Life Sciences

How Did ElevateBio Manage To Nab $401M In This Economy?

ElevateBio, a Massachusetts-based gene therapy startup, announced $401 million in Series D funding.

ElevateBio, a Massachusetts-based gene therapy startup, announced on Wednesday it raised $401 million in Series D funding.

The company’s round was led by the AyurMaya Capital Management Fund, a VC fund managed by Matrix Capital Management, which joined Novo Nordisk, SoftBank Vision Fund 2 and Samsara BioCapital as part of ElevateBio’s investor syndicate.

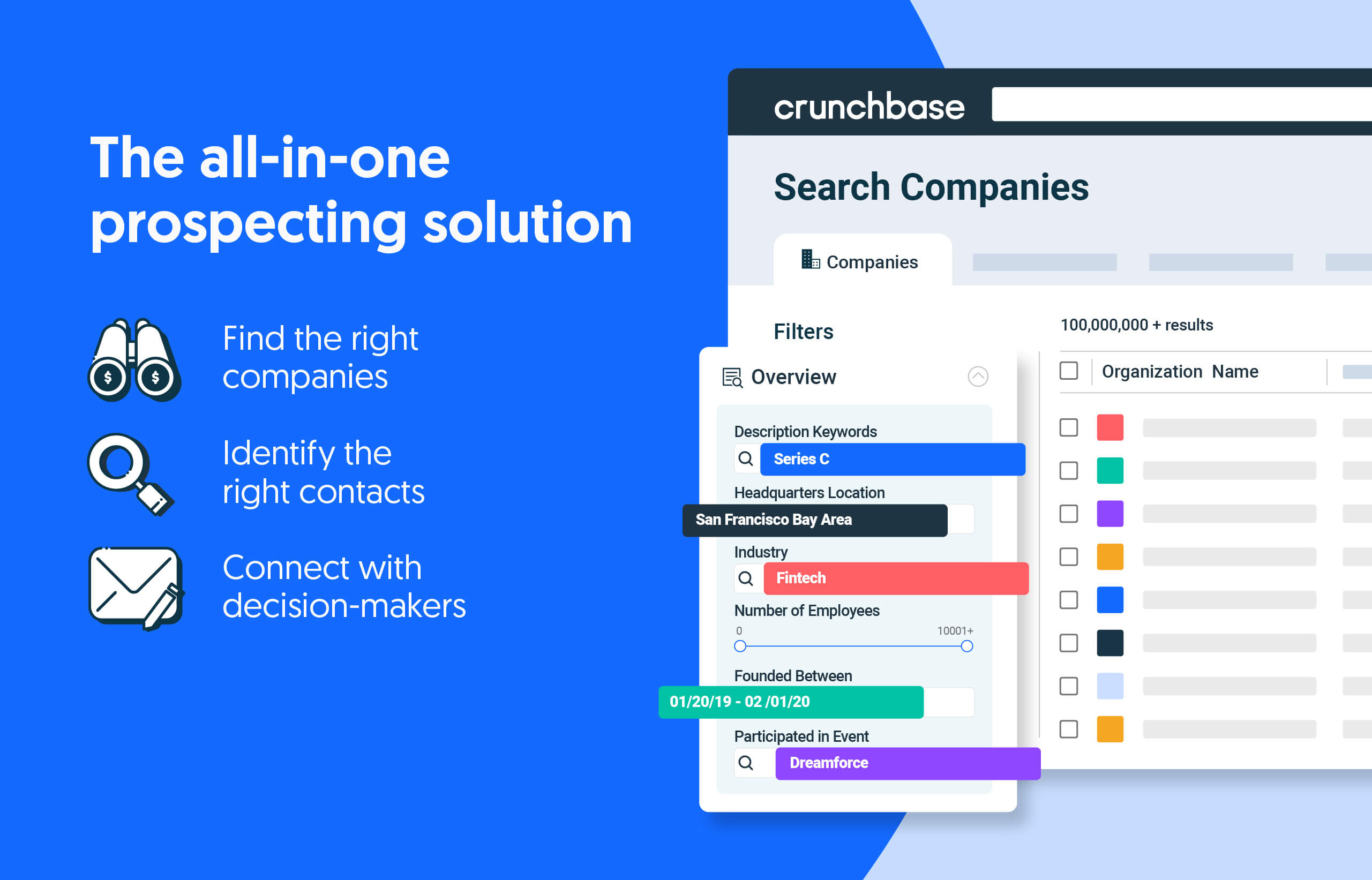

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

“We have made significant strides in scaling our technologies and end-to-end capabilities in our pursuit to become the world’s most indispensable cell and gene therapy technology company,” ElevateBio CEO David Hallal said in a statement.

A fast-growing biotech startup

Boy, did they. ElevateBio, in my opinion, is pretty close to being its own big pharma company. The startup operates a slew of technology platforms that span from drug development to manufacturing and interconnect with one another, allowing ElevateBio to bring a drug from conceptualization all the way to commercialization. It even has a subsidiary, Life Edit, which develops therapeutics for genetic diseases.

But, since it isn’t, the startup has also inked a deal with an actual big pharma company: Novo Nordisk. Life Edit will work with Novo Nordisk to develop a suite of base editing therapies, which is a fancy way of saying they’re making drugs that can make changes to the DNA sequence.

Demand for cell and gene therapies is growing in part due to the promise that by adding genes to the body, or by correcting a defect in a gene, the immune system can fight its way through disease. The concept is pretty novel in that it may allow certain patients to circumvent managing disease on a daily basis.

ElevateBio is in a pretty unique position compared to its peers. Many startups are struggling under the funding environment imposed by close-fisted investors, and have had to slash research and development programs in order to conserve cash and extend their runway.

ElevateBio, in the meantime, has its hand in multiple drug development pipelines. The company also has a partnership with Moderna that was announced in February to develop in vivo mRNA gene editing therapeutics.

It seems like a big week for biotech — the second-largest fundraising round in the space happened yesterday when ReNAgade Therapeutics raised $300 million in Series A funding.

manufacturing

therapeutics

gene therapy

gene editing

biotech

pharma

vc

fund

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….