Life Sciences

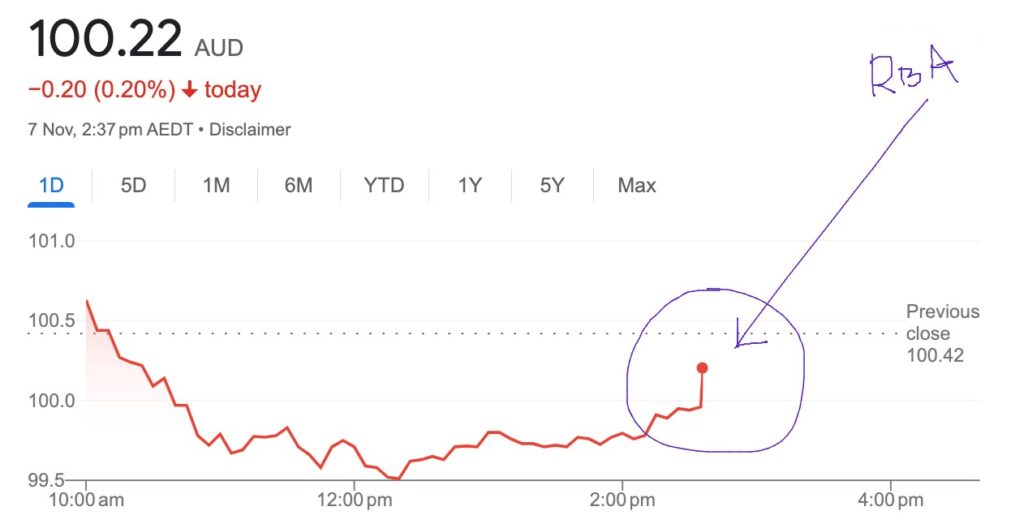

Closing Bell: Local markets close lower as RBA bites before Christmas

The ASX is lower after the Reserve Bank of Australia raised its official cash rate by 25bp to 4.35%, its … Read More

The post Closing Bell: Local markets…

- The ASX has closed 0.29% lower, snapping its recent five-day streak

- Sectors to rise led by Healthcare

- Small cap winners: AL8, MHK

The benchmark S&P/ASX 200 (XJO) index has closed Tuesday at 6,977 points, down 20 points or -0.29%.

This arvo at race time-ish, the Reserve Bank of Australia (RBA) decided to hike the cash rate by a further 25 basis points to 4.35%, as inflation continues to play chicken with the central bankers and possum with the Aussie economy.

It was the RBA’s first rate hike since June and new Governor M. Bullock’s first in charge.

“While the upside surprise in Q3 inflation data meant market commentators were widely expecting today’s move, markets were less certain, with the interest rate market assigning a 58% chance of a rate hike,” says IG Markets analyst Tony Sycamore.

“The discrepancy between commentators and the rates market was a reflection of the uncertainty created by recent discussions in political circles as to whether the Q3 upside inflation surprise represented a material change to the RBA’s inflation outlook.”

Bad news for mortgage holders, not so bad if you’re Australia’s biggest lender:

Commonwealth Bank (ASX:CBA)

All the major lenders were lower on Tuesday, but perked up pretty quickly at the free kick another official cash rate hike offers them.

According to the financial comparison firm Mozo, up until this afternoon the Big Four banks have so far passed on rate increases of exactly 4.00% to variable rate home loan customers, and now offer an average variable rate of 7.21%.

Westpac shares however, are still some -2.5% the worse, leading sector losses and showing that not even the central bank can throw a dog a bone.

Westpac (ASX:WBC)

WBC dropped a handsome $7.2bn FY23 profit on Monday as well as a $1.5bn buyback, but raining on that parade has been UBS analysts which reckon WBC is beset by higher costs and future risk.

“Westpac’s investment case remains anchored in the group’s ability to extract efficiencies and improve its overall competitiveness by delivering scale benefits and driving down per unit operating costs,” UBS told clients in a morning note.

“Near term upgrades are driven by better-than-expected bad debts as asset quality continues to surprise on the upside and marginal cost downgrades to FY24.”

All the banks are lower at the close with NAB, dropping reports its full year results on Thursday is off 0.9 per cent to $29.09.

Across all lenders on the Mozo database, 3.91% of a possible 4.00% of the RBA hikes have been passed to home loan customers since the cycle started last year.

The Big Four banks have passed on exactly 4.00% to customers.

So far this cycle, the interest rate hikes have seen Aussie mortgage holders with a $500,000 needing an extra $1,037 more every month to cover rising repayments.

Mozo says 57% of mortgage holders admitted they’d be under ‘financial stress’ when their mortgage rate hit 6.00% or more, and the average variable rate across all providers on the Mozo database is 6.62%

If lenders pass on the 0.25% hike by the RBA today in full, this means the average mortgage holder will be paying an extra $1,116/month or $13,395/year more than they were before the hikes started in May 2022.

ASX Sectors on Tuesday

Ripped from the Headlines

With Albo in town, China’s trade surplus for October narrowed sharply to US$56.53 billion

from US$82.35 billion in the same period last year.

This onerous figure was well below market forecasts of US$82 billion and the smallest trade surplus since February.

Exports – down 6.4% vs the expected -3.3% were almost twice as bad as forecasts were bracing for, reflecting China’s febrile demand from overseas while imports unexpectedly crept higher.

Imports unexpectedly grew by 3%, the first increase since February, and easily beating market expectations of a 4.8% fall, amid Beijing’s quasi-efforts to boost domestic demand.

The trade surplus with the US narrowed to US$30.82 billion in October from US$33.119 billion in September.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| NRZR | Neurizer Ltd | 0.003 | 50% | 2,201,986 | $255,348 |

| MHK | Metalhawk. | 0.205 | 46% | 744,945 | $11,027,942 |

| AL8 | Alderan Resource Ltd | 0.015 | 36% | 14,163,217 | $6,783,641 |

| DCX | Discovex Res Ltd | 0.002 | 33% | 738,663 | $4,953,852 |

| LNU | Linius Tech Limited | 0.002 | 33% | 860,407 | $6,783,436 |

| WIA | WIA Gold Limited | 0.037 | 28% | 6,452,952 | $26,699,864 |

| PIM | Pinnacleminerals | 0.235 | 27% | 2,415,967 | $4,731,375 |

| KGD | Kula Gold Limited | 0.015 | 25% | 1,752,787 | $4,478,543 |

| DOU | Douugh Limited | 0.005 | 25% | 52,225 | $4,270,836 |

| FAU | First Au Ltd | 0.0025 | 25% | 1,699,901 | $2,903,987 |

| IMU | Imugene Limited | 0.065 | 25% | 123,911,254 | $372,578,693 |

| LSR | Lodestar Minerals | 0.005 | 25% | 2,637,000 | $8,093,589 |

| SFG | Seafarms Group Ltd | 0.005 | 25% | 455,000 | $19,346,397 |

| SRZ | Stellar Resources | 0.01 | 25% | 5,715,265 | $8,785,492 |

| TKL | Traka Resources | 0.005 | 25% | 200,158 | $3,501,317 |

| NIS | Nickelsearch | 0.084 | 24% | 57,854,423 | $10,900,218 |

| AZL | Arizona Lithium Ltd | 0.023 | 21% | 25,298,641 | $63,056,934 |

| MEL | Metgasco Ltd | 0.012 | 20% | 984,211 | $10,638,867 |

| TAS | Tasman Resources Ltd | 0.006 | 20% | 2,800 | $3,563,346 |

| KZA | Kazia Therapeutics | 0.08 | 19% | 457,548 | $15,835,408 |

| TG1 | Techgen Metals Ltd | 0.027 | 17% | 20,000 | $1,774,870 |

| C1X | Cosmosexploration | 0.14 | 17% | 211,296 | $5,337,000 |

| HYT | Hyterra Ltd | 0.021 | 17% | 187,024 | $9,493,176 |

| XGL | Xamble Group Limited | 0.07 | 17% | 90,000 | $17,049,375 |

| 8IH | 8I Holdings Ltd | 0.014 | 17% | 7,915 | $4,288,272 |

As my erstwhile colleague and former school mate Roberto Badman pointed out a few hours ago, the ASX small cap leader Alderan Resources (ASX:AL8) is named for the peaceful unaligned planet Alderaan, where Princess Leia grew up under the watchful eye of Jimmy Smits.

Robert also says that has nothing to do with the similarly named Alderan’s share price hitting warp drive on Tuesday.

“In fact, we’re struggling to see what exactly is the Force that’s giving it a boost, so… Bob refers us back to this recent news from the 31st of October, when the gold and copper-hunting junior – among the few hard-rock explorers suddenly inside Brazil’s ‘Lithium Valley’ hotspot on the search for the white gold battery metal.

In late September, Alderan executed a binding agreement with Parabolic Lithium to acquire a 100% interest in seven lithium exploration projects consisting of 24 granted exploration licences covering 472km2 in Brazil’s Eastern Lithium Belt.

All seven projects are within, and to the south, of the famed ‘Lithium Valley’ in the resource-rich Minas Gerais state, which hosts 40 of Brazil’s top 100 mines. And those include Companhia Brasileire De Litio (CBL) and Sigma Lithium Corporation (NASDAQ: SGML; TSX: SGML), along with the deposits of Latin Resources (ASX:LRS) and Lithium Ionic (TSX.V: LTH).

In October, the company noted that project site visits were currently underway, with geologist-led field inspections looking to provide some expert confirmation of potential lithium mineralisation from pegmatite fields.

Legal due diligence was also reportedly well on track.

Earlier this afternoon, the Aussie clinical stage immuno-oncology upstart, Imugene (ASX:IMU) dropped a promising clinical trial update of its Phase 1 MAST (Metastatic Advanced Solid Tumours) trial evaluating the safety and efficacy of novel cancer-killing virus CF33-hNIS (VAXINIA).

Imugene CEO Leslie Chong says IMU’s Phase 1 trials are generally designed to look for safety, tolerability and early response signals to determine the optimal dose for further development.

“The early positive response data we are seeing at the mid-dose level in hard-to-treat bile duct cancer suggests that VAXINIA may be a potent anti-cancer drug as we interrogate higher dose levels.

“With no adverse safety signals, thus allowing us to dose higher, VAXINIA will have a very high therapeutic window which is valuable in oncology drug development.”

Kill cancer. More please.

Also higher on Tuesday is NickelSearch (ASX:NIS). The WA nickel sulphide explorer is having a +40% kind of week so far, and is up another 17% or so at the time of writing/not looking at the Melbourne Cup form guide today.

Late last week, NIS released the following into the wilds and to Stockhead.

Per our special report, then:

- NIS unveiled six new areas of lithium interest at the Carlingup project in WA – taking the total to 28 areas of interest for Lithium-Caesium-Tantalum (LCT) pegmatites identified to date.

- In September, the explorer teamed up with major lithium producer Allkem (ASX:AKE) to assess the lithium prospectivity of Carlingup, about 10km from AKE’s 140,000tpa Mt Cattlin lithium mine.

- Allkem also recently flagged latent capacity at Mt Cattlin to potentially toll-treat third party product – which could bode well for the company if Carlingup’s lithium potential is confirmed.

- In April an independent geochemical review highlighted the lithium potential at Carlingup, identifying 22 areas of LCT pegmatite potential.

- Further review and targeting work across a larger portion of the project area has flagged another six areas of exploration interest.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the least performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.001 | -33% | 21,954,138 | $15,396,757 |

| FHS | Freehill Mining Ltd. | 0.002 | -33% | 25,000 | $8,534,403 |

| MTH | Mithril Resources | 0.001 | -33% | 560,806 | $5,053,207 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 1,280,529 | $31,285,147 |

| DXN | DXN Limited | 0.0015 | -25% | 1,500,000 | $3,446,680 |

| GTG | Genetic Technologies | 0.002 | -20% | 410,000 | $28,854,145 |

| RLC | Reedy Lagoon Corp. | 0.004 | -20% | 1,161,668 | $3,083,418 |

| 1MC | Morella Corporation | 0.005 | -17% | 1,428,141 | $36,981,556 |

| YPB | YPB Group Ltd | 0.0025 | -17% | 196,825 | $2,341,384 |

| BXN | Bioxyne Ltd | 0.011 | -15% | 2,026,444 | $24,721,390 |

| DEL | Delorean Corporation | 0.028 | -15% | 48,911 | $7,118,790 |

| GSM | Golden State Mining | 0.017 | -15% | 4,909,818 | $3,821,766 |

| FNX | Finexia Financialgrp | 0.23 | -15% | 13,626 | $13,068,730 |

| AEV | Avenira Limited | 0.012 | -14% | 5,152,074 | $24,220,101 |

| AOA | Ausmon Resorces | 0.003 | -14% | 663,957 | $3,524,498 |

| BFC | Beston Global Ltd | 0.006 | -14% | 2,032,094 | $13,979,328 |

| FGL | Frugl Group Limited | 0.012 | -14% | 200,000 | $13,384,868 |

| INP | Incentiapay Ltd | 0.006 | -14% | 33,333 | $8,855,445 |

| IVX | Invion Ltd | 0.006 | -14% | 12,870 | $44,951,425 |

| ROC | Rocketboots | 0.12 | -14% | 19,530 | $4,555,390 |

| RB6 | Rubixresources | 0.125 | -14% | 996,731 | $7,909,750 |

| SUV | Suvo Strategic | 0.026 | -13% | 3,775,391 | $24,315,393 |

| JCS | Jcurve Solutions | 0.033 | -13% | 141,500 | $12,477,051 |

| TYX | Tyranna Res Ltd | 0.0165 | -13% | 6,758,203 | $62,442,081 |

| CLA | Celsius Resource Ltd | 0.01 | -13% | 4,608,517 | $25,829,594 |

TRADING HALTS

Reward Minerals (ASX:RWD) – Pending the release of an announcement in relation to a potential material acquisition

Impact Minerals (ASX:IPT) – Pending the release of the Lake Hope Scoping Study

Challenger Gold (ASX:CEL) – Pending the release to the market of a material announcement in relation to a Scoping Study for the Hualilan Gold Project in Argentina

Inca Minerals (ASX:ICG) – Pending an announcement regarding a capital raising

The post Closing Bell: Local markets close lower as RBA bites before Christmas appeared first on Stockhead.

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….