Government

UPDATED: J&J goes blockbuster hunting (again) with $245M cash upfront for next-gen CAR-T

Bioregnum Opinion Column by John Carroll

J&J is working on creating its next Legend. Only this time, it’s moving right into the driver’s seat instead…

Bioregnum Opinion Column by John Carroll

Bioregnum Opinion Column by John CarrollJ&J is working on creating its next Legend. Only this time, it’s moving right into the driver’s seat instead of taking the co-pilot role.

This morning the pharma giant put out word that it’s forking over $245 million in a hefty cash upfront to land global development and commercialization rights to two early-stage, autologous CAR-T therapy programs from a US/China player — CBMG — that has a track record of allying itself with the biggest names in the development world. And they’re going right after B-cell malignancies.

It’s the kind of deal that should put an end to CBMG’s low-profile days, especially as it provokes questions from other cancer biotechs about rival CD20 tech in CAR-T as these drugs advance in the clinic under J&J.

Inspired by sets of clinical data that include a stellar snapshot of a sliver of Phase I efficacy data for relapsed B cell non-Hodgkin lymphoma patients from 2021’s ASCO, gathered at Shanghai’s top-notch Tongji University, J&J is diving deep — reminiscent of the stunning and risky play it made for Legend after their amazing debut at ASCO. There’s no detailed word of the milestones or royalties on the table for this current deal, but considering the development costs ahead, it’s clearly a multibillion-dollar commitment by J&J, which hands off a development project that could consume a couple billion dollars.

“It’s great for patients where you look at how this is different from others, in that you now have even much better products come out, you can save more patients’ lives,” says CBMG CEO Tony (Bizuo) Liu. “That’s what it’s about. So that’s where we’re just so super-happy, honored to work with the leadership. They’re super-excited, can’t wait to get this further trial going to move to the market.”

The deal gives J&J oversight of a clinical-stage CD19/CD20 bispecific CAR-T, carving a less common — though not exclusive — combo path around the development lane for a batch of CD19/CD22 drugs looking to succeed what’s proven to be a durable grouping of anti-CD19 pioneers in NHL. The pharma giant is also taking over on C-CAR066, a solo CD20-targeted drug that exhibited its own early promise in the summer of 2021, when it reported highly positive data for 10 patients with a therapy which boasted a median manufacturing rate of seven days.

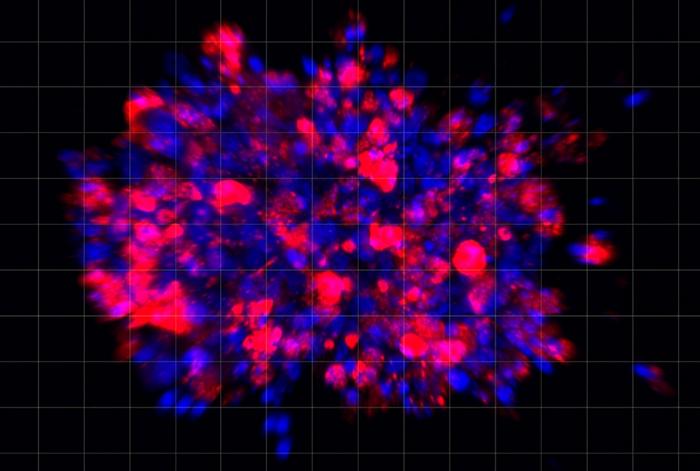

J&J’s appetite for the bispecific was whetted by the early success of C-CAR039, a 4-1BB bispecific anti-CD19/CD20. The research group of Aibin Liang scored a 93% ORR with the drug — which has a Regenerative Medicine Advanced Therapy designation from the FDA for diffuse large B cell lymphoma— and a complete response rate of 85.2% among 27 evaluable patients with B cell NHL.

All of the patients evaluated experienced an adverse event, and while most were grade 1 or 2 cases of cytokine release syndrome, quite common among the powerful CAR-Ts, there were two grade 1 cases of neurological AEs.

Liang has done extensive published research at Tongji on controlling CAR-T toxicities. And now the Phase Ib US study is underway for the bispecific with a parallel US program set to begin for the CD20 solo in the second half, according to J&J.

CBMG has its headquarters in Rockville, MD, and deep roots in and around Shanghai. It has an ongoing alliance with AstraZeneca and a once on/now off deal with Novartis that temporarily gave it manufacturing and commercialization rights for Kymriah in China, where it has extensive manufacturing ops that mirror operations in the US.

In this new deal with J&J, the pharma partner gets ex-China rights, but Liu says the allies are working out an option to include co-commercialization rights inside the huge Asian market.

Legend deal

J&J is uniquely positioned to execute on this kind of deal. A little more than five years ago, the pharma giant’s oncology group under longtime chief Peter Lebowitz rocked biotech with its $350 million cash upfront to ally itself with Legend on its BCMA CAR-T for multiple myeloma. And they have big hopes of doing it again.

“The major unmet need right now is diffuse large B-cell lymphoma,” Lebowitz tells me this morning. “And so that’s the big focus. Though we’ll also likely develop this in other B-cell malignancies as well.”

“In deals like this, it’s still some early data and we’re bringing it to the US and other parts of the world as well,” he adds. “There’s still some risk to discharge, but from what we’ve seen so far, it absolutely could be a game-changer. And based on the current data it looks like it has a clinical profile that could be best-in-class. What comes with that, when you have a drug that improves in efficacy and tolerability, it also opens up space to build the right regimen for it as well.

“When we do these deals it’s because we think it could be a new standard of care and change the treatment paradigm. That’s true for Carvykti and the Legend deal and it well could be true for this one.”

Lebowitz has been running the oncology R&D group for J&J for more than 10 years, an unusually long track record in biopharma. It’s paid off with a string of approvals, including one last year, one this, and two prospective OKs coming up next year. Few R&D groups can lay claim to that kind of success rate.

At the time they worked out the Legend deal, the execs around Nick Leschly at a pre-split bluebird bio pooh-poohed the rival to their leading program for bb2121 and its China-based development program, raising doubts about just how sick the patients were and raising eyebrows at the overall accuracy of the China data.

Later, then-J&J R&D chief Mathai Mammen told me that the company had gone after its due diligence with a double-barreled blast of background work that got down to reading every scrap of paper that every researcher at Legend had scribbled on. Only after that did they buy in on the multibillion-dollar alliance.

J&J’s involvement bridged the way to the US with a deeper set of global trials, and the FDA rewarded cilta-cel with an approval. The old bluebird’s campaign against it folded early against the jaw-dropping data.

New chapter

Getting in now with CBMG’s drugs will lead to a potentially earlier leap to a worldwide regulatory pathway as the pharma giant takes control, looking to stay in the fast track lane.

FDA’s oncology czar Richard Pazdur, meanwhile, has barred the door to approvals on China-only data, making an early move to the US essential for anyone looking to beat a path to first-in-class or best-in-class status.

As for CBMG, Liu took the company private close to three years ago in a $383 million deal after trading on Nasdaq. The move began even before the Trump administration had looked to create new auditing standards for China biotechs trading in the US.

“We made a bet on CD19s and 20 based on science,” Liu tells me. “But in privatization, we saw the benefits of focus.”

For Liu, biotech is the third major chapter in his career, following stints with Microsoft and then Alibaba with a company he sees as now deeply embedded as a transpacific player, boasting a major presence in the US among the 350 staffers he can count at CBMG. With this deal, he adds, the company can now turn to developing a broad pipeline of products, looking out five to 10 years to leapfrog into pharma status in their own right.

Says Liu:

We don’t need to keep putting money in from the development perspective (on the J&J programs). That allows us to allocate our resources now, and focus on the solid tumor aspect and autoimmune disease.

After the ASCO data came out, AstraZeneca-CICC Fund, Sequoia Capital China and Yunfeng Capital led their $120 million Series A round.

Other partners

CBMG and AstraZeneca designed their autologous (from the patient) GPC3-directed armored CAR-T with an “affinity-tuned single-chain variable fragment (scFv)” aimed at improving its safety profile.

Novartis and CBMG mutually decided some time ago to dissolve their Kymriah alliance, as the cancer pioneer ran into development and commercialization trouble that limited their future. Novartis, says Liu, remains an active backer of the company, rounding out the big three allies CBMG can count in Big Pharma.

Now CBMG takes the stage as a prominent new partner of one of the biggest cancer drug players out there, hoping to show that it’s ready for prime time.

J&J execs appear primed for another prime time round as well as they look to repeat the magic behind Carvykti.

manufacturing

biotech

pharma

fda

research

trading

fund

nasdaq

buy

Here Are the Champions! Our Top Performing Stories in 2023

It has been quite a year – not just for the psychedelic industry, but also for humanity as a whole. Volatile might not be the most elegant word for it,…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

Scientists use organoid model to identify potential new pancreatic cancer treatment

A drug screening system that models cancers using lab-grown tissues called organoids has helped uncover a promising target for future pancreatic cancer…