Wellness

Semiconductors carry the technology team for February but there were still some surprising gainers

Two semiconductor players gained +90% for the month – but there are also some surprising gainers in software, even music … Read More

The post Semiconductors…

- Two semiconductor companies were among the top 5 tech movers for February

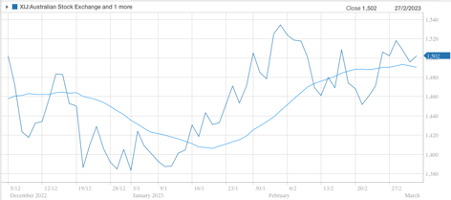

- The ASX XIJ is trending up for the month

- Top ASX tech stocks for February: ECG, RVS, BLG, CXZ and JXT

The ASX XIJ or technology index was a bit of a rollercoaster for February, hitting a high of 1,540 points on the 3rd, dropping to 1,452 points on the 21st, before levelling off at 1,518 by the end of the month.

Overall, the sector is looking up which could partially be thanks to some solid performances in the semiconductor space.

Investment bank JP Morgan thinks semiconductors look prime for recovery this year, basically because they are vital in so many products, applications and services which are valuable assets whatever phase of the economic cycle we’re in.

But there are also some surprising gainers in software, even music databases, so let’s take a closer look.

Here are the top 25 ASX tech stocks for the month of February >>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

| Code | Company | Price | % Month | Market Cap |

|---|---|---|---|---|

| ECG | Ecargo Hldg | 0.054 | 260% | $34,146,375 |

| RVS | Revasum | 0.270 | 93% | $26,479,164 |

| BLG | Bluglass Limited | 0.069 | 92% | $91,089,515 |

| CXZ | Connexion Telematics | 0.018 | 80% | $16,984,189 |

| JXT | Jaxstaltd | 0.055 | 72% | $19,525,547 |

| SPA | Spacetalk Ltd | 0.052 | 68% | $16,027,579 |

| IHR | intelliHR Limited | 0.105 | 64% | $36,549,045 |

| WBT | Weebit Nano Ltd | 7.640 | 61% | $1,319,670,498 |

| RMY | RMA Global | 0.140 | 56% | $80,901,682 |

| NVU | Nanoveu Limited | 0.017 | 55% | $5,428,324 |

| LDX | Lumos Diagnostics | 0.049 | 53% | $12,445,063 |

| FLX | Felix Group | 0.160 | 52% | $25,075,154 |

| NXL | Nuix Limited | 1.320 | 45% | $401,403,214 |

| ICE | Icetana Limited | 0.043 | 43% | $8,670,786 |

| HTG | Harvest Tech Grp Ltd | 0.098 | 40% | $57,419,694 |

| BTN | Butn Limited | 0.195 | 39% | $12,539,022 |

| HSC | HSC Technology Group | 0.011 | 38% | $24,515,033 |

| ZEO | Zeotech Limited | 0.053 | 36% | $78,753,872 |

| ROC | Rocketboots | 0.135 | 35% | $4,286,250 |

| CCE | Carnegie Cln Energy | 0.002 | 33% | $31,285,147 |

| GTG | Genetic Technologies | 0.004 | 33% | $34,624,974 |

| ROO | Roots Sustainable | 0.002 | 33% | $2,078,439 |

| YPB | YPB Group Ltd | 0.004 | 33% | $1,219,638 |

| MKL | Mighty Kingdom Ltd | 0.046 | 31% | $16,310,980 |

| SKF | Skyfii Ltd | 0.078 | 30% | $32,881,132 |

January Top 5

ECARGO (ASX:ECG) +260%

This company is kind of a mix between ecommerce and supply chain technology, and has been a perpetual struggler, having only eked out one full year profit ($200,000 in 2021) since listing in 2014 at 40c per share.

In February, the China-focused company surged 260% on no news — for a 500% gain year to date — and played a straight bat to the subsequent ASX speeding ticket.

It then released FY results 28 February which showed 43% growth in revenue to $23.5m and its second ever net profit of $890,000.

ECG put this down to a solid uplift in demand for high quality imported products in China and sales through the group’s proprietary B2B technology platform.

“We are incredibly proud of the results we achieved this year, which were done with the backdrop of severe lockdowns in China for much of the year,” CEO Lawrence Lun said.

“The results demonstrate not only the resilience of our business model, but also shows the decisions we are making with respect to brand partnerships and investment into our proprietary technology platforms are yielding strong results.”

“Over the year, we signed on strategically-selected brands with exclusive distribution rights. As demand for high quality imported products in Health & Wellness, Personal Care, and Maternal & Baby categories continue to grow in China, we are helping our brands to grow sales in the China’s vast market, which in turn is growing eCargo’s revenue.

Lun said the company’s proprietary technology platforms continue to grow – namely PinJiuFang Wines and JuJiaXuan – which are helping brand partners penetrate the eCommerce and retail market in China through establishing a stronger digital presence and expanding their distribution network.

“Off the back of this success, we will continue to build our technology platforms in 2023 to better provide our brands with a one-stop commerce solution for the Asian market, empowered by technology and data,” he said.

The group also plans to launch a new social commerce platform targeting Asia in 2023, fulfilling a suite of technology platforms that covers order and warehouse management, B2B and B2C trading and marketing.

REVASUM (ASX:RVS) +93%

Revasum sells equipment used in making semiconductors, a selection of very expensive automatic machines involved in grinding and polishing.

FY22 preliminary unaudited revenue was US$14.7m, a 7.6% increase year on year (YOY) from US$13.7m in FY21 – and there’s a total backlog (confirmed orders not yet shipped) of US$8m as of January 26.

“We completed 2022 on a strong note with multiple tool shipments in the quarter and a healthy backlog going into 2023,” president and CEO Scott Jewler said.

“While the supply chain for some critical components has improved, other parts remain at extended lead times.

“In the second half of the year, we significantly increased our customer facing activity and based on this interaction we have fine-tuned our design and process engineering priorities for the coming year.

“Growth in the compound semiconductor industry remains robust particularly for silicon carbide (SiC) wafers where our 7AF-HMG grinders and 6EZ polishers are operating at full capacity at multiple market leaders.”

In 2022, multiple leading silicon carbide wafer manufacturers announced investments in large new facilities which will begin to come online in 2024.

Revasum expects them to drive a significant increase in demand for wafer manufacturing equipment – including its grinders and polishers.

“The industry is in the early stages of the EV replacement cycle of the internal combustion engine and growth rates for SiC devices of 35%-40% per year are projected for the next five years by most analysts,” the company said.

“Silicon carbide wafers, which contribute as much as 35% of the cost of goods sold for a SiC device, is expected to remain an area of intense technology focus and investment.”

Revasum said its Q422 unaudited cash balance was US$0.9m.

BLUGLASS (ASX:BLG) +92%

Another one in the semiconductor space, BLG received its first customer orders for commercial lasers during the month.

Two leading laser original equipment manufacturers (OEM) in the quantum and industrial robotics segments have ordered the company’s 405nm and 420nm 250mW single-mode gallium nitride (GaN) lasers, whatever they are.

Revenues from these initial low-volume orders are immaterial; however, once the lasers are qualified, BluGlass expects to secure recurring larger-volume orders from these customers.

“These orders are an important step towards commercial revenues and demonstrate demand for our lasers from key industry players in underserved wavelengths, flexible form factors, and semi-custom designs,” president Jim Haden said.

“As a result of this increased interest in our newly released products, we expect additional orders from potential customers and partners to be imminent.”

The company is one of just a handful of gallium nitride laser manufacturers globally, operating in a high-value, high-margin semiconductor sector – which it says is worth around US$2.5 billion.

BLG is continuing to optimise its laser design and manufacturing processes, with the aim to complete vertical integration of downstream manufacturing processes at its

Fremont fab in Silicon Valley which will “contribute to additional quality, performance, and reliability improvements,” the company says.

ECG, RVS and BLG share prices today:

CONNEXION TELEMATICS (ASX:CXZ) +80%

The fleet management software company announced mid-Feb that cornerstone customer General Motors (GM) is extending the supply of the company’s OnTRAC platform to all its Courtesy Transportation Program (CTP) participating dealerships.

CXZ expects subscription revenue to rise commensurate with the increase in the number of dealerships subscribed to the platform to the tune of around US$250k a month – or US$3 million ($4.3 million) annually.

“In turn, this is likely to materially increase Connexion’s total revenue,” the company said.

CXZ’s software is used by 1 in 5 Franchised Light-Vehicle Dealerships in the US, and they company is confident it’s in a strong strategic position from which to grow its industry B2B software platform by targeting new OEMs and franchised dealerships.

H1 FY23 revenue was up slightly (US$2,101,024 compared to US$1,903,822) but the company says its gross profit is the best metric to measure its performance as it looks to scale – and that was US$1.68m for the half year – up 36% on the prior comparable period.

JAXSTA (ASX:JXT) +72%

Another unusual gainer, Jaxta is the world’s largest dedicated database of official music credits and in Feb announced plans to acquire Vampr – which is the world’s largest music creator networking platform/app.

Apparently Vampr is like a social network connecting musicians, creatives and artists so they can collaborate, create new music and monetise their work – and will give Jaxta access to 1.3 million creators to drive subscriptions.

“The acquisition of Vampr represents a rare opportunity to accelerate our B2C expansion through the launch of our e-commerce platform, vinyl.com,” CEO Beth Appleton said.

“We continue to focus on driving revenue growth and profitability capitalising on the bedrock of the Jaxsta platform and the moat we have built through our industry leading music data solution.

“Together, I believe we are going to be an exceptional business, forming a fully integrated music tech company and platform that will be at the forefront of the rapidly evolving music industry landscape.”

Added to this, Jaxta’s H1 FY23 results were pretty solid, with the company increasing quarter over quarter revenues by 140% and decreasing quarter over quarter operating costs by $85K (not including contractor fees paid to Icontech for the development of Vinyl.com which is set to launch this quarter).

CXZ and JXT share prices today:

The post Semiconductors carry the technology team for February but there were still some surprising gainers appeared first on Stockhead.

manufacturing

diagnostics

wellness

health

device

devices

personal care

Lion’s Mane Mushroom: History, Benefits, and Adaptogen Properties

Explore the intriguing world of Lion’s Mane Mushroom in our comprehensive guide. Dive into its unique properties, historical significance, and myriad health…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

Reasons You should Get this: Neptune Wellness Solutions Inc (NASDAQ:NEPT), WeTrade Group Inc. (NASDAQ:WETG)

NEPT has seen its SMA50 which is now -9.28%. In looking the SMA 200 we see that the stock has seen a -92.25%. WETG has seen its SMA50 which is …

The…