Life Sciences

PwC’s Health Services 2023 Deals Outlook – Volume Remains Resilient Against Headwinds

What You Should Know: – While megadeals, trading multiples and overall deal values in the health services sector have not been immune to interest rate…

What You Should Know:

– While megadeals, trading multiples and overall deal values in the health services sector have not been immune to interest rate hikes and recessionary fears, PwC’s 2023 Health Services Deals Outlook report released recently forecasts a strong year ahead.

– Increasing transaction volumes and players embracing value-based care—coupled with large levels of corporate cash and private equity dry powder—are leading to continued expansion for deal volumes in 2023.

Trends and Insights into Health Services in 2023

The key insights are as follows:

1. Deal Volume Remains Resilient: Megadeals, trading multiples, and overall deal values in the sector have not been immune to interest rate hikes and fears of an economic downturn. However, transaction volumes continue to increase due to enhanced attention on private equity (PE) platform add-ons during this challenging macroeconomic rate environment and continued sector resilience. Megadeals, trading multiples, and overall deal values in the sector have not been immune to interest rate hikes and fears of an economic downturn.

However, transaction volumes continue to increase due to enhanced attention on private equity (PE) platform add-ons during this challenging macroeconomic rate environment and continued sector resilience. These factors, along with the continued large levels of corporate cash and PE dry powder, lead to a continued strong outlook for health services deal volumes in 2023.

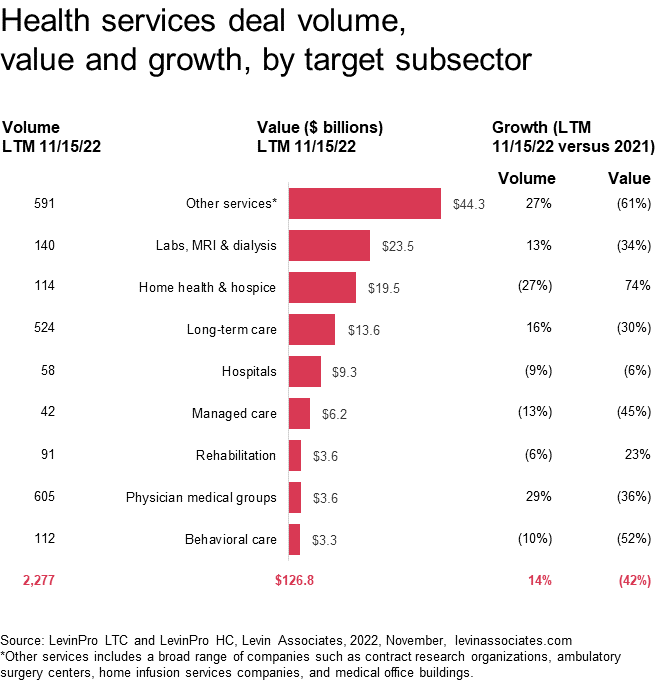

2. An Outlook of Health Services: Health services deal volumes increased further from levels seen in 2021, but have softened thus far in Q4-22. Year-over-year deal volumes increased in each quarter through Q3-22, though some pullback has been seen in Q4 through November 15 (251 announced deals in Q4-22 through November 15 versus 307 in the same period in 2021). While deal volumes have continued to increase, deal values have declined from the peak set in 2021, a function of smaller value roll-up and platform add-on transactions representing a greater portion of activity in the current year. Industry-wide enterprise value (EV) to EBITDA multiples have also declined from heightened levels seen at the end of 2021.

As of November 15, the average multiple across health services sub-sectors was 14.4x, down from 15.9x as of December 31, 2021 and 14.9x as of December 31, 2020. Multiples dropped in four of the seven sub-sectors whose multiples we track, led by outsourcing (down from 19.2x to 15.0x) and managed care (down from 17.3 to 14.2). Nearly half of announced deal value over the 12 months ending November 15 was from megadeals, consistent with the ratio seen in 2021. The 12 months ending November 15 had seven megadeals, including:

– $18 billion merger between two healthcare real estate investment trusts (REITs) and an $8.9B acquisition of Summit Health-City MD, a provider of primary, specialty and urgent care services, by Village MD (a Walgreens subsidiary). These two deals collectively represent $26.9B of the total $44.3B of other services deal value in the 12 months ending November 15.

– Two home health & hospice megadeals noted above, which totaled $14B of transaction value.

– Other megadeals include Quidel Corporation’s acquisition of Ortho Clinical Diagnostics ($8.0B), Mediclinic International’s acquisition by a consortium of investors ($7.4B) and Chubb’s acquisition of Cigna’s life, accident and supplemental benefits businesses ($5.4B).

3. Health Services Deal Value and Volume: For select sectors, M&A volume retreated when compared to the historic levels experienced in 2021; however, the health services sector continued an impressive display of volume level through the last 12 months (LTM) ending November 15. While traditional buy-side activity comprised a portion of this volume, an upcoming PwC study has identified the role divestitures can play in creating value in the healthcare sector.

PwC anticipates increased divestitures activity within health services for 2023 based on a variety of economic, regulatory and overall strategic repositioning. Given the variety of healthcare participants (e.g. for profit, not for profit and PE, etc.), each of the parties have varied processes for decision-making, but growth is the one goal they all share. As management teams assess growth, the power of strategically reviewing and aligning an organization’s portfolio is critical to shareholder returns. Other key themes that can help create value through divestitures include: timely decision-making, actively embracing the process of divestitures and navigating inertial factors like entanglements.

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….