Life Sciences

What are the Safest Investments Through Rising Rates?

What are the safest investments through rising rates? During the last two years, investors have seen painful inflation, causing them to seek refuge. But…

What are the safest investments through rising rates?

During the last two years, investors have seen painful inflation, causing them to seek refuge. But because of a new period of higher interest rates, investors are looking for ways to shelter their money, especially amid the rising risk of a recession.

The Fed, in an effort to tame the inflation beast, has been raising interest rates since March 2022. This followed a two-year inflationary period from June 2020 to June 2022, partly due to the COVID-19 pandemic.

Inflation, based on the Consumer Price Index (CPI), rose 7.7% from June 2020 to 9.1% in June 2022. With the Fed raising rates to curb inflation, moving money into safer stocks like health care can help limit the potential damage.

What are the Safest Investments through Rising Rates? Health Care

Investors may ask the question, what are the safest investments through rising rates? A relatively safe industry to invest in is health care. A key reason comes from the health care industry’s importance. The federal government has funded the health care industry in the past to sustain a supply of essential workers and equipment.

During periods of high inflation, health care typically shows resilience. Companies like J&J (NYSE: JNJ), United Health (NYSE: UNH) and Walgreens Boot Alliance (NYSE: WBA), averaged a stock price increase of 1.12% from January 2022 to January 2023.

Through times of panic, health care, along with national defense, tend to be subsidized by the federal government. For example, In the 2008 recession, the U.S. government spent $2.3 billion on the national health care system.

During the pandemic, the U.S. Department of Health and Human Services stimulated the health care industry with more than $150 billion in spending to combat COVID-19. Of that $150 billion dollars, $9.4 billion was spent on public health employment and payroll. The health care industry’s duty to support the general public’s health and well-being is a major reason why it is a good hedge against recessions.

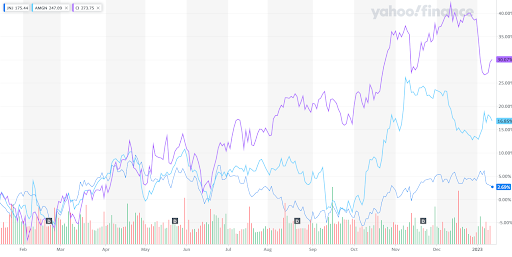

Possible health care targets for investing include Johnson & Johnson (NYSE: JNJ) of New Brunswick, New Jersey, and United Health (NYSE: CI) of Bloomfield, Connecticut. These companies hold a strong presence in the industry because of their sheer size. But they also have gained the most government attention when it comes to enduring times of panic. Both companies received funding from the U.S. Department of Health and Human Services during the pandemic to fund trials of new vaccines and pharmaceuticals. These two companies have also seen their stock price increases of more than 20% from 2017-2022. The graph presented exhibits the stock price of Cigna, Johnson & Johnson and Amgen (NYSE: AMGN), courtesy of Yahoo Finance.

If investors are looking for risk-averse equities to buy, health care exchange-traded funds (ETFs) offer such an opportunity. The First Trust Nasdaq Pharmaceuticals ETF (NASDAQ: FTXH) incorporates large drug companies with international presence.

What are the Safest Investments through Rising Rates? Recession Shields

While a possible recession bears unknown consequences to the well-being of the U.S. economy, the health care industry offers a relatively safe way to shelter the funds of investors. The health care industry provides protection from the unpredictable outlook of 2023. Investors can buy shares in an individual health care company or an ETF.

The post What are the Safest Investments Through Rising Rates? appeared first on Stock Investor.

vaccines

pharmaceuticals

stocks

etf

shares

index

fund

nasdaq

buy

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….