Life Sciences

TECH-HEAVY: This is the week Big Tech is coming out to play (or pay)

The Nasdaq Composite booked its fourth straight week of gains, jumping 4.3%, last week, the Tech-Heavy’s longest weekly winning streak … Read More

The…

The Nasdaq Composite booked its fourth straight week of gains, jumping 4.3%, last week, the Tech-Heavy’s longest weekly winning streak since August. A lifetime ago.

The legs of this rally will be sorely tested this week, however, as the Ultra Big Tech Names comes out to play… or perhaps explain.

Apple (AAPL), Amazon (AMZN) and Meta Platform (META) are all on the block for 4th quarter earnings confessions.

And it’ll be a busy week for investors with a dollop of large-cap reports all round, while the Federal Reserve’s get together will bring us all the latest iteration on interest rates, due Wednesday in the US.

The week ahead will be another one full of action for investors with policymakers in the US, UK and EU all scheduled to go dark for their cost-of-everything decisions.

The US non-farm payrolls report and inflation data out of several major European nations should also prove market-moving.

Vantage Markets’ analyst Daniel Moss reckons The US Federal Reserve is likely to shift the pace of its rate hikes down to 25-basis points on Thursday, ‘in response to a significant decline in the inflation rate over the last six months.’

“Market pricing shows that investors believe that a quarter-point hike is 98.4% probable, which is completely understandable given the most recent inflation print undershot consensus estimates significantly and came in at the lowest level since October 2021. Indeed, on a monthly basis the Consumer Price Index (CPI) actually decreased by 0.1%, the first decline since May 2020,” Daniel adds.

A lot happening.

But first…

All of a sudden US traders appeared willing last week to gamble on the bottom being touched, ahead of the long anticipated Federal Reserve decision.

For the week, the S&P 500 and Dow Jones Industrial Average climbed 2.5%, and 1.8% respectively.

That may’ve been the tide turning as last week’s business on Wall Street turned risky, then aggressive.

The high-rise, high-growth plays like Mr Musk’s Tesla (TSLA) and Mr Hemsworth’s Netflix (NFLX), found solid buying after an extended stay in the dog house of ‘22.

Optimism stateside was also buoyed by some surprisingly happy Q4 returns and some willing guidance provided by gamesome chief executives.

Then there’s the anticipation Wall St is betraying over the way China (and Hong Kong) are just tossing out all their previous zero-COVID-19 anxieties. Let’s not forget Seoul ditching its indoor mask mandate and the likely flood of retail activity from the wider region.

Investors are crossing fingers that resources get a bump from increased stimulus from Beijing and the uptick in manufacturing and even potentially the lubrication of a few of the still rusty Asis-originated supply chain issues.

Of the circa 20% of S&P 500 companies which have reported so far, almost 75% have beaten analyst expectations.

So. Busy week.

Let’s break it down day by day.

Monday, January 30

Microsoft (MSFT) is introducing its old but new lower-cost tier called Microsoft 365 Basic. It’ll go for US$1.99 a month and include 100 GB of storage, some email, and apparently easy access to support experts.

In earnings news, Franklin Resources and SoFi Technologies report before the market opens and thereafter we bet into the semiconductor side of things with NXP Semiconductors.

Tuesday, January 31

Things get pretty large from today.

The Federal Reserve’s Open Market Committee (FOMC) will begin day one of its two-day mind meld, emerging with a decision on interest rates announced Wednesday.

Before markets open Tuesday will bring Q4 performances from Exxon Mobil, General Motors, McDonald’s, Pfizer, Caterpillar, Moody’s and Spotify.

When markets close it’ll be Snap.

Economic data for Tuesday: it’s the Case-Shiller home price index, the Chicago PMI and a useful consumer confidence read.

Wednesday, February 1

Piunch and/or Punch yourselves on Wednesday 1st at 1400 (2pm New York time, 5am Thursday, Sydenham time) for the FOMC will declare to the known universe the latest decision on rates. While most economists expect another rate hike, this one may be a smaller 0.25 basis points.

The Fed’s been implementing tighter monetary policy measures to address the inflation, recession, stagflation… you name it, that’s why they’re doing it…

Also on Wednesday – it’s an OPEC+ panel!

They’ll be likely to endorse the current oil output policy, as concerns over the economic outlook are balanced by hopes for an increase in demand from China.

Before the markets open investors will be eagerly attending the earnings calls for T-Mobile US, Altria Group, Waste Management and of course, Scotts Miracle-Gro.

Let’s take a look …

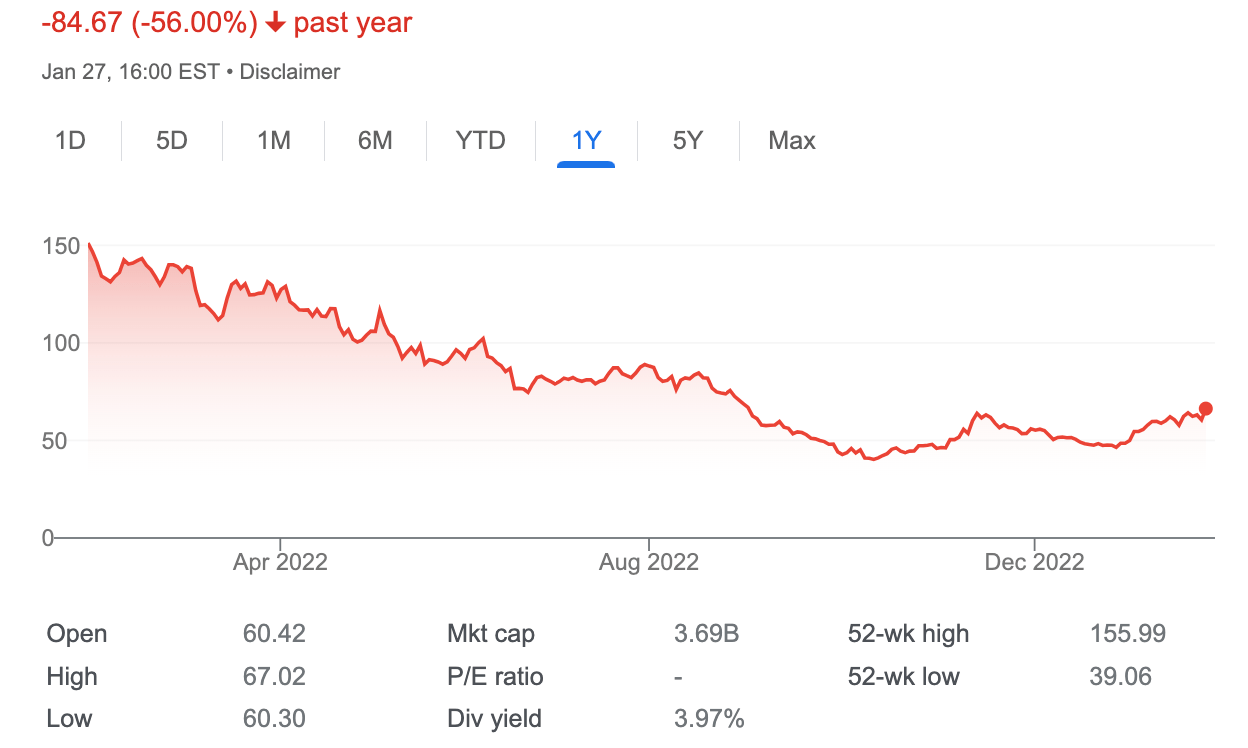

The Scotts Miracle-Gro Company (NYSE:SMG)

A tough year.

This was for the last close on Friday.

And this is how 2023 has been so far for SMG…

I think Friday’s near 10% run for the $US3.7bn market cap, came off the back of a great big US insurer, Great West Life Assurance Co. lifting its stake in the ag firm by by 24.9% over Q3, revealed by the latest 13F filing with the US Securities and Exchange Commission (SEC).

After the bell investors will listen into Allstate’s, MetLife’s, Aflac’s, Allegiant Travel’s, and …Meta Platforms’ earnings calls.

Meta’s Q4 after the bell

Wall Street expects the Facebook parent to earn $2.21 per share on revenue of US$31.44 billion. This compares to a year ago when Q4 earnings came to US$3.67 per share on revenue of US$33.67 billion.

This was Meta for the last close on Friday.

This was Meta last year…

And January thus far…

Last year Meta really copped diabolic losses even when compared to its FAANG buddies in terms of market cap percentage.

A hole, circa US$450bn, is right through Meta’s heart ahead of Valentine’s Day.

Aside from treacherously slow user growth and some genuine weakness in its digital ad business, at its core Facebook and Instagram products look dull alongside competitors like TikTok.

Economic data for Wednesday will include mortgage applications, ADP national employment, ISM manufacturing PMI and the JOLTS job openings.

Thursday, February 2

The Bank of England (BoE) is set to make its interest rate decision. I’m preparing some gags.

Investors won’t be laughing. They’ve a mega-day of earnings calls ahead, like:

- ConocoPhillips

- Eli Lilly

- Honeywell International

- Sirius XM Holdings

- Stanley Black & Decker

- Ferrari

- World Wrestling Entertainment (WWE)

- 1-800-Flowers.com

- Lazard

- Hanes

But these are the names we’re staying for after the bell:

- Apple

- Amazon

- Alphabet

- Starbucks

- Ford

- Qualcomm

- Microchip Technology

- Columbia Sportswear

- GoPro

- Skechers USA

- US Steel

- Merck

- Estée Lauder

- Harley-Davidson

- Hershey

Also on Thursday The Americans will also be dropping some relevant indicators, like Challenger layoffs, initial jobless claims, preliminary productivity, my personal fave: durable goods and factory orders.

Friday, February 3

Earnings on Friday are calmer.

Cigna, Regeneron Pharma and Zimmer Biomet.

The post-Fed economic round up still has power to move markets, however – most critical – the January jobs report (forecast up to 3.5% from 3.6% last month). Employers are thought to have added 185,000 jobs, (down from the 223,000 in December).

Further easing in US jobs growth read will be the icing on any success cake The Fed might be baking in its kitchen back there – suggesting its efforts are doing some good (although killing jobs isn’t of itself ‘good’).

There’s some of the usually suspect indicators pop up as well: S&P Global services PMI flash, ISM non-manufacturing PMIs and… another one… something, not as gripping…

Around the traps, its a central bank bonanza

The Fed decision on Wednesday will be followed by the BoE and then the ECB rates decision on Thursday (EU time).

The EU’s got jobless read on Wednesday too.

MONDAY

EU consumer confidence

EU services and industrial sentiment

China composite PMI

China manufacturing PMI

Japan unemployment rate

TUESDAY

EU GDP

US wages

US employment benefits

US house price index

US consumer confidence

US weekly crude stock

WEDNESDAY

US Fed interest rates decision

US mortgage applications

US non-farm employment

US manufacturing PMI

US JOLTS jobs opening

US crude oil and gasoline inventories

EU manufacturing PMI

EU CPI

EU unemployment rate

THURSDAY

ECB interest rates decision

US initial jobless claims

US factory orders

FRIDAY

US unemployment rate

EU S&P PMI EU services PMI

China Caixin manufacturing PMI

The post TECH-HEAVY: This is the week Big Tech is coming out to play (or pay) appeared first on Stockhead.

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….