Life Sciences

No longer ‘dead or just hibernating,’ drugmakers return to heart medicines

In 2015, now-FDA Commissioner Robert Califf joined industry, academic and regulatory representatives in Washington to discuss why more drugs weren’t…

In 2015, now-FDA Commissioner Robert Califf joined industry, academic and regulatory representatives in Washington to discuss why more drugs weren’t in development for cardiovascular diseases, the leading US cause of death and once a mainstay of pharmaceutical industry blockbusters.

The group pointed to many reasons. Clinical trials could take years and testing was expensive. Wide availability of generic drugs made the commercial prospects uncertain. Their paper title summed up the mood: “Cardiovascular Drug Development: Is it Dead or Just Hibernating?”

Many of the old challenges still hold true today, experts said. But one thing has changed: the science.

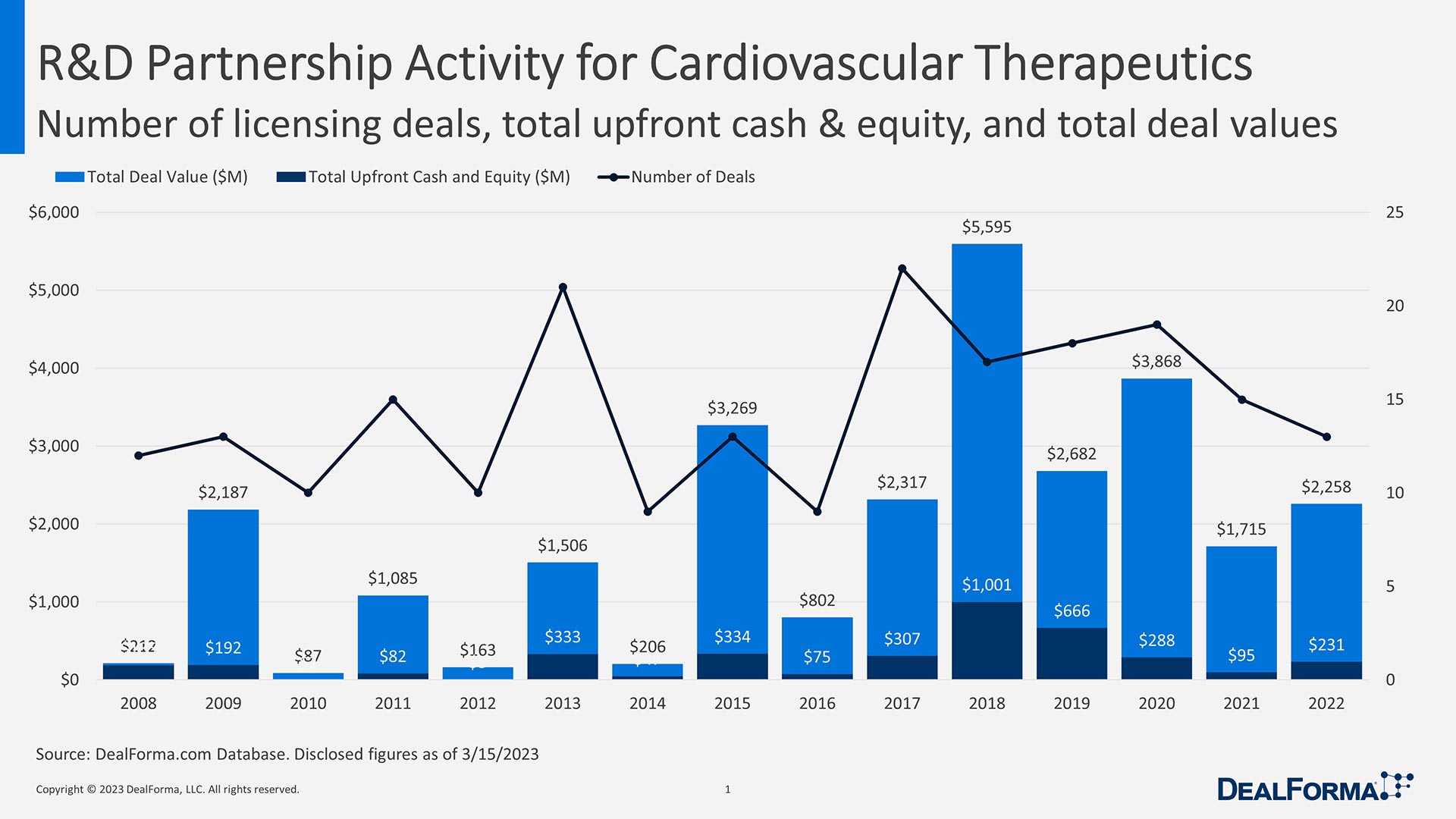

The return of pharma companies to cardio has been driven by a slate of new technologies and drug targets. Money is pouring back in as well — licensing deals in cardiovascular therapies totaled just over $16 billion in the past five years, eclipsing the $11.8 billion in total deal value over the 10-year period before that, according to DealForma.

The moment comes decades after the FDA approved the first cholesterol-lowering statin, Merck’s lovastatin. These statins became some of the industry’s biggest blockbusters, supported huge in-person sales forces and reshaped the field. When they went off patent, it marked the end of an era as drugmakers turned to cancer and rare disease. But the pendulum is swinging back, it appears.

Out of hibernation

Six years ago, at his first JP Morgan conference — which is known to be speed dating grounds for biopharma deals — Merck’s Joerg Koglin met with 10 or so companies that were developing new therapies for cardiovascular diseases, he told Endpoints News.

Joerg Koglin

Joerg KoglinThis year, Koglin, who is now the pharma’s vice president of global clinical development, said he met with 30 or 40 companies in the cardiovascular space over the span of three days in San Francisco.

These meetings could potentially translate into more deals. This comes after Merck acquired Acceleron for $11.5 billion in 2021 to gain its heart drug aimed at the underlying mechanism of pulmonary arterial hypertension, a rare type of high blood pressure in the arteries that carry blood from the heart to the lungs.

Koglin said cardiovascular drug development has been reinvented, noting that it is nothing like what it was 20 years ago. Where old medicines mostly targeted symptoms of diseases, new ones directly target the diseases instead.

At a cardiology meeting in New Orleans earlier this month, Merck presented Phase III data that found the drug candidate, sotatercept, reduced the risk of death or clinical worsening by 84% compared to placebo.

Eliav Barr

Eliav BarrThe blood vessels are like a rubber hose, Merck chief medical officer Eliav Barr said at the New Orleans meeting. In pulmonary arterial hypertension, the walls of that hose get thicker and thicker due to uncontrolled cell growth, so the space for blood to flow gets smaller. Sotatercept works by stopping that cell growth in the blood vessel wall.

“This is really different than some of the other drugs that are really good at symptomatic relief for the short term, but they slow down deterioration as opposed to modify the disease itself,” Barr said.

Merck plans to seek FDA approval for sotatercept in the first half of this year.

The company has highlighted its cardiovascular pipeline as potentially generating more than $10 billion in revenue by the mid-2030s — key for the pharma company, which loses patent exclusivity to the cancer drug Keytruda in 2028. Keytruda made $20 billion in sales in 2022 and accounted for nearly 40% of Merck’s sales.

Bristol Myers Squibb has likewise developed a heart drug that targets the root cause of disease, though for a different indication. Last year, the FDA approved the drug, marketed as Camzyos, for obstructive hypertrophic cardiomyopathy, a condition where the heart wall thickens and blocks the blood from flowing through.

Previously, the go-to treatment was a combination of beta-blockers and calcium channel blockers.

Ahmad Masri

Ahmad Masri“What’s changed is that now we can directly look at and directly treat the myocardium,” said Ahmad Masri, the director of Oregon Health & Science University’s Hypertrophic Cardiomyopathy Center, who was an investigator on the clinical trial.

Bristol Myers believes the drug will reach $4 billion in peak sales, which will also help stave off losses from its top-selling drugs losing patent protections. The company gained the drug after plunking down $13.1 billion to buy MyoKardia.

Diabetes giant Novo Nordisk also diversified into cardiovascular disease through acquisitions, buying two companies for $4 billion combined. And Novo Nordisk’s diabetes drug Ozempic, a GLP-1 agonist, has a label for cardiovascular risk reduction. Eli Lilly is studying its GLP-1 agonist, Mounjaro, in cardiovascular indications and also weight loss.

‘Little A’

Cardiovascular disease is a broad umbrella, but the most common is coronary artery disease, when plaque builds up in the heart vessels. Cholesterol-lowering drugs like statins offer a way to treat the disease, but many people still have high cholesterol despite treatments, doctors said.

Steve Nissen

Steve NissenElevated lipoprotein(a) has long been a known risk factor for coronary artery disease. High levels of Lp(a), which is bad cholesterol tagged with a unique protein, are found in 20% of the population. “But without any way to treat it, there was no reason to invest,” Cleveland Clinic’s Steve Nissen said.

Drugmakers now hope to develop more treatment options by cutting lipoprotein(a) levels via new therapies that block protein from being made from RNA. Novartis’ head of cardiovascular drug development David Soergel noted that drugs like these are changing the picture of what heart disease treatments look like, as the industry develops more heart treatments that aren’t a typical daily pill.

Novartis, Amgen and Silence Therapeutics are working on such lipoprotein(a) treatments, with the candidates from the former two in Phase III trials. Novartis already has an RNAi therapy on the market for lowering cholesterol, which is marketed as Leqvio and requires dosing only twice a year.

Challenges ahead

Still, signaling that exciting science alone isn’t enough to revive the space, companies face insurance barriers and the reality of competing in a saturated field.

At the major cardiology meeting in New Orleans this year, Ann Arbor-based biotech company Esperion presented long-awaited data showing its drug bempedoic acid cut events like heart attack, stroke and death by 15% compared to placebo in patients who can’t tolerate statins, which may convince providers to prescribe its drug and bolster sales.

But the data have underwhelmed investors – the company’s stock fell after the announcement. And Esperion’s partner, Japanese drugmaker Daiichi Sankyo, has said the drug isn’t effective enough to trigger a $300 million milestone payment. Esperion is suing Daiichi, which has said there are “differences of opinion” over whether it owes the money.

And sales of the drug have been lackluster enough that in late 2021, Esperion had to let go 40% of its staff.

Michelle O’Donoghue

Michelle O’DonoghueOther companies have faced pushback over pricing from payers, which is not uncommon. After Amgen and Sanofi/Regeneron introduced innovative new cholesterol drugs known as PCSK9 inhibitors (the same target as Novartis’ RNA drug Leqvio), the price pressure and low uptake led them to slash the price of the products – an almost unheard-of move in the industry.

“It becomes critical to understand what payers are willing to pay for, should the study be ultimately successful, because the cardiovascular therapeutic space is relatively well-saturated,” Brigham and Women’s Hospital cardiologist Michelle O’Donoghue said. “That being said, there’s tremendous opportunity for some of these drugs that are in development because there is a huge market for them.”

therapeutics

medical

biotech

pharma

weight loss

therapy

fda

clinical trials

buy

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….