Markets

51% Of Home-Based Care Organizations Plan To Dive Into Higher-Acuity Care Models

Many people still consider home health and home care as sectors completely separate from hospital-at-home care. Increasingly, however, that is not the…

Many people still consider home health and home care as sectors completely separate from hospital-at-home care.

Increasingly, however, that is not the case. As more care comes into the home, home-based care organizations are finding ways to become involved – whether through partnerships or proprietary programs.

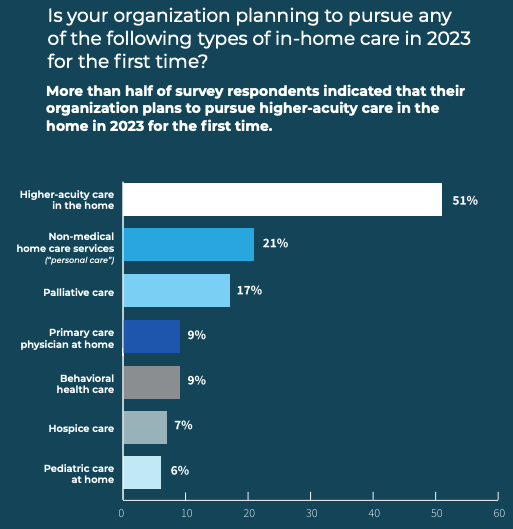

In 2023, over half of home-based care organizations plan to pursue higher-acuity care in the home for the first time, specifically meaning hospital-at-home or SNF-at-home care.

That’s according to a new survey from Homecare Homebase and Home Health Care News.

The survey had nearly 300 respondents who identify as working for organizations that work in home-based care, typically in home health care or personal home care. The organizations vary in size, from large to small providers.

Behind higher-acuity in the home, more organizations are delving into non-clinical home care services, palliative care and primary care in the home.

There are a few examples of companies that are already fully engaged on higher-acuity care. That includes most of the larger home health companies, but namely Amedisys Inc. (Nasdaq: AMED).

Amedisys purchased Contessa Health – a home-based, high-acuity care provider and enabler – in the summer of 2021 for $250 million. It was willing to accept the near-term drag on financials to reap the long-term benefits of having high-acuity care capabilities in house.

Its CEO, Paul Kusserow, explained to HHCN last month the value of having Contessa underneath its umbrella.

“What we’d hoped with Contessa was to be highly distinctive, to do things other people don’t do and can’t do,” Kusserow said. “And to move into markets where no one else is, and create these markets. The key for us now is to keep going deeper with our existing client base and selling a couple new clients per year. Bringing in more business to then get to break even, and then starting to make this profitable.”

A recent example is Amedisys’ and Contessa’s partnership with the University of Arkansas for Medical Sciences (UAMS). That partnership is across the continuum, whether it be on home health, hospice, SNF at home, hospital-at-home, or personal care.

Kusserow’s thoughts on the hospital-at-home landscape lend credence to the ethos behind more providers getting involved in the model.

“But we’re also seeing people that tried to do it on their own, hospitals that tried to do it on their own and fundamentally realized it’s way too complex for them to do on their own, and therefore they’re coming back to us and wanting to form JVs with us,” Kusserow said. “I feel really good about what we have at Contessa.”

Elsewhere, there are companies in personal care that are working in hospital-at-home models already. For instance, Honor and Home Instead – the former of which acquired the latter in August of 2021 – are working with DispatchHealth to provide acute care in the home.

BrightStar Care is similarly lending its expertise to help facilitate hospital-at-home care.

“We’re bringing certified nursing assistants, RNs or LPNs, depending on what the level of in-state regulations there are, so that the care coordination is being mapped out,” BrightStar Care CEO Shelly Sun told HHCN last May.

SNF-at-home care became very popular almost immediately after the public health emergency (PHE) was initiated, as skilled nursing homes were struggling with the effects of COVID-19.

Hospital at home, meanwhile, began to up in popularity when the Centers for Medicare & Medicaid Services (CMS) created a payment mechanism for the model during the PHE. That has been extended by two years past the PHE, which is now set to end in May.

Since then, hospital-at-home programs from health systems like Kaiser Permanente have seen great success. But there are other health systems that have been wary about getting their own programs off the ground.

Home-based care providers view that as a chance for them to step in and offer up their in-home care experience to fill in safety and staffing gaps.

“Home care nurses, in my experience, are very experienced, highly trained and really know how to do things when there’s no one else around who can help,” Sara Keller, associate professor in the division of infectious diseases at Johns Hopkins University, told HHCN last month.

The post 51% Of Home-Based Care Organizations Plan To Dive Into Higher-Acuity Care Models appeared first on Home Health Care News.

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Seducing stocks: Canoo Inc (NASDAQ:GOEV 5.43%), Ginkgo Bioworks Holdings Inc (NYSE:DNA -1.12%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…