Life Sciences

The Great Recalibration: 2022 Health Innovation Funding Dropped by 50% YoY, Yet We’re as Optimistic…

The Great Recalibration: 2022 Health Innovation Funding Dropped by 50% YoY, Yet We’re as Optimistic as Ever. Here’s Why.In our year-end StartUp Health Insights report, we explore the factors that could make 2023 a break-out year for early-stage health …

The Great Recalibration: 2022 Health Innovation Funding Dropped by 50% YoY, Yet We’re as Optimistic as Ever. Here’s Why.

In our year-end StartUp Health Insights report, we explore the factors that could make 2023 a break-out year for early-stage health startups (in spite of gloomy macro-ecomonic trends) and explain why a health moonshot mindset should always involve a long view of the market.

2022 saw a dramatic decline in venture funding across the health innovation landscape compared to the year prior. While deal volume also dropped, the dip may signal an important opportunity to usher in a transformative phase of progress and create room for a new generation of health moonshot innovation — the kind that leaps us forward in previously unimaginable ways.

Ask battle-tested entrepreneurs and innovators and they will tell you this truth: more capital does not ensure better solutions. In fact, some would argue that the noise and frothiness of recent years made it even harder for radically new ideas to get oxygen and traction. The momentum of groupthink moves fast with investors and industry alike, and unfortunately we’ve seen first hand how often true innovations get overshadowed and crowded out when the market is at a fever pitch.

Most alarmingly, it’s not only funding that has declined. Health outcomes have also gotten worse by most any measure: life expectancy has gone down, mental health is challenging the world, suicides have skyrocketed, addiction and related deaths are catastrophic as are obesity, diabetes, and heart disease. The metrics on health outcomes are painful to examine for anyone investing in progress, transformation, and health moonshots as we are.

So why are we more optimistic than ever in the face of such sobering data?

Through history, so many of the great transformations have occurred during and following great recalibrations. And we are in a Great Recalibration. In the post-COVID era of innovation, it’s not certain where the world is going and that can be a good thing. These are the moments when innovators and entrepreneurs lead the way forward and, in our view, when health moonshots not only become possible, but essential.

Here’s some brief insights from the past year and our topline takeaway for why there’s a fresh opportunity for those focusing on transformative solutions for the healthcare industry and people’s health and wellness.

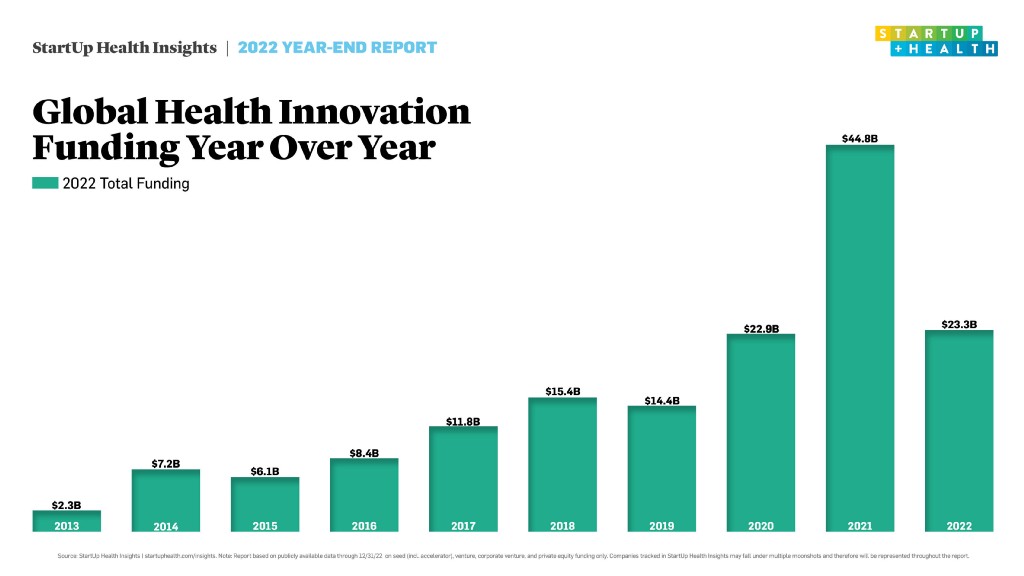

StartUp Health tracked $23.3B in health innovation funding globally, marking a roughly 50% decline over 2021. We saw 857 total deals (down from 1013), topped by mega-deals for Ultima Genomics in the United States ($600M) and Doctolib outside the US ($549M). The decline in funding, while appearing dramatic within a two-year window, still puts 2022 health innovation funding ahead of 2020, if only by a nose, and continues the upward trend of digital health funding that we’ve been tracking since 2010. Put another way, there was still a tremendous amount of investment into hundreds of businesses; furthermore, with so many new funds launching in recent years, many investors are sitting on capital they are anxious to deploy.

When we began the process of tracking digital health funding in 2010, and publishing StartUp Health Insights, we were the only company tracking early stage funding data globally. The term “digital health” wasn’t even a category yet.

Day by day, we tracked every deal we could get information on and scoured the internet for health innovation fundraising activity. We didn’t do it to sell data reports. We did it because we believed, passionately, that we were in the early days of a transformation phase we and others called a moment for the “creative destruction of health” and our “Insights” funding data helped to track the growth of the industry. Most importantly, we used the Insights to provide our community of Health Transformers important actionable intelligence they could use to grow their health moonshot companies.

In 2010, we tracked about $1.2B in funding across 151 deals globally. It seems paltry now, but we celebrated these funding rounds, knowing that it was building towards something much, much bigger. At that time, there was no way of knowing that just 11 years later, Devoted Health, a StartUp Health portfolio company, would pull in $1.15B in a single raise.

In our 2014 report, we celebrated that global health innovation funding had grown from $1.2B in 2010 to $7.2B, a six-fold increase in four years. We called it “The Year Digital Health Broke Out.” And it was, though it proved the first of many such milestones.

“The healthcare industry continues to be one of the biggest opportunities for entrepreneurs and investors,” wrote Venrock partner Bob Kocher in 2014. “Today market forces are driving new incentives and paving the way for disruption.” His words remain prescient today.

2014 confirmed our vision that the time was right for a health moonshot mission to empower healthcare entrepreneurs — our Health Transformers — to improve health for everyone in the world. Yet we knew we were still in the early innings.

In 2017, funding jumped to $11.5B globally and we saw more than $2B raised in a single quarter for the first time. Unity Stoakes, StartUp Health’s president and co-founder, called this health innovation’s “second wave.”

Then, in early 2020, COVID-19 hit. The world went to ground and at first investors put deals on ice, waiting to see how this new paradigm would shake out. But then, the tide turned. It became painfully evident to patients, doctors, and funders that the need for tech-enabled healthcare was upon us and, frankly, a generation overdue. Whether it was telemedicine, virtual clinics, remote monitoring, or health-tracking apps, investors sat up, paid attention, opened up their wallets, and set in motion an exuberant year of health innovation investing. When the dust settled on 2021, we’d tracked a whopping $44B in global health innovation, doubling the amount raised in 2020, which itself was a strong year.

That brings us to today.

Why this walk down memory lane? Because when we look at the funding numbers from 2022, we can choose to take a short view or a long view. We search to examine the long view of health innovation trends and insights because health moonshots take years, not months. Systems change over time, and yes then all at once. But that “all at once” is a journey in our experience.

Is funding down by half year over year? Yes. Has health innovation been on a historic, ceiling-breaking upward trend in funding over the last 12 years? Absolutely. Does health innovation recede in importance when investors tighten their belts? No, but it creates an opportunity for recalibration — and critically, for new solutions to rise.

Aggregating the Market

Now for a look at some of the important data we’ve looked at in the market. CB Insights reported a 57% decline in digital health funding, year over year, while Galen Growth put the deficit at 41%. Rock Health (which tracks US-only data) and StartUp Health split the middle, showing approximately a 50% reduction in funding. The spread is a reminder that “digital health” is still a market in development, and we’re still defining our terms. It’s also a reminder that trends in the United States and globally don’t always align. At StartUp Health, we’ve taken a global lens to health moonshots from day one, knowing that if we’re to meet the greatest health challenges of our time, it’s going to take a collaborative global army of entrepreneurs.

According to our StartUp Health data, total deal count is down only 15% year over year, compared with the nearly 50% drop in funding. This suggests a move towards smaller, earlier-stage investments, a trend that was also picked up by Pitchbook in their “2023 US Venture Capital Outlook” report. The report projects that “seed-stage startup valuations and deal sizes will continue their ascent, reaching new annual highs,” because “Seed-stage startups are more insulated from public market volatility than their early- and late-stage counterparts…Having just raised their first round of institutional capital, they are farther away from an IPO and can bide their time until paths to liquidity reopen.”

The same sentiment was on display at JPM in January, says Unity Stoakes, who noted an increase in early stage M&A activity. “With so many new funds in the market, there is deep interest in making investments in companies that still have not yet set their valuations during the past cycle,” says Stoakes. “This could signal a positive year for strong companies and teams at the earliest stages of development.” One rationale? With less hype noise and more focus, early-stage healthcare companies with clearly defined solutions have a big opportunity not just to do deals and fundraise this year, but to lean-in aggressively to stand out and gain traction while the later stage companies restructure and recalibrate.

Rock Health concurred in their year-end report: “In the current VC climate, strong horses (earlier stage companies with established product market fit…and paths to profitability) will beat out unicorns, though investors run the risk of betting on the wrong equine.”

So what to make of 2022.

Rock Health writes that 2022 “signals the tail end of a macro funding cycle” and suggests that 2023 could see a year of rebalancing, with investors preferring “boring” strategies like managing cash and investing in tech infrastructure. Galen Growth took a slightly more positive spin, writing that digital health “showed resilience with funding levels far exceeding pre-pandemic levels of 2019, more regulatory filings than 2021, and a 1.5x increase in partnering activity.”

Our conclusion is, maybe unsurprisingly, as optimistic as it was in 2010, but for rather different reasons. We believe that the 2022 decrease in funding for health innovation may usher in a Great Recalibration during which frothy market noise is decreased and great companies get the attention — and capital — they deserve. It’s a time for macro market recalibration — a shift towards innovations that truly and finally move the needle on health metrics — as well as at the individual startup level. We believe that smart startups will have an opportunity in 2023 to reframe their offering in light of this new market reality and put lasting health moonshot progress back at the center of the conversation.

This report was written and designed by Logan Plaster based on data collected and managed by Tara Salamone, Jennifer Hankin, and Nicole Kinsey. Additional analysis by Unity Stoakes, Priya Reddy, Padma Rao, and Josh Cherry-Seto. Download the slides here.

Data is from StartUp Health Insights, the most comprehensive funding database for health innovation. Get all our free reports and sign up for StartUp Health Insider™ to get weekly funding insights, news, and special updates delivered to your inbox.

Passionate about breaking down health barriers? If you’re an entrepreneur or investor, contact us to learn how you can join our Health Equity Moonshot.

Investors: Contact us to learn how you can invest in Health Transformers and Health Moonshots.

Digital health entrepreneur? Don’t make the journey alone. Learn more about the StartUp Health Community and how StartUp Health invests.

Follow us on social media for daily updates on Health Transformers: Twitter, LinkedIn, Facebook, and Instagram.

The Great Recalibration: 2022 Health Innovation Funding Dropped by 50% YoY, Yet We’re as Optimistic… was originally published in StartUp Health on Medium, where people are continuing the conversation by highlighting and responding to this story.

genomics

wellness

healthcare

digital health

telemedicine

apps

vc

venture capital

sell

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….