Government

Top Penny Stocks To Buy? 4 To Watch Under $5

Penny stocks to watch under $5

The post Top Penny Stocks To Buy? 4 To Watch Under $5 appeared first on Penny Stocks to Buy, Picks, News and Information…

What Are Penny Stocks?

Penny stocks are shares of companies trading for under $5. They generally are the stock of companies in early or development stages that are typically smaller in size. While the vast majority of penny stocks trade on the OTC market or “Over-The-Counter,” there are many that are listed on the NASDAQ and NYSE. Whether the companies have fallen on hard times or are building their business comes secondary to their potential to break out and record explosive gains.

How To Trade Penny Stocks

There’s no substitute for being educated as a trader. In the era of YouTube and online education, finding the right instructor is key. It’s also worth mentioning that when it comes to online trading education, having access to the right tools and a community of likeminded traders helps.

The basics of trading penny stocks involves finding cheap stocks, placing a buy order, then selling when the price reaches your desired target. It sounds simple, and it is. But it isn’t easy and should always begin with due diligence and research. Knowing how to find penny stocks to buy is where it all starts and having a list of penny stocks to watch helps.

In this article, we look at a handful of cheap stocks under $5 gaining momentum in the stock market today. Whether it’s new headlines or something else acting as a catalyst, we’ll dive into the details. We’ll also look to see if there are any upcoming events that could also be noteworthy to account for if any of these stocks under $5 are on your list of penny stocks this week.

Penny Stocks To Watch

Protalix BioTherapeutics Inc. (NYSEAMERICAN: PLX)

Inozyme Pharma Inc. (NASDAQ: INZY)

Sabre Corporation (NASDAQ: SABR)

bluebird bio Inc. (NASDAQ: BLUE)

Protalix BioTherapeutics Inc. (PLX)

Thanks to an explosive session for biotech penny stocks like Vistagen (VTGN), the sector as a whole is gaining momentum. Protalix is one of the companies gaining attention and some penny stock news has come into focus.

This week Protalix reported financial results for the second quarter ended June 30, 2023 and provided a business update on recent regulatory, clinical and corporate developments. It beat estimates for EPS by a significant margin, it also posted a notable sales level compared to what Wall Street was anticipating.

– Short Vs. Long Term Penny Stocks Investing

Dror Bashan, Protalix’s President and Chief Executive Officer explained, “We are very proud to have received regulatory approval for Elfabrio® in both the United States and the European Union, a significant milestone for adult Fabry disease patients and their families alike. Our commercial partner, Chiesi Global Rare Diseases, has the expertise and global reach to maximize the potential of Elfabrio, and Chiesi has already launched the product in the United States…We now turn our focus to strengthening our rare disease pipeline programs and building a sustainable portfolio.”

Inozyme Pharma Inc. (INZY)

One of the latest catalysts helping the move in Inozyme came from insiders buying up shares of INZY stock. Institutional investor Pivotal bioVenture Partners Fund purchased nearly $4 million of the biotech stock at $4.80 as part of the recent $60 million financing round announced last month.

The raise came shortly after Inozyme gave an update regarding its global development strategy of its INZ-701 in patients with ENPP1 deficiency. Following recent discussions with the FDA, CEO Douglas Treco, Ph.D. explained, “We are pleased to have finalized our pediatric pivotal trial design with PPi, a well-established natural inhibitor of mineralization, as a primary endpoint in the U.S. and a co-primary endpoint in the EU. We have already observed that INZ-701 meaningfully increased PPi levels in our ongoing trial of INZ-701 in adults with ENPP1 Deficiency, and, based on our discussions with regulators in the U.S. and EU, we believe we have a clear path forward in our clinical development program for the treatment of ENPP1 Deficiency.”

This week the company reported second quarter earnings results beating analyst estimates on earnings per share. The company also highlighted progress in advancing its INZ-701 with interest data coming next month. On the back of this news, with fresh capital in hand and active insiders following these developments, INZY stock could be one of the penny stocks to watch.

Sabre Corporation (SABR)

Shares of Sabre are on the move again after a nice pop last week. The software and technology company focuses on global travel clients, including retailing, fulfillment, and distribution in connecting travel suppliers with buyers.

– Penny Stocks To Buy? 5 To Watch With Big News This Week

Last week the company announced second-quarter earnings results and beat EPS and sales estimates. The market anticipated a loss per share of $0.23 but Sabre reported a smaller loss of $0.17. Sales came in at $737.53 million compared to expectations of $704.5 million.

Sabre also sees Q3 revenue coming in around $725 million, which was lower than the $725.79 million anticipated. Regarding its full-year, revenue is expected in a range of $2.9 billion to $3 billion compared to $2.9 billion expected.

Against this backdrop, SABR stock has surged. Meanwhile, analysts have begun to jockey. Mizhuo, for instance, maintains a Neutral rating. However, the firm raised its price target to $5. Morgan Stanley analysts also have a similar stance with an Equal-Weight rating and a $5.50 target.

bluebird bio Inc. (BLUE)

Earnings season is in full swing and showing the true colors of the companies reporting. bluebird bio is the latest to post its second-quarter results in the stock market today. The company beat EPS estimates but missed on sales expectations. bluebird said that its commercial launch of ZYNTEGLO and SKYSONA remained strong and that a Biologics License Application for its lovo-cel in sickle cell disease was accepted for priority review by the FDA.

As we approach the anniversaries of the FDA approvals of ZYNTEGLO and SKYSONA, we have continued to advance our commercial strategy and prove the model for the gene therapy field on our path to profitability,” said Andrew Obenshain, chief executive officer, bluebird bio. “Additionally, with the ongoing FDA review of lovo-cel and potential approval by the end of this year, bluebird is preparing for our largest opportunity yet to impact the lives of patients and families – a gene therapy for individuals living with sickle cell disease in the US.”

With this, BLUE stock has climbed higher on Tuesday, breaking above the $4 mark during the morning session.

The post Top Penny Stocks To Buy? 4 To Watch Under $5 appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

gene therapy

biologics

biotech

pharma

application

therapy

fda

research

stocks

shares

trading

fund

nasdaq

otc

buy

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

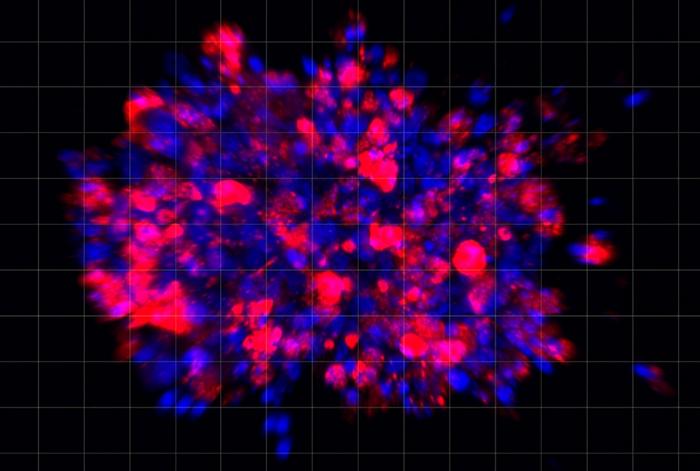

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…