | $ 1,028,458,408.42 |

| CBL | Control Bionics | 0.21 | 2% | -70% | $ 28,267,654.81 |

| CYC | Cyclopharm Limited | 1.44 | 2% | -14% | $ 29,377,864.42 |

| HGV | Hygrovest Limited | 0.064 | 2% | -20% | $ 39,563,180.90 |

| AVE | Avecho Biotech Ltd | 0.013 | 0% | -19% | $ 98,109,635.76 |

| TRU | Truscreen | 0.046 | 0% | -19% | $ 151,842,790.35 |

| ALT | Analytica Limited | 0.001 | 0% | -50% | $ 173,787,847.00 |

| PXS | Pharmaxis Ltd | 0.077 | 0% | -47% | $ 310,767,187.85 |

| TSN | The Sust Nutri Grp | 0.14 | 0% | -55% | $ 129,100,328.25 |

| SCU | Stemcell United Ltd | 0.013167 | 0% | -7% | $ 6,890,400.00 |

| ICS | ICSGlobal Limited | 0.575313 | 0% | 0% | $ 61,117,459.15 |

| FFC | Farmaforce Ltd | 0.035 | 0% | -47% | $ 323,768,027.90 |

| OIL | Optiscan Imaging | 0.115 | 0% | -54% | $ 25,400,637.71 |

| OVN | Oventus Medical Ltd | 0.02 | 0% | -82% | $ 40,438,477.31 |

| GTG | Genetic Technologies | 0.004 | 0% | -50% | $ 133,717,354.80 |

| OSP | Osprey Med Inc | 0.2 | 0% | -82% | $ 6,723,744.42 |

| GLH | Global Health Ltd | 0.34 | 0% | -31% | $ 13,477,356.56 |

| ATX | Amplia Therapeutics | 0.1 | 0% | -53% | $ 160,045,653.60 |

| RAC | Race Oncology Ltd | 2 | -1% | -42% | $ 78,614,048.17 |

| RHY | Rhythm Biosciences | 1.42 | -1% | 26% | $ 466,319,546.00 |

| CAN | Cann Group Ltd | 0.28 | -2% | -7% | $ 11,027,007.33 |

| M7T | Mach7 Tech Limited | 0.66 | -3% | -32% | $ 18,413,718.68 |

| NTI | Neurotech Intl | 0.095 | -3% | 121% | $ 20,887,325.99 |

| MDR | Medadvisor Limited | 0.155 | -3% | -51% | $ 12,552,394.37 |

| UBI | Universal Biosensors | 0.29 | -3% | -65% | $ 102,912,078.39 |

| NYR | Nyrada Inc. | 0.145 | -3% | -49% | $ 41,924,765.82 |

| IHL | Incannex Healthcare | 0.27 | -4% | -36% | $ 427,061,400.50 |

| MVF | Monash IVF Group Ltd | 1.01 | -4% | 2% | $ 256,490,302.62 |

| 1AD | Adalta Limited | 0.05 | -4% | -50% | $ 100,520,537.43 |

| S66 | Star Combo | 0.23 | -4% | -32% | $ 56,196,215.07 |

| CPH | Creso Pharma Ltd | 0.038 | -5% | -70% | $ 265,373,819.01 |

| BIT | Biotron Limited | 0.057 | -5% | 12% | $ 17,794,072.56 |

| MXC | Mgc Pharmaceuticals | 0.017 | -6% | -67% | $ 122,431,495.90 |

| DXB | Dimerix Ltd | 0.15 | -6% | -53% | $ 16,774,304.20 |

| NC6 | Nanollose Limited | 0.067 | -6% | -28% | $ 23,595,642.38 |

| IMC | Immuron Limited | 0.088 | -6% | -45% | $ 14,888,636.80 |

| PCK | Painchek Ltd | 0.029 | -6% | -39% | $ 119,633,213.70 |

| MX1 | Micro-X Limited | 0.13 | -7% | -53% | $ 2,390,348,688.99 |

| PBP | Probiotec Limited | 2.16 | -7% | -1% | $ 71,447,511.30 |

| EZZ | EZZ Life Science | 0.305 | -8% | -28% | $ 14,027,193.09 |

| DVL | Dorsavi Ltd | 0.012 | -8% | -42% | $ 50,692,627.54 |

| 4DX | 4Dmedical Limited | 0.645 | -8% | -57% | $ 443,811,800.25 |

| NXS | Next Science Limited | 0.93 | -8% | -35% | $ 182,977,663.50 |

| KZA | Kazia Therapeutics | 0.23 | -8% | -84% | $ 152,200,961.49 |

| ARX | Aroa Biosurgery | 0.78 | -9% | -22% | $ 30,106,676.39 |

| RHT | Resonance Health | 0.062 | -9% | -46% | $ 457,255,403.88 |

| RCE | Recce Pharmaceutical | 0.77 | -9% | -7% | $ 26,309,479.92 |

| OCC | Orthocell Limited | 0.4 | -9% | -15% | $ 120,447,697.50 |

| AC8 | Auscann Grp Hlgs Ltd | 0.04 | -9% | -57% | $ 372,794,698.11 |

| PAA | Pharmaust Limited | 0.078 | -9% | -9% | $ 385,620,479.44 |

| VHT | Volpara Health Tech | 0.6 | -10% | -52% | $ 16,643,780.35 |

| CDX | Cardiex Limited | 0.315 | -10% | -56% | $ 101,619,541.16 |

| ICR | Intelicare Holdings | 0.036 | -10% | -68% | $ 57,636,932.12 |

| VBS | Vectus Biosystems | 0.76 | -10% | -44% | $ 18,761,109.78 |

| ZNO | Zoono Group Ltd | 0.125 | -11% | -73% | $ 243,507,908.07 |

| AN1 | Anagenics Limited | 0.032 | -11% | -38% | $ 6,054,604.94 |

| ALA | Arovella Therapeutic | 0.024 | -11% | -58% | $ 14,606,489.21 |

| BWX | BWX Limited | 0.63 | -11% | -87% | $ 24,240,364.95 |

| RGS | Regeneus Ltd | 0.047 | -11% | -38% | $ 42,583,449.16 |

| GSS | Genetic Signatures | 0.915 | -12% | -41% | $ 42,583,449.16 |

| ALC | Alcidion Group Ltd | 0.145 | -12% | -62% | $ 5,233,799.32 |

| PSQ | Pacific Smiles Grp | 1.465 | -12% | -41% | $ 183,725,679.30 |

| IMU | Imugene Limited | 0.2275 | -13% | -43% | $ 6,011,325.08 |

| IIQ | Inoviq Ltd | 0.55 | -13% | -64% | $ 34,298,260.16 |

| OPT | Opthea Limited | 1.135 | -14% | -18% | $ 28,368,033.80 |

| VTI | Vision Tech Inc | 0.275 | -14% | -73% | $ 46,085,198.10 |

| ONE | Oneview Healthcare | 0.115 | -15% | -70% | $ 24,602,017.39 |

| IMM | Immutep Ltd | 0.275 | -15% | -53% | $ 31,985,910.17 |

| RNO | Rhinomed Ltd | 0.16 | -16% | -51% | $ 19,096,396.27 |

| BOT | Botanix Pharma Ltd | 0.068 | -16% | -11% | $ 50,786,808.29 |

| RSH | Respiri Limited | 0.041 | -16% | -49% | $ 15,668,880.45 |

| IDT | IDT Australia Ltd | 0.125 | -17% | -81% | $ 47,764,383.09 |

| BDX | Bcaldiagnostics | 0.075 | -17% | -63% | $ 5,899,234.12 |

| VLS | Vita Life Sciences.. | 1.76 | -17% | 43% | $ 10,305,255.62 |

| CYP | Cynata Therapeutics | 0.34 | -17% | -39% | $ 17,148,435.07 |

| ILA | Island Pharma | 0.165 | -18% | -51% | $ 349,142,055.66 |

| ATH | Alterity Therap Ltd | 0.014 | -18% | -56% | $ 37,446,504.35 |

| AMT | Allegra Orthopaedics | 0.14 | -18% | -39% | $ 62,818,828.66 |

| IRX | Inhalerx Limited | 0.057 | -19% | -40% | $ 102,545,622.30 |

| OSL | Oncosil Medical | 0.05 | -19% | 3% | $ 80,713,334.45 |

| IPD | Impedimed Limited | 0.064 | -20% | -51% | $ 49,615,472.30 |

| 1ST | 1St Group Ltd | 0.008 | -20% | -53% | $ 143,020,505.10 |

| AT1 | Atomo Diagnostics | 0.059 | -21% | -73% | $ 12,666,058.00 |

| ZLD | Zelira Therapeutics | 1.45 | -23% | -78% | $ 24,355,214.09 |

| ADO | Anteotech Ltd | 0.053 | -23% | -71% | $ 192,201,700.50 |

| RAD | Radiopharm | 0.16 | -24% | 0% | $ 68,207,734.98 |

| RAD | Radiopharm | 0.16 | -24% | 0% | $ 2,246,374,515.04 |

| PAR | Paradigm Bio. | 1.3 | -24% | -33% | $ 53,522,814.07 |

| MVP | Medical Developments | 1.76 | -25% | -47% | $ 67,160,847.60 |

| CHM | Chimeric Therapeutic | 0.1 | -27% | -70% | $ 445,329,654.42 |

| ADR | Adherium Ltd | 0.008 | -27% | -47% | $ 136,035,310.32 |

| TLX | Telix Pharmaceutical | 5.67 | -28% | -14% | $ 23,377,427.02 |

| PNV | Polynovo Limited | 1.335 | -30% | -39% | $ 71,296,050.33 |

| CGS | Cogstate Ltd | 1.265 | -31% | -26% | $ 25,799,012.36 |

| TD1 | Tali Digital Limited | 0.004 | -33% | -88% | $ 50,544,366.14 |

| EPN | Epsilon Healthcare | 0.026 | -33% | -83% | $ 20,917,417.50 |

| AGH | Althea Group | 0.085 | -35% | -68% | $ 105,261,552.34 |

| MEM | Memphasys Ltd | 0.023 | -46% | -62% | $ 26,533,404.70 |

| DOC | Doctor Care Anywhere | 0.097 | -54% | -87% | $ 137,503,458.12 |

| NSB | Neuroscientific | 0.1 | -57% | -72% | $ 19,813,287.20 |

Living Cell Technologies (ASX:LCT)

LCT has advanced its Parkinson’s disease research, with choroid plexus tissue successfully shipped from New Zealand to Australia as part of the third clinical trial of NTCELL.

The choroid plexus (porcine brain) tissue was provided by New Zealand biotech NZeno from its designated pathogen-free facility in Invercargill.

LCT’s research agreement with UTS and the Australian Foundation for Diabetes Research has enabled the production of NTCELL in Australia, which was a new milestone for this project.

Once production of NTCELL has been optimised, it will be manufactured at a Good Manufacturing Practice (GMP) facility for use in the company’s third clinical trial of NTCELL in Parkinson’s disease.

The medical device company reported record sales in FY22.

Revenues from shipped and invoiced sales were $37.8m for FY22, up 6% on FY21 of $35.7m.

Bottom line NPAT improved to $1.4m in FY22 compared to $1.0m in FY21.

The company continues to actively pursue ongoing step-out commercial growth opportunities for its MEG and Somfit technology platforms.

Antisense Therapeutics (ASX:ANP)

Outcomes from a collaboration to study the neurological aspects of Long COVID-19 have identified novel blood markers as potential diagnostic and therapeutic targets.

The study was done between Antisense and US-based researchers led by global leader in the field, Dr Igor Koralnik, at the Northwestern Medicine Neuro-COVID clinic in Chicago.

Antisense said analysed data has identified a number of proteins that are significantly modulated in the blood of Long COVID-19 patients when compared to patients who had recovered from Long COVID-19 infection.

The regenerative bone and tissue implant specialist has moved one step closer to a China market entry after signing a distribution deal with Kontour (Xi’an) Medical Technology.

Under the deal, the Shanghai stock exchange-listed Kontour will market and sell Osteopore products across mainland China.

Kontour has agreed to a purchase target of US$500k of Osteopore products in the first year and US$1m in the second year, subject to receiving a clearance from China’s NPMA (National Medical Products Administration).

At Stockhead we tell it like it is. While Osteopore is a Stockhead advertiser, it did not sponsor this article.

The post Check Up: As the pandemic winds down, what’s happening with Covid focused biotechs? appeared first on Stockhead.

manufacturing

diagnostics

proteomics

therapeutics

vaccines

biologics

pharmaceuticals

medical

wellness

biotech

pharma

life sciences

healthcare

imaging

implant

diagnostic

bone

medicine

health

pharmaceutical

device

preventative

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….