Life Sciences

Warren, AOC Seek Details About SVB’s Relationship With Clients, Investors

The letters — sent out Sunday — went to 14 of SVB’s biggest depositors.

Senator Elizabeth Warren of Massachusetts and Representative Alexandria Ocasio-Cortez of New York sent letters to a handful of depositors with Silicon Valley Bank seeking details about their relationship with the failed bank.

The letters — sent out Sunday — went to 14 of the bank’s biggest depositors. Among other issues, they seek answers on how long the firms banked with SVB, why they decided to keep their deposits there and what other “benefits” — such as low-interest mortgages — board members and executives may have received from the bank.

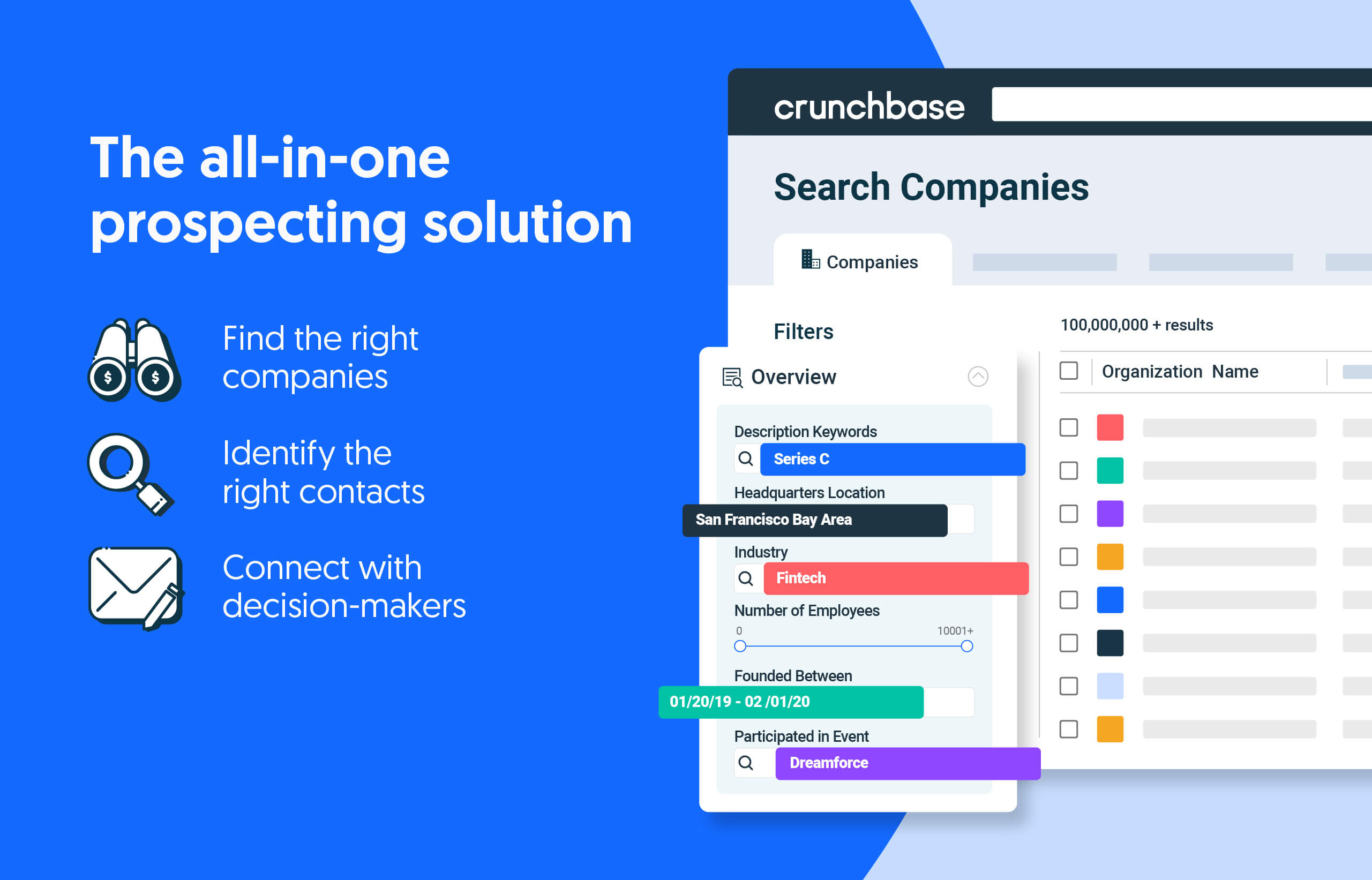

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

“In particular, we are interested in reports describing SVB’s ‘coddling’ and ‘white glove’ treatment of some of its largest venture capitalist (VC) depositors, their executives, and the founders of the tech startup companies they back, and the extent to which ‘SVB’s willingness to pull out ‘all sorts of bells and whistles’ for VCs and founders was one of the key ways it differentiated itself,’” the letter reads.

The letter also states that it is part of an effort “to understand the mutual backscratching dynamic that resulted in favorable treatment for VCs and startups, and massive, uninsured deposits into SVB,” and asks for answers to its questions by April 24.

The letters

The 14 firms that received letters are Circle, BILL, BlockFi, Eiger, Ginkgo Bioworks, iRhythm Technologies, Lending Club, Oncorus, Payoneer Global, Protagonist Therapeutics, Roblox, Rocket Lab, Roku and Sangamo Therapeutics.

Both Warren and Ocasio-Cortez have been critical of the bank and its executives since the collapse.

Late last month, First Citizens BancShares agreed to buy $72 billion worth of assets of the failed Silicon Valley Bank.

SVB’s collapse was the biggest US bank failure in more than a decade. SVB was the dominant bank for tech startups and venture debt in the U.S., cultivating a reputation for close-knit relationships with the power brokers of venture and taking chances on young startups that most banks wouldn’t have the time of day for.

Related reading:

- Silicon Valley Bank Stock Plunge Sends Jitters Through The Startup World

- Silicon Valley Bank Fails, Is Taken Over By Banking Regulators

- Silicon Valley Bank Collapse Leaves Tech Industry Scrambling For Answers

- Silicon Valley Bank Bet Big On Biotech. And Now It’s Gone.

- Guaranteeing SVB’s Deposits Was The Right Thing To Do

- SVB Puts Subsidiaries Up For Sale As HSBC Buys UK Unit

- Silicon Valley Bank’s Collapse Will Leave A Big Hole In the Startup World

- SVB Kept Up With Fast-Paced Health Startups. The New Normal May Be Slower

- SVB’s Demise Cools An Already Chilly Climate For Startup Funding

- SVB, Signature Shutdowns Not Chilling Crypto

- In Their Own Words: What Silicon Valley Bank Meant To The Valley

- Regulators Announce Plan To Ensure SVB Depositors

- Silicon Valley Bank’s Collapse Will Leave A Big Hole In The Startup World

- In Their Own Words: What Silicon Valley Bank Meant To The Valley

- First Citizens Buys Silicon Valley Bank’s Deposits And Loans

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….