Life Sciences

OurCrowd Launches $200M Global Health Equity Fund

OurCrowd Launches $200M Global Health Equity Fund What You Should Know: – Global venture firm OurCrowd launches the $200M Global Health Equity Fund (GHEF)…

OurCrowd Launches $200M Global Health Equity Fund

What You Should Know:

– Global venture firm OurCrowd launches the $200M Global Health Equity Fund (GHEF) in collaboration with the WHO Foundation.

– The fund team will be led by OurCrowd CEO, Jon Medved, and OurCrowd Managing Partner, Dr. Morris Laster, with the support of the WHO Foundation’s Chief Impact Investment Officer, Geetha Tharmaratnam. It will be managed by an OurCrowd team of clinical experts with decades of experience in medical technologies and startup growth.

GHEF Investment Thesis

The GHEF is a $200 million unique financial-first impact venture capital investment fund, focusing on breakthrough technology solutions that can impact healthcare globally. It will fuel innovation and increase investment in the health sector, with the shared goals of delivering competitive returns to investors and ensuring equitable access to medical care.

The fund was conceived in the wake of the continuing COVID-19 pandemic, which sent shockwaves through health systems across the world. It exposed chronic weaknesses in health systems, the underfunding of healthcare provision, and inequitable access to technology solutions, including the vaccines, medicines, and diagnostics developed to fight COVID-19, which remain unavailable to the majority of the populations of low-income countries.

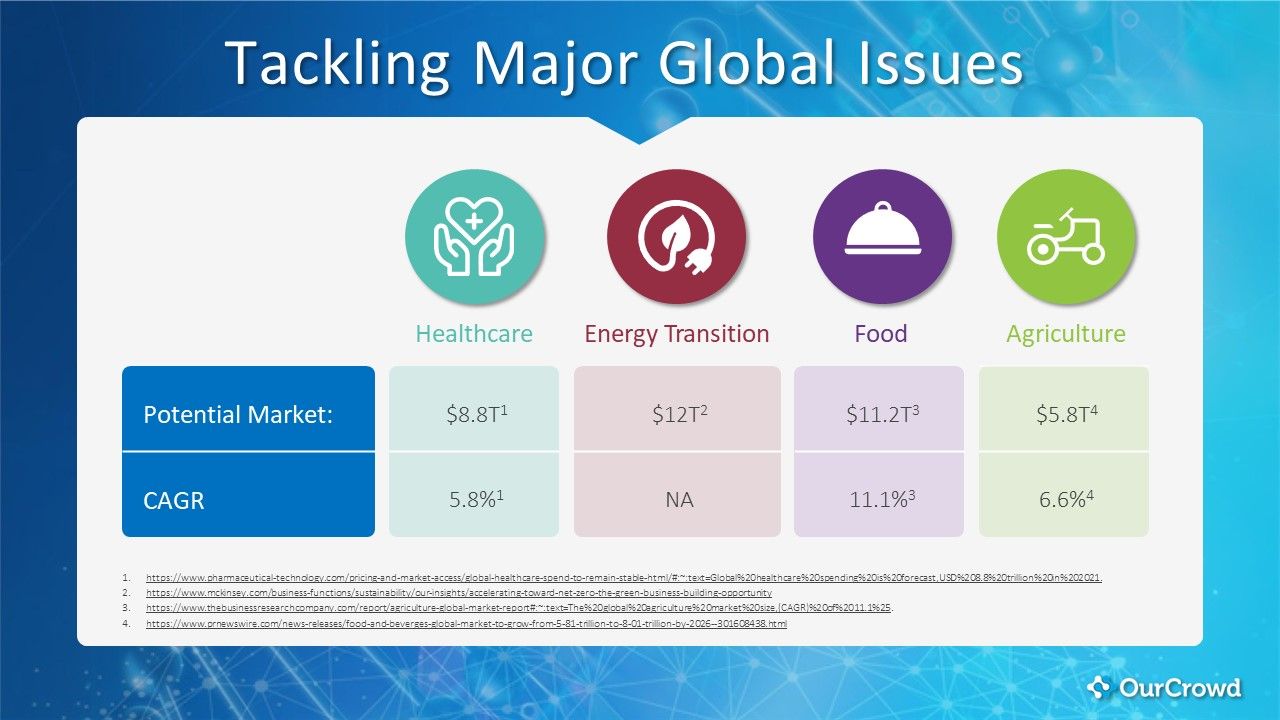

The Global Health Equity Fund will focus on healthcare and the industries that are direct determinants of health, including energy transition and food agriculture, which together address markets worth trillions of dollars globally. The target portfolio companies will therefore not only innovate to improve medical care but will also work to mitigate current global health risks related to climate, fossil fuels, and looming food shortages.

“COVID-19 was a wake-up call for me as an investor,” said Jon Medved, Founder, and CEO of OurCrowd. “The pandemic opened my eyes to health inequity around the world and reinforced the potential of innovative technology to save lives.”

“I am proud of our track record of identifying healthcare investments that have delivered value to patients and investors. This new fund builds on that success with the explicit orientation of having impact. The collaboration with the WHO Foundation will allow us to identify even more exciting investments and facilitate the commitment of investors and entrepreneurs to equitable access to the technologies we support.”

diagnostics

vaccines

medical

healthcare

venture capital

markets

fund

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….