Life Sciences

Closing Bell: Brave small caps rise over 1% in defiance of latest wanton, unhinged RBA 50 bps rate hike

ASX 200 drops load circa 1430 (AEST) ends 0.4% lower Small caps index laughs openly in face of danger, gains … Read More

The post Closing Bell: Brave…

- ASX 200 drops load circa 1430 (AEST) ends 0.4% lower

- Small caps index laughs openly in face of danger, gains 1%

- RBA hits us with another 50bps rate hike

The ASX 200 — not unlike the still, glassy ocean before a hurricane — was flat and lifeless at 2.15pm Sydenham time, a few minutes before the Reserve Bank of Australia added another 50 basis points increment of pain to the wider economy and the little households that drive it.

The RBA took the cash rate 0.50% higher at this arvo’s September board meeting, citing ongoing inflationary pressures amidst tightening labour market.

Needless to say, the benchmark index, afraid of its own afternoon shadow, shrank at the very mention of Dr Governor Lowe and began selling up and heading for the boondocks.

I don’t like to quote Phil Gould but when an incensed Mark Geyer was left out of his Penrith Panthers run on side back in the early-90’s he confronted the older man in the sheds before the entire team. Gould’s response:

“Come on then son, don’t let fear hold you back.”

And thusly, at the other end of the S&P Courageous Company Index, the smaller, more vulnerable local caps just gathered steam and shirt-fronted Tuesday, ending the day over 1% stronger, in both a fiduciary and a moral sense.

Meanwhile, in Martin Place

The cash rate setting, at 2.35%, is now at the highest level since January 2015, but still a tad below the pre-COVID decade average of 2.56%.

In justifying yet another brutal 50bps whack, the bank covered old territory with new urgency, bating on about inflation being the highest since 1994, the height of grunge… as Pearl Jam released the forgotten gem, Vitalogy album.

Even worse, inflation is set to rise further – thank you very much to low unemployment and strong demand.

The tight labour market is giving some oomph to wages growth. Dr Shane Oliver at AMP capital says that “in some areas labour costs are increasing briskly and it is important that medium-term inflation expectations remain “well anchored”.

Dr Lowe et al reaffirmed their position that inflation will rise to 7.75% by year end, before falling in 2023 and 2024.

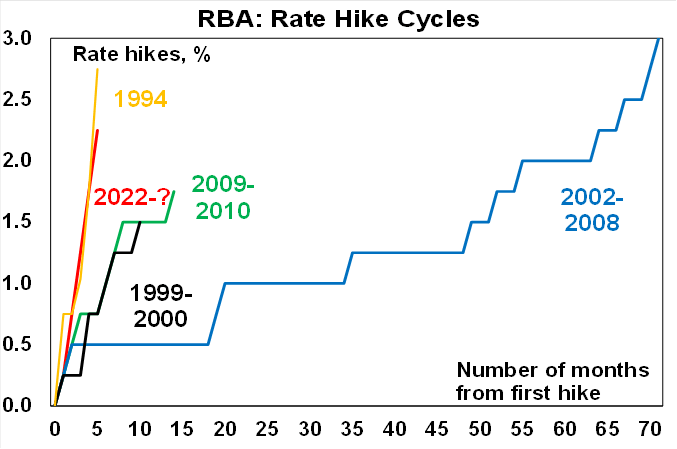

“This is the fastest increase in rates since a total increase of 2.75% over five months from August to December 1994,” Dr Oliver said. “The speed of the rate hikes compared to the last three tightening cycles reflects the extent of the blow out in inflation and the low starting point for the cash rate.”

“We expect the RBA to so slow the pace of hikes in the months ahead and will watch Governor Lowe’s speech on Thursday for any guidance in this direction, but its looking like our assessment for the cash rate to peak at 2.6% around year end is now too conservative so we have revised it up to 2.85%.

Does ABARES sh*t in the winter crops?

I’m quite certain they do not. But, talking of the Australian Bureau for Agricultural Resource Economics and Sciences (ABARES), for the first time, the value of Australia’s food and stuff farmers make exports is expected to top $70 billion as good weather conditions (are they drunk?) and high prices continue for farmers.

Australia’s winter crops alone are expected to yield more than 55 million tonnes, according to ABARES.

But the value of farm production overall will soften slightly, dropping from $85 billion in 2021–22 to $81.8 billion this year, as China’s all over the shop economy and the high cost of fertiliser offer up fresh headwinds for Aussie farmers.

Does the Australian Bureau of Statistics… whatever

And I’m no student of the nation’s current accounts, but it seems the Bureau of Numbers has clocked the surplus growing by $18.3 billion during the the June quarter, driven into a state of apoplexy by the rising prices of many key commodity exports.

According to the ABS it was our 13th straight current account surplus, the longest surplusness on record.

The numbers people said annual exports of Coal topped $100 billion in value for the first time as exports jumped 14.7% while the terms of trade rose 4.6% also to its highest level on record.

Mining and Agricultural commodities – that’s how we roll, BTW – were the heroes of the dish.

Meanwhile in China

As Sichuan Province grapples with China’s latest lockdown throw away the key wrestle with the Omicron variant, this happened:

Nothing says big earthquake in Sichuan better than a rocking, sizzling pot of red hot soup. pic.twitter.com/ORBKfLjV8J

— 王丰 Wang Feng (@ulywang) September 5, 2022

The epicentre, some 200 kms from Chengdu is Luping County where Xinhua reports up to 50 people have died.

Bad news comes in threes, so as reports suggest there are now well over 300 million people under some form of lockdown, it might be a good time to hope for the best but prepare for the opposite of that.

Meanwhile in Reuben’s world

August turned out to be another decent month for fans of resource stocks and none more so than Cobre (ASX:CBE) which Reuben tells me gained well over 400% last month and that the “plucky, not-so-little-any-more copper explorer” added circa +1,400% from 3c to 46c in the two months ending August 31.

“The catalyst has been ongoing exploration success at the Ngami copper project in Botswana, where mineralisation “continues at depth as well as laterally along more than 4km of proven strike”, says CBE boss Martin Holland.

“Given the significant copper results and strong exploration potential of the project, the company has mobilised a second drill rig to site with plans underway to deploy additional rigs to the project by year end in order to unlock this exciting copper discovery at Ngami,” he said August 30.

Outstanding, said Reuben, before wiping a solitary tear from his prematurely age-d, but undeniably resolute face.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| OXX | Octanex Ltd | 0.02 | 33% | 176,492 | $3,884,665.29 |

| EMT | Emetals Limited | 0.021 | 31% | 38,531,722 | $13,600,000.00 |

| REZ | Resourc & En Grp Ltd | 0.027 | 29% | 1,503,565 | $10,495,921.57 |

| ABX | ABX Group Limited | 0.16 | 28% | 1,728,606 | $27,948,851.75 |

| TYX | Tyranna Res Ltd | 0.043 | 26% | 108,231,995 | $79,470,262.68 |

| SPD | Southernpalladium | 1.45 | 26% | 70,225 | $49,540,076.05 |

| OPN | Oppenneg | 0.15 | 25% | 118,905 | $17,668,573.44 |

| OAR | OAR Resources Ltd | 0.005 | 25% | 1,643,837 | $8,684,151.59 |

| PRM | Prominence Energy | 0.0025 | 25% | 529,666 | $4,849,217.64 |

| XST | Xstate Resources | 0.0025 | 25% | 15,505,812 | $6,430,363.30 |

| CBE | Cobre | 0.46 | 21% | 9,011,645 | $77,409,585.30 |

| ERW | Errawarra Resources | 0.205 | 21% | 233,033 | $6,727,086.15 |

| CPT | Cipherpoint Limited | 0.006 | 20% | 3,457,530 | $1,922,029.32 |

| ROG | Red Sky Energy. | 0.006 | 20% | 10,093,803 | $26,511,135.99 |

| MM1 | Midasmineralsltd | 0.245 | 20% | 2,056 | $11,712,011.62 |

| UBI | Universal Biosensors | 0.295 | 18% | 413,632 | $52,961,108.75 |

| TIG | Tigers Realm Coal | 0.02 | 18% | 553,548 | $222,133,940.26 |

| KZA | Kazia Therapeutics | 0.235 | 18% | 258,514 | $29,927,331.20 |

| CZN | Corazon Ltd | 0.021 | 17% | 239,442 | $10,985,950.03 |

| GLV | Global Oil & Gas | 0.0035 | 17% | 1,267,616 | $5,620,064.12 |

| GCY | Gascoyne Res Ltd | 0.38 | 15% | 3,958,980 | $140,591,633.82 |

| LER | Leaf Res Ltd | 0.031 | 15% | 46,936 | $30,854,236.50 |

| SKY | SKY Metals Ltd | 0.07 | 15% | 265,391 | $22,983,791.67 |

| ADX | ADX Energy Ltd | 0.008 | 14% | 4,172,097 | $24,535,207.66 |

| BUY | Bounty Oil & Gas NL | 0.008 | 14% | 2,110,924 | $9,593,506.87 |

ABx Group (ASX:ABX) certainly knows how to party (those reports are as yet unconfirmed), but what we do know is that the digger has received assays from most of its winter drilling campaign and those have gone and expanded the ‘lateral extent of REE mineralisation by 230% to 4.01 square km.’

If it seems a lot it is. ABx’s Deep Leads REE mineralisation is enriched in the more valuable permanent magnet type of REE and includes true ionic adsorption clay zones that achieve 50% to 75% leaching extraction rates, which are high extraction rates by mine and even world standards. The stock is killing it.

WA-based gold-nickel explorer Errawarra Resources (ASX:ERW) reports a key tenement comprising the Andover West Project has been granted for a period of five years from September 1.

Andover West covers an area of 100km2 in a very favourable geological setting for nickel in the West Pilbara, close to Azure Minerals’ advanced Andover nickel exploration project – home to a mineral resource of 4.6Mt at 1.11% Ni, 0.47% Cu and 0.05% Co.

ERW says the grant of the tenement is an important milestone, as it largely clears the way for more substantive on-ground exploration activities.

To kick-start exploration, Errawarra in cooperation with Ngarluma Aboriginal Corporation has scheduled a heritage clearance survey to be undertaken this month over areas including the priority nickel target.

ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.002 | -33% | 2,569,349 | $45,307,721.13 |

| RML | Resolution Minerals | 0.008 | -30% | 15,169,725 | $10,140,081.21 |

| DDD | 3D Resources Limited | 0.0015 | -25% | 11,101,460 | $8,863,744.18 |

| GGX | Gas2Grid Limited | 0.0015 | -25% | 10,686,100 | $8,116,204.16 |

| SIT | Site Group Int Ltd | 0.003 | -25% | 45,000 | $4,204,980.51 |

| SI6 | SI6 Metals Limited | 0.007 | -22% | 1,548,804 | $13,393,701.71 |

| TD1 | Tali Digital Limited | 0.004 | -20% | 71,539 | $6,163,152.62 |

| PKO | Peako Limited | 0.019 | -17% | 1,134,924 | $7,094,444.32 |

| MXO | Motio Ltd | 0.035 | -17% | 9,040 | $10,344,236.99 |

| JAY | Jayride Group | 0.175 | -17% | 68,264 | $37,040,694.18 |

| CLE | Cyclone Metals | 0.0025 | -17% | 1,494,000 | $18,350,210.95 |

| MTH | Mithril Resources | 0.005 | -17% | 73,199 | $17,641,398.25 |

| RR1 | Reach Resources Ltd | 0.005 | -17% | 8,447,750 | $11,460,303.83 |

| RNX | Renegade Exploration | 0.006 | -14% | 3,714,835 | $6,227,386.47 |

| DMG | Dragon Mountain Gold | 0.013 | -13% | 407,552 | $5,905,074.98 |

| ILA | Island Pharma | 0.165 | -13% | 53,517 | $8,216,802.32 |

| CTO | Citigold Corp Ltd | 0.007 | -13% | 302,488 | $22,669,272.73 |

| RZI | Raiz Invest Limited | 0.5 | -12% | 606,575 | $53,263,915.62 |

| PFT | Pure Foods Tas Ltd | 0.18 | -12% | 53,650 | $18,118,098.85 |

| KNM | Kneomedia Limited | 0.024 | -11% | 434,153 | $36,338,697.17 |

| 1ST | 1St Group Ltd | 0.008 | -11% | 53,449 | $11,593,564.34 |

| PCL | Pancontinental Energ | 0.004 | -11% | 1,418,236 | $33,994,002.65 |

| S3N | Sensore Ltd | 0.445 | -11% | 29,318 | $12,592,591.50 |

| ABV | Adv Braking Tech Ltd | 0.025 | -11% | 2,843 | $10,616,165.45 |

| EPN | Epsilon Healthcare | 0.025 | -11% | 317,122 | $6,729,912.22 |

No small cap left behind.

WHAT YOU MISSED BECAUSE YOU WERE TOO BUSY TEXTING

It’s that time of day again – the crowd’s already thinning, and Bernice has started putting chairs up on the tables, but there’s still a couple of last orders in the wings.

It’s been a busy week already for Sipa Resources (ASX:SRI), which announced today that infill rock chip sampling and previous aircore drilling have defined two new gold targets for testing in early Q4 at its Warralong project in the Pilbara region of Western Australia.

Then Sipa went public with news that Blencowe Resources is going to back out of its Option Agreement over Sipa’s Uganda Nickel-Copper, reverting it back to wholly-owned by Sipa.

Blencowe reportedly decided to focus on its graphite project, nixing the deal just days after Sipa gave them a three-month extension to think about the purchase. All that, and it’s not even Wednesday yet.

And if you’re a fan of both numbers and gibberish, then hold onto your hat – Golden Cross (ASX:GCR) has reported an update to its Mineral Resource Estimate at the aptly-named Copper Hill, which looks a little like this:

JORC 2012-compliant resource estimate of 470,000 tonnes (t) Copper (Cu) and

1,340,000 ounces (oz) Gold (Au) contained in updated resource of 148 million

tonnes (Mt) grading 0.32% Cu and 0.28g/t Au at 0.2% Cu only cut-off grade.A further 42Mt grading 0.13% Cu and 0.28g/t Au occurs below the 0.2% Cu only

cut-off but above a 0.2g/t Au cut-off, to give a total of 190Mt grading 0.28% Cu,

0.28g/t Au and 1.3g/t Silver (Ag), containing a total of 520,000t Cu, 1,720,000oz

Au and 7,900,000oz Ag.

Thank you for compiling these Mr Stronach, you’re not such a compliant JORC either.

TRADING HALTS

Torque Metals (ASX:TOR) – TOR has drilling results at the Company’s Paris Project, where the company is rumoured to have hit a rich vein of cheese.

Pacgold (ASX:PGO) – Pacgold also has drilling results on the way. Waka waka waka waka waka.

Orthocell (ASX:OCC) – OCC’s got the deets on a new distribution agreement for its nerve repair device, Remplir.

Australian Pacific Coal (ASX:AQC) – AQC has hit pause to carry out investigations into a potential change to the structure of the transactions currently contemplated by the Company.

Avenira (ASX:AEV) – Capital raise

Perpetual Resources (ASX:PEC) – Capital Raise

Panther Metals (ASX:PNT) – Capital Raise

Iperionx (ASX:IPX) – Capital Raise

Maga (ASX:DUMB) – Capitol Raze

The post Closing Bell: Brave small caps rise over 1% in defiance of latest wanton, unhinged RBA 50 bps rate hike appeared first on Stockhead.

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….