Markets

Bank Runs Continue as Multiple Banks on Verge of Collapse

While the Fed’s move yesterday (Sunday, March 12th) to bailout depositors from the Big Tech banks that crashed in recent days may have prevented a stock…

by Brian Shilhavy

Editor, Health Impact News

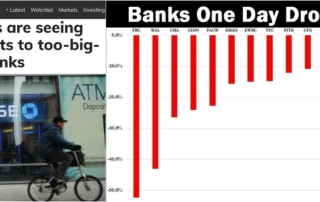

While the Fed’s move yesterday (Sunday, March 12th) to bailout depositors from the Big Tech banks that crashed in recent days may have prevented a stock market crash today, it did not stop the bank runs, and more than 30 banks halted trading at one point today.

Breaking: More than 30 banks have been placed under trading halts.#Bankcollapse #BankRuns pic.twitter.com/4UgHYCpuA3

— The Jericho Report (@JerichoReport) March 13, 2023

Hey Ukraine can we have our billions of dollars back? We’re having some problems of our own. #Bankcollapse #Banking #BankRuns #BankofAmerica #FirstRepublicBank pic.twitter.com/fEykAT2DTC

— Jessica (@JessicaBanner13) March 13, 2023

The Fed/TSY/FDIC stepped in and saved the world again last night… but nobody told regional banks, whose shares are down dramatically today…

Admittedly off the lows of the day, but all with multiple trading halts today. FRC, WAL, and MYFW are the highest default risk banks in the Russell 3000 Banks Subsector, according to Bloomberg…

Source: Bloomberg

But it’s not just the small banks who are seeing default risk increase, all of the global majors are seeing CDS spreads rise…

Source: Bloomberg

Most banking is done online now, so long lines at banks to withdraw funds are not something most are going to see these days. What is happening instead is that customers are withdrawing their funds from the riskier, mostly smaller banks, and putting them into larger banks that they believe are “too big to fail” because they believe the Fed will step in to prevent that.

The unexpected demise of Signature Bank over the weekend, along with the failure of Silicon Valley Bank on Friday, ignited a shoot-first-ask-questions-later reaction among regional-bank investors as customers moved deposits to the largest U.S. banks for perceived safekeeping, observers said Monday.

Stocks of regional banks such as First Republic Bank FRC, -58.93%, Western Alliance Bancorp WAL, -44.16%, PacWest Bancorp PACW, -27.53% and Zions Bancorp ZION, -20.82% dropped Monday even after U.S. bank regulators set up a new emergency-loan program as a backstop for deposits.

Over the weekend, crypto-friendly Signature Bank SBNY, -22.87% was closed by regulators, even though only a minority of its deposits were tied to digital currency. The company was hit hard despite the fact that it derives most of its business from traditional commercial banking services to companies outside the world of startups and digital currencies.

“Investors are scared by a flight of deposits to the too-big-to-fail banks,” Janney Montgomery Scott bank analyst Christopher Marinac told MarketWatch. “It’s a perception problem that’s become a perception crisis.”

Even though the Federal Reserve announced a new backstop program and President Joe Biden declared U.S. banks safe, investors remain skeptical about the fixes in place for the banking system — or they simply haven’t taken the time to absorb the moves by regulators to calm investors, Marinac said.

“There’s a disbelief out there that the there are no more failures coming,” he said. (Full article.)

While this is quickly turning into a partisan issue with each side blaming the other, open up your wallet and look at the color of your federal reserve notes (known as U.S. dollars). They are GREEN, not blue, and not red.

You “reap what you sow” is a fact of life, not only in agriculture (you can’t plant corn and expect to harvest watermelons), but also in the financial world, and after years of corruption in the business world and financial markets, the time to reap the consequences seems to be upon us.

America has prospered for too long off the backs of cheap labor outside the U.S. while investments and start up firms have become just as risky and worthless as gambling in Las Vegas, throwing money around as entertainment without producing anything of real value.

This is a MORAL issue, not a political issue. The time to pay off our debts that we have immorally been ignoring for decades, no matter which political office has been in power, is now upon us it would seem.

ReallyGraceful has a nice summary in a video she published today.

Comment on this article at HealthImpactNews.com.

See Also:

Understand the Times We are Currently Living Through

Year 2023: Will America Fulfill Its Destiny? Jesus Christ is the Only “Transhuman” the World Has Ever Seen or Will Ever See

An Invitation to the Technologists to Join the Winning Side

Synagogue of Satan: Why It’s Time to Leave the Corporate Christian Church

Spiritual Wisdom vs. Natural Knowledge – Why There is so Much Deception Today

How to Determine if you are a Disciple of Jesus Christ or Not

Epigenetics Exposes Darwinian Biology as a Religion – Your DNA Does NOT Determine Your Health!

What Happens When a Holy and Righteous God Gets Angry? Lessons from History and the Prophet Jeremiah

Insider Exposes Freemasonry as the World’s Oldest Secret Religion and the Luciferian Plans for The New World Order

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

Fact Check: “Christianity” and the Christian Religion is NOT Found in the Bible – The Person Jesus Christ Is

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Mark of the Beast?

Medicine: Idolatry in the Twenty First Century – 7-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our newsletters? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

The post Bank Runs Continue as Multiple Banks on Verge of Collapse first appeared on Vaccine Impact.

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Seducing stocks: Canoo Inc (NASDAQ:GOEV 5.43%), Ginkgo Bioworks Holdings Inc (NYSE:DNA -1.12%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…