Life Sciences

Makeup Unicorn Oddity’s IPO Comes As Beauty Funding Falters

So far this year, just over $300 million in venture funding went to the beauty category, down more than 50% from the same period last year. But over in…

Beauty is a pretty unattractive area for startup investors lately. So far this year, just over $300 million in venture funding went to the category, down more than 50% from the same period last year. That puts 2023 on track to deliver the lowest annual tally for beauty-related funding in years.

But over in IPO-land, a different story is playing out. Later this month, Oddity Tech, an Israel-based direct-to-consumer cosmetics and self-care products provider, is set to go public in a Nasdaq offering that sets a target valuation around $1.9 billion.

To reach that goal, it helps that Oddity’s financials, unlike most startups, are easy on the eye. The company is actually profitable, projecting net income of more than $40 million in the first half of this year. Revenue is also growing fast, surging 46% in 2022 to top $320 million.

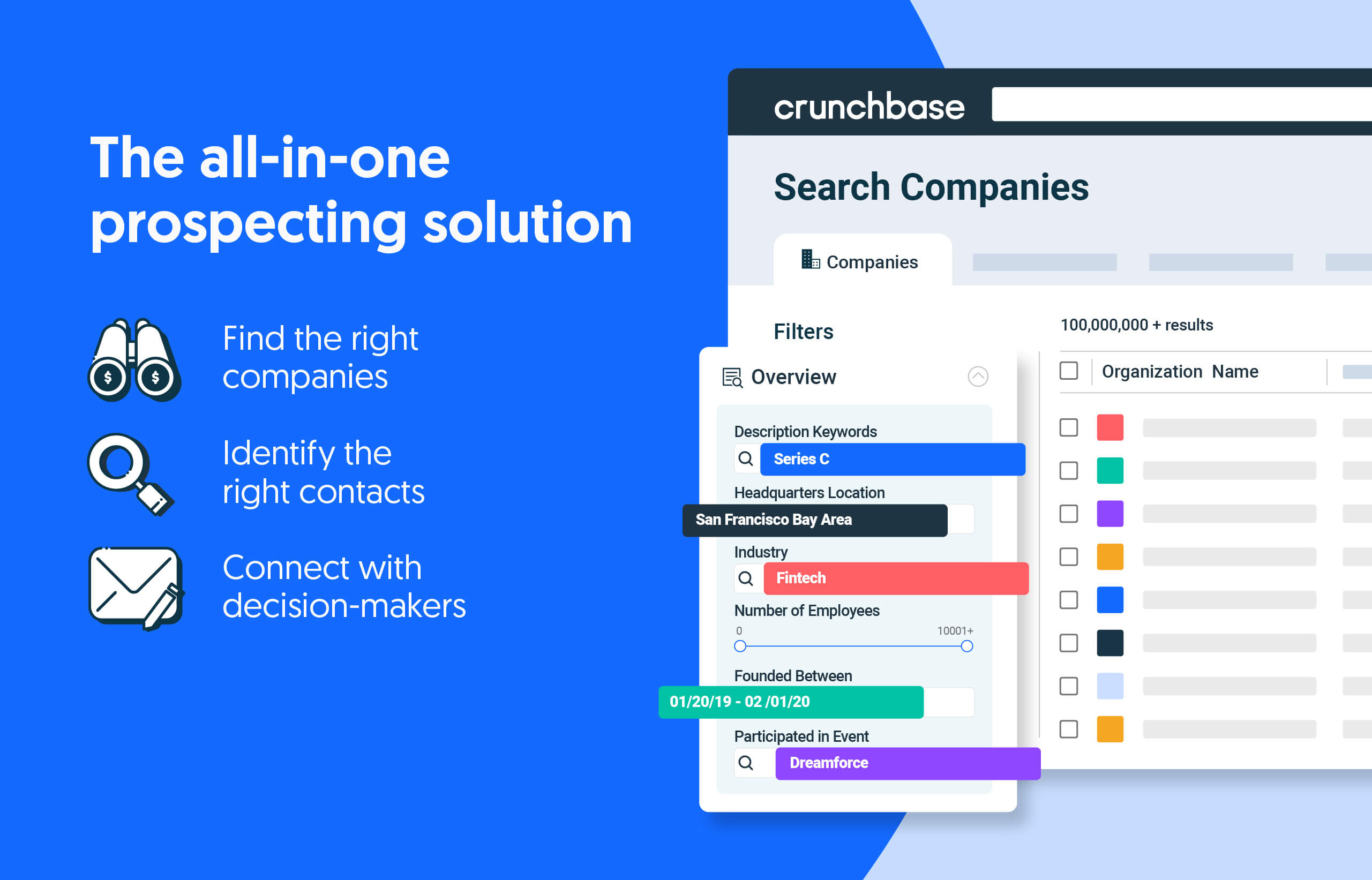

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Most sales come from Oddity’s flagship makeup brand, IL MAKIAGE. Products are sold direct-to-consumer through an online store featuring a mix of influencer videos and quizzes to match users with items such as foundation and mascara that suit their tastes and complexions. Last year, the company also launched a wellness brand, SpoiledChild, offering skincare, haircare and probiotics.

Beauty tech

Oddity likes to brag about its tech-driven approach to the beauty business. In its IPO prospectus, the company repeatedly points out that its tech team is the largest group and comprises over 40% of its headcount. It cites data science, machine learning and computer vision as areas of heavy investment.

Truth be told, I wasn’t personally enthralled by the results of its quiz-driven makeup selection process. (It recommended eyebrow mascara, a product I neither need nor want.) That said, it does seem to have struck a chord with a broad swathe of the cosmetics-buying public. And although people still buy the majority of cosmetics and care products at brick-and-mortar stores, Oddity makes a compelling case that we’ll see more consumption shift online.

The company also has raised significant venture backing, closing a $130 million financing in January 2022. Its prospectus lists consumer-focused investor L Catterton as its largest venture shareholder, with 42% of Class A shares.

So far, Oddity’s success hasn’t driven investors to seek out online makeup and self-care startups in a big way. But some deals are happening. This year, the largest makeup-related round by far was a $40 million Series B for Makeup By Mario, an online beauty store founded by celebrity makeup artist Mario Dedivanovic. Debut, a San Diego startup that applies biotech to beauty product development, also raised a good-sized round of $34 million in its June Series B.

Overall, however, beauty-related investment has been trending lower. To illustrate, we used Crunchbase data below to tally global seed- through late-stage financing in the beauty category from 2018 to today:

If Oddity has a blowout public offering, perhaps that will convince investors to direct more attention and funding to the beauty space. For now, however, startup founders may have an easier time persuading potential customers of the potential rewards of putting money into looking their best.

Related Crunchbase Pro query

Global Seed Through Late-Stage Funding For Beauty-Related Startups

Editor’s note: This article was updated to reflect Oddity Tech’s updated, higher target valuation as of Monday morning.

Illustration: Li-Anne Dias

cosmetics

wellness

biotech

beauty

skincare

shares

nasdaq

buy

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….