Life Sciences

Stock Market This Week: Penny Stocks, News, & What To Watch Jan 23-27

The Stock Market This Week: Economic Calendar, most notable earnings, & more for January 23-January 27, 2023

The post Stock Market This Week: Penny…

Stock Market Outlook This Week: January 23rd – January 27th

Whether you’re looking for penny stocks to buy or the best high-dividend stocks to invest in 2023, this week in the stock market will be an interesting one. While broad sector trends proved bullish at the end of last week, a slew of new earnings and lack of Fed commenatary could make for an exciting next few days. The current Federal Reserve blackout period will last until the first day of the January FOMC meeting where we’ll finally get some insight from policy makers as to what to expect for at least the next few months of the first quarter.

Fed Commentary Boosts Morale For Bulls In The Stock Market In January

Last week, a number of Fed members made comments that brought some added volatilty to the markets. By the end of Friday’s session, these opinions culminated in a surge of bullish optimism to take markets firmly higher for the week. Here are a few statements made last week, that could be referenced in liu of new comments during the Fed’s blackout period:

Susan Collins

Boston Federal Reserve President Susan Collins said she anticipates “the need for further rate increases, likely to be just above 5%, and then holding rates at that level for some time…More measured rate adjustments will better enable us to address the competing risks that monetary policy now faces” and that rates could rise at a “slower pace.”

Lael Brainard

Fed Vice Chair Lael Brainard explained that “Even with the recent moderation, inflation remains high, and policy will need to be sufficiently restrictive for some time to make sure inflation returns to 2% on a sustained basis.” Brainard also discussed how this action could “enable us to assess more data as we move the policy rate closer to a sufficiently restrictive level, taking into account the risks around our dual-mandate goals.”

John Williams

Federal Reserve Bank of New York President John Williams said on Thursday, “With inflation still high and indications of continued supply-demand imbalances, it is clear that monetary policy still has more work to do to bring inflation down to our 2% goal on a sustained basis.” Williams also warned that “Bringing inflation down is likely to require a period of below-trend growth and some softening of labor market conditions,” but “restoring price stability is essential to achieving maximum employment and stable prices over the longer term, and it is critical that we stay the course until the job is done.”

Esther George

Kansas City Fed President Esther George: “The direction is a good one.Inflation is still well above the Fed’s target.To be true to the price stability mandate, it looks like we’ll have to be a little more patient to see if we’re on the right trend and going to be there more convincingly to that 2% target.”

Christopher Waller

Federal Reserve Governor Christopher Waller, who’s remarks are typically hawkish, actually made comments that were much more dovish than usual, last week. He said, “Based on the data in hand at this moment, there appears to be little turbulence ahead, so I currently favor a 25-basis point increase at the (Federal Open Market Committee’s) next meeting,” and that the central bank is “pretty close” to a “sufficiently restrictire” interest rate to bring inflation under control.

– 4 Penny Stocks To Buy In January According To Insiders

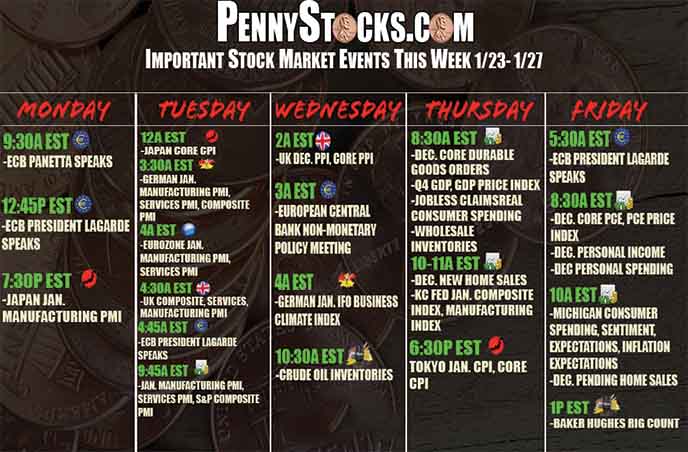

The Stock Market This Week: Key Economic Data To Know January 23rd – January 27th

Tech earnings, key economic data, international economic reports will dictate the pace of the markets this week. While the calendar isn’t as active this week, that doesn’t mean there aren’t plenty of events to consider. That includes U.S. Q4 GDP and, of course, the latest round of jobs reports which are hopeful to show Fed policy working to dampen inflation.

Stock Market News & Events On Monday, January 23, 2022

Monday is all about global data and central bank commentary. The ECB’s Panetta and President Lagarde speak during the first half of the day. Meanwhile, after US markets close, Japan will release its January manufacturing PMI results, which could impact markets on Tuesday morning depending on what is released.

– Penny Stocks: Technical Analysis Tips for 2023

Stock Market News & Events On Tuesday, January 24, 2022

Tuesday is one of the busier days on the ecnomic calendar this week. Japan Core CPI comes out right as the page turns on the calendar. We’ll also get German PMI for January as well as Eurozone and UK PMI reports. ECB President Lagarde will hold top position on central bank commentary and US manufacturing, services, and S&P composite PMI data will get released just as markets open.

Stock Market News & Events On Wednesday, January 25, 2022

Much like Monday, Wednesday’s economic events are lighter and focus more on global data. The UK’s December PPI and Core PPI will be in focus before US markets open. More from the ECB could also sway sentiment as the central bank hosts its non-monetary policy meeting. German economic data will also be something to keep track of as its IFO business climate index report comes out as traders ready for premarket trading in the US.

Stock Market News & Events On Thursday, January 26, 2022

Thursday will have US economic data at center-stage. Fourth quarter GDP, jobless claims, consumer spending, and wholesale inventories will come out before markets open. Shortly after the opening bell, we get new home sales and KC Fed data. Following the close, Japan reports Tokyo CPI and Core CPI for January, which could impact markets on Friday depending on what’s released.

Stock Market News & Events On Friday, January 27, 2022

ECB President Lagarde opens things up on Friday with a speaking engagement before U.S. markets open. One hour before the 9:30 AM ET bell, investors will be eyeing U.S. December PCE, Core PCE, and personal spending data. We also get Michigan consumer data including spending, sentiment, and inflation expectations. More housing market data also gets reported during Friday’s morning session.

What else should you prepare for in the stock market this week, and how should you be positioned to capitalize on the opportunities that come with it? Find out LIVE when you tune in to True Trading Group’s Stock Market LIVE Stream tonight on YouTube.

Notable Earnings In The Stock Market This Week

Monday, January 23, 2022, Most Anticipated Earnings

Baker Hughes Company (BKR)

Brown & Brown, Inc. (BRO)

Synchrony Financial (SYF)

Logitech International S.A. (LOGI)

Zions Bancorporation N.A. (ZION)

Crane Holdings, Co. (CR)

F.N.B. Corporation (FNB)

ServisFirst Bancshares, Inc. (SFBS)

Umpqua Holdings Corporation (UMPQ)

Bank of Hawaii Corporation (BOH)

Independent Bank Group, Inc (IBTX)

NBT Bancorp Inc. (NBTB)

Enterprise Financial Services Corporation (EFSC)

Hope Bancorp, Inc. (HOPE)

Great Southern Bancorp, Inc. (GSBC)

TrustCo Bank Corp NY (TRST)

CrossFirst Bankshares, Inc. (CFB)

Bank of Marin Bancorp (BMRC)

RBB Bancorp (RBB)

Concrete Pumping Holdings, Inc. (BBCP)

MainStreet Bancshares, Inc. (MNSB)

Tuesday, January 24, 2022, Most Anticipated Earnings

Microsoft Corporation (MSFT)

Johnson & Johnson (JNJ)

Danaher Corporation (DHR)

Verizon Communications Inc. (VZ)

Texas Instruments Incorporated (TXN)

Raytheon Technologies Corporation (RTX)

Union Pacific Corporation (UNP)

Lockheed Martin Corporation (LMT)

General Electric Company (GE)

Intuitive Surgical, Inc. (ISRG)

Canadian National Railway Company (CNI)

3M Company (MMM)

PACCAR Inc. (PCAR)

The Travelers Companies, Inc. (TRV)

Capital One Financial Corporation (COF)

Halliburton Company (HAL)

D.R. Horton, Inc. (DHI)

F5, Inc. (FFIV)

Invesco Plc (IVZ)

Western Alliance Bancorporation (WAL)

Silgan Holdings Inc. (SLGN)

Old National Bancorp (ONB)

UMB Financial Corporation (UMBF)

GATX Corporation (GATX)

Community Bank System, Inc. (CBU)

Simmons First National Corporation (SFNC)

Atlantic Union Bankshares Corporation (AUB)

Navient Corporation (NAVI)

Columbia Banking System, Inc. (COLB)

WesBanco, Inc. (WSBC)

Trustmark Corporation (TRMK)

Renasant Corporation (RNST)

Agilysys, Inc. (AGYS)

Marten Transport, Ltd. (MRTN)

National Bank Holdings Corporation (NBHC)

Veritex Holdings, Inc. (VBTX)

Stride, Inc. (LRN)

First Commonwealth Financial Corporation (FCF)

NextGen Healthcare, Inc. (NXGN)

Premier Financial Corp. (PFC)

QCR Holdings, Inc. (QCRH)

Forestar Group Inc (FOR)

Peoples Bancorp Inc. (PEBO)

Hanmi Financial Corporation (HAFC)

Cambridge Bancorp (CATC)

Wednesday, January 25, 2022, Most Anticipated Earnings

Tesla, Inc. (TSLA)

ASML Holding N.V. (ASML)

Abbott Laboratories (ABT)

NextEra Energy, Inc. (NEE)

AT&T Inc. (T)

International Business Machines Corporation (IBM)

Boeing Company (BA)

Elevance Health, Inc. (ELV)

Automatic Data Processing, Inc. (ADP)

ServiceNow, Inc. (NOW)

Progressive Corporation (PGR)

U.S. Bancorp (USB)

CSX Corporation (CSX)

General Dynamics Corporation (GD)

Freeport-McMoran, Inc. (FCX)

Crown Castle Inc. (CCI)

Lam Research Corporation (LRCX)

Norfolk Southern Corporation (NSC)

Edwards Lifesciences Corporation (EW)

Hess Corporation (HES)

Amphenol Corporation (APH)

Kimberly-Clark Corporation (KMB)

Las Vegas Sands Corp. (LVS)

TE Connectivity Ltd. (TEL)

AMERIPRISE FINANCIAL SERVICES, LLC (AMP)

Nasdaq, Inc. (NDAQ)

United Rentals, Inc. (URI)

Raymond James Financial, Inc. (RJF)

Steel Dynamics, Inc. (STLD)

Teledyne Technologies Incorporated (TDY)

Teradyne, Inc. (TER)

Textron Inc. (TXT)

Aspen Technology, Inc. (AZPN)

MarketAxess Holdings, Inc. (MKTX)

Seagate Technology Holdings PLC (STX)

Packaging Corporation of America (PKG)

Flex Ltd. (FLEX)

Wolfspeed, Inc. (WOLF)

Knight Transportation, Inc. (KNX)

SEI Investments Company (SEIC)

CACI International, Inc. (CACI)

Prosperity Bancshares, Inc. (PB)

BOK Financial Corporation (BOKF)

NextEra Energy Partners, LP (NEP)

Qualtrics International Inc. (XM)

Levi Strauss & Co (LEVI)

RLI Corp. (RLI)

Axalta Coating Systems Ltd. (AXTA)

Hexcel Corporation (HXL)

Popular, Inc. (BPOP)

Axis Capital Holdings Limited (AXS)

Calix, Inc (CALX)

Cohen & Steers Inc (CNS)

Cathay General Bancorp (CATY)

Plexus Corp. (PLXS)

Group 1 Automotive, Inc. (GPI)

Liberty Energy Inc. (LBRT)

Extreme Networks, Inc. (EXTR)

SL Green Realty Corp (SLG)

Boot Barn Holdings, Inc. (BOOT)

Novagold Resources Inc. (NG)

RPC, Inc. (RES)

Celestica, Inc. (CLS)

Monro, Inc. (MNRO)

Hess Midstream LP (HESM)

Live Oak Bancshares, Inc. (LOB)

Pathward Financial, Inc. (CASH)

Triumph Financial, Inc. (TFIN)

Origin Bancorp, Inc. (OBNK)

Cimpress PLC (CMPR)

Washington Trust Bancorp, Inc. (WASH)

Univest Financial Corporation (UVSP)

Ethan Allen Interiors Inc. (ETD)

Horizon Bancorp, Inc. (HBNC)

HBT Financial, Inc. (HBT)

CPB Inc. (CPF)

Business First Bancshares, Inc. (BFST)

Equity Bancshares, Inc. (EQBK)

Covenant Logistics Group, Inc. (CVLG)

Bridgewater Bancshares, Inc. (BWB)

Marine Products Corporation (MPX)

Alerus Financial Corporation (ALRS)

NVE Corporation (NVEC)

Blue Foundry Bancorp (BLFY)

Sify Technologies Limited (SIFY)

Thursday, January 26, 2022, Most Anticipated Earnings

Visa Inc. (V)

Mastercard Incorporated (MA)

Comcast Corporation (CMCSA)

SAP SE (SAP)

Intel Corporation (INTC)

Marsh & McLennan Companies, Inc. (MMC)

Northrop Grumman Corporation (NOC)

Sherwin-Williams Company (SHW)

Blackstone Inc. (BX)

KLA Corporation (KLAC)

Valero Energy Corporation (VLO)

Archer-Daniels-Midland Company (ADM)

Arthur J. Gallagher & Co. (AJG)

Dow Inc. (DOW)

Nucor Corporation (NUE)

Xcel Energy Inc. (XEL)

STMicroelectronics N.V. (STM)

L3Harris Technologies, Inc. (LHX)

ResMed Inc. (RMD)

Rockwell Automation, Inc. (ROK)

Mobileye Global Inc. (MBLY)

Nokia Corporation (NOK)

Deutsche Bank AG (DB)

T. Rowe Price Group, Inc. (TROW)

Weyerhaeuser Company (WY)

Tractor Supply Company (TSCO)

Canon, Inc. (CAJ)

Southwest Airlines Company (LUV)

McCormick & Company, Incorporated (MKC)

W.R. Berkley Corporation (WRB)

Fair Isaac Corporation (FICO)

First Citizens BancShares, Inc. (FCNCA)

American Airlines Group, Inc. (AAL)

Eastman Chemical Company (EMN)

East West Bancorp, Inc. (EWBC)

Cullen/Frost Bankers, Inc. (CFR)

Robert Half International Inc. (RHI)

Webster Financial Corporation (WBS)

Olin Corporation (OLN)

Old Republic International Corporation (ORI)

Murphy Oil Corporation (MUR)

United States Steel Corporation (X)

Alaska Air Group, Inc. (ALK)

SouthState Corporation (SSB)

Valley National Bancorp (VLY)

United Bankshares, Inc. (UBSI)

Eagle Materials Inc (EXP)

Glacier Bancorp, Inc. (GBCI)

Applied Industrial Technologies, Inc. (AIT)

TFS Financial Corporation (TFSL)

AppFolio, Inc. (APPF)

First Interstate BancSystem, Inc. (FIBK)

Virtu Financial, Inc. (VIRT)

Federated Hermes, Inc. (FHI)

Associated Banc-Corp (ASB)

Ameris Bancorp (ABCB)

Eastern Bankshares, Inc. (EBC)

CNX Resources Corporation (CNX)

WSFS Financial Corporation (WSFS)

Pacific Premier Bancorp Inc (PPBI)

PacWest Bancorp (PACW)

JetBlue Airways Corporation (JBLU)

Xerox Holdings Corporation (XRX)

Axos Financial, Inc. (AX)

First Merchants Corporation (FRME)

Towne Bank (TOWN)

NetScout Systems, Inc. (NTCT)

First Financial Bancorp. (FFBC)

Carpenter Technology Corporation (CRS)

Hilltop Holdings Inc. (HTH)

Seacoast Banking Corporation of Florida (SBCF)

Bread Financial Holdings, Inc. (BFH)

The Bancorp, Inc. (TBBK)

Sandy Spring Bancorp, Inc. (SASR)

OSI Systems, Inc. (OSIS)

OFG Bancorp (OFG)

Berkshire Hills Bancorp, Inc. (BHLB)

S&T Bancorp, Inc. (STBA)

Taro Pharmaceutical Industries Ltd. (TARO)

Lakeland Bancorp, Inc. (LBAI)

Matthews International Corporation (MATW)

Heritage Financial Corporation (HFWA)

ConnectOne Bancorp, Inc. (CNOB)

Customers Bancorp, Inc (CUBI)

John B. Sanfilippo & Son, Inc. (JBSS)

Byline Bancorp, Inc. (BY)

First Foundation Inc. (FFWM)

Heritage Commerce Corp (HTBK)

MarineMax, Inc. (HZO)

Amalgamated Financial Corp. (AMAL)

Kearny Financial (KRNY)

HarborOne Bancorp, Inc. (HONE)

Haynes International, Inc. (HAYN)

First Mid Bancshares, Inc. (FMBH)

Flushing Financial Corporation (FFIC)

Midland States Bancorp, Inc. (MSBI)

Nurix Therapeutics, Inc. (NRIX)

Coastal Financial Corporation (CCB)

Farmers National Banc Corp. (FMNB)

Friday, January 27, 2022, Most Anticipated Earnings

Chevron Corporation (CVX)

American Express Company (AXP)

Charter Communications, Inc. (CHTR)

ICICI Bank Limited (IBN)

HCA Healthcare, Inc. (HCA)

Colgate-Palmolive Company (CL)

Roper Technologies, Inc. (ROP)

LyondellBasell Industries NV (LYB)

Church & Dwight Company, Inc. (CHD)

Booz Allen Hamilton Holding Corporation (BAH)

Dr. Reddy’s Laboratories Ltd (RDY)

Autoliv, Inc. (ALV)

Gentex Corporation (GNTX)

Badger Meter, Inc. (BMI)

First Hawaiian, Inc. (FHB)

Moog Inc. (MOG)

The post Stock Market This Week: Penny Stocks, News, & What To Watch Jan 23-27 appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

manufacturing

therapeutics

healthcare

stocks

index

markets

trading

nasdaq

buy

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….