Markets

Inflation Could Result in Additional $370B in Healthcare Costs by 2027

What You Should Know: – McKinsey & Company’s latest report reveals inflation could result in $370 billion in an additional increase above the baseline…

What You Should Know:

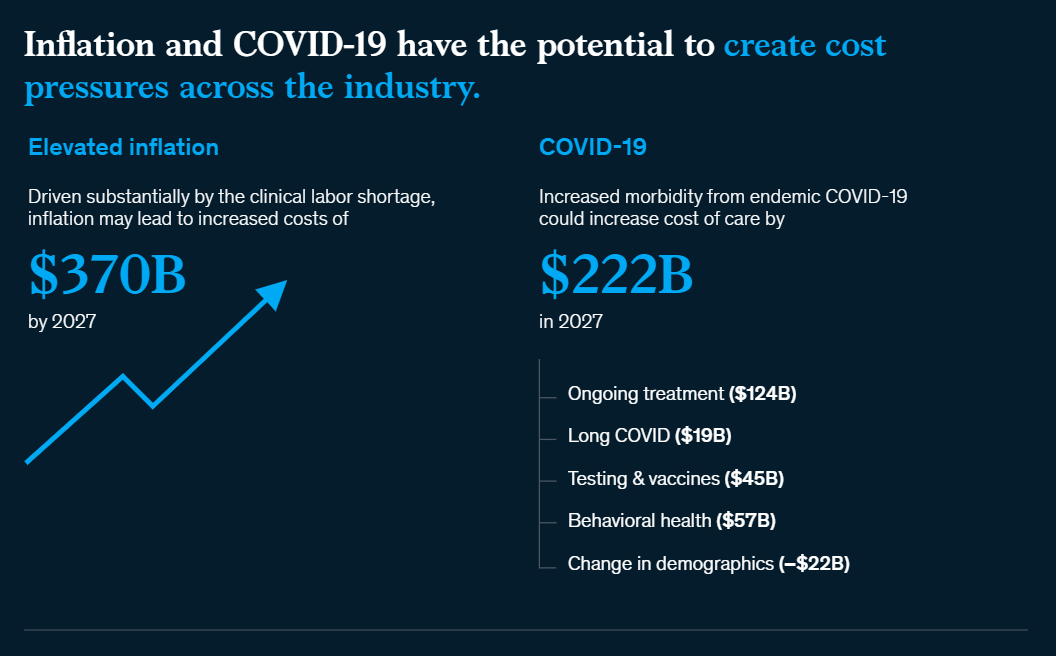

– McKinsey & Company’s latest report reveals inflation could result in $370 billion in an additional increase above the baseline in healthcare costs by 2027, causing the government, employers and consumers to burden the cost.

– The piece showcases the impact healthcare inflation will have over the next five years without immediate action, threatening affordability and access to care for consumers, and posing a material risk to profitability for providers, payers, and other healthcare stakeholders.

Trends in Inflation and Their Impacts on Healthcare

According to the new report by McKinsey & Company, the decade from 2010 to 2020 marked a period of relative calm for the US healthcare industry, with national health expenditures (NHE) rising at predictably strays rates. Then, the COVID-19 pandemic unleashed a prolonged period of disruption, illness, and loss that continues to wane slowly. L Labor shortages, inflation, and endemic COVID-19 challenge the industry as it threatens affordability and access to care for consumers, and it poses material risks to profitability for providers, payers, and other healthcare stakeholders. McKinsey research reveals the combined effects of these forces could accelerate the increase in NHE by approximately $600 billion through 2027.

According to the report, healthcare leaders, especially those in the private sector, have an opportunity to step up and invest in innovation for the betterment of healthcare. Indeed, implementing a well-known set of interventions—in care delivery transformation, administrative simplification, clinical productivity, and technology enablement—could generate a collective opportunity of more than $1 trillion and potentially up to $1.5 trillion through 2027, according to McKinsey analysis. However, to move fast enough to capture this opportunity, healthcare leaders need to rethink how they approach organizational growth and transformation.

McKinsey’s 15th annual healthcare conference, held in July 2022 in Chicago, explored the current healthcare climate, forces contributing to the coming storm, and steps healthcare leaders can take to help them weather these turbulent times and thrive. The report organizes these insights and trends into three main themes, explained as follows:

1. New forces affecting the healthcare industry

The highest inflation levels since the 1970s, the growing likelihood of a recession, and low consumer sentiment are buffeting the US economy—and the healthcare industry is not immune to their effects. Workforce spending, which accounts for more than 40 percent of total spending for healthcare providers is rising rapidly. And endemic COVID-19 may bring increased morbidity, especially for the most vulnerable segments of the population.

Healthcare inflation is being driven primarily by rising labor costs, but other factors are exacerbating cost pressures. For example, costs for supply inputs have grown 15 to 25 percent over the past three years. Overall, by 2027, inflation could result in an additional $370 billion in healthcare spending above the expected baseline increase.

The healthcare labor crisis spans job categories, but McKinsey research—both globally and in the United States—reveals it is especially acute in nursing. A decline in labor pools from outside the United States, demographic shifts, and increased turnover driven by healthcare worker decisions to pursue non-patient-care careers or to retire are intensifying pressure on the labor supply.

2. Who will bear the burden?

Without the effects of the brewing storm, NHE was expected to grow at a rate of 5.5 percent per year through 2027.8 These additional costs, however, are projected to push up the rate of NHE growth to 6.8 percent according to McKinsey analysis, or about 2.5 percentage points above forecasted GDP growth.

In a survey of employers, 60 percent of respondents reported healthcare cost increases that outpaced inflation in the past three years; 63 percent expect that trend to continue, signaling potential cost challenges in the future. Moreover, 95 percent of employers stated they would pass along any cost increases greater than 4 percent per annum to employees.

While average household savings remain temporarily high due to the pandemic, consumer confidence is dropping, and real wage growth is negative as a result of inflation. Consumers already face substantial exposure to medical expenses—in a February 2022 survey, for example, more than 20 percent of consumers reported having more than $1,000 in medical debt—and they will have difficulty absorbing these higher costs for much longer.

A range of factors indicates that it may be difficult for the government to absorb the additional medical-cost burden. First, recent record-high federal budget deficits have brought the federal debt to historic highs. The two largest deficits in history occurred in 2020 and 2021 at $3.1 trillion and $2.8 trillion, respectively. This spending has increased the federal debt as a share of GDP to 124 percent. Meanwhile, rising interest rates are increasing federal-debt service costs. Additionally, healthcare spending represents a record 20 percent of GDP.

3. How to weather the storm

During the pandemic, leaders across the entire healthcare ecosystem rallied in surge after surge around the highest priorities, collaborated in unprecedented ways, and made and executed decisions at a breakneck pace—all to save lives and pull the health system back from the precipice. Now they can build on that momentum to not only weather the storm but also emerge stronger. Although profit pools are at risk, healthcare leaders who adjust their business models accordingly can expect bright prospects for their organizations in the years ahead.

Accelerating and scaling innovation in care delivery transformation, productivity improvement, technology enablement, and organizational growth will be central to healthcare leaders’ efforts. Together, investing in these areas could create value of more than $1 trillion and up to $1.5 trillion. Attaining this value will require structural shifts to the system to better align incentives among risk bearers and deliver a patient-centric experience along the entire care continuum.

The future of care delivery is fundamentally changing. The trends are slowly but steadily moving to a world in which care delivery is more personalized and supported by technology. More patients receive care in ambulatory settings, at home, and virtually. Data and analytics inform decision-making across the care continuum. The shift to value-based care is reflected in care models and insurance. Private investors increasingly fund all of these changes in care delivery. Meanwhile, regulatory shifts support increased price transparency and secure sharing of patient data, and the healthcare ecosystem overall, while still fragmented, is becoming more integrated.

Technology enablement is the need of the hour. During the pandemic, when providers and payers pivoted to tech-enabled care delivery, they discovered that they have the capacity to redesign systems much more quickly than they previously thought possible. Moreover, $250 billion of US healthcare spending could potentially shift to virtual or virtually enabled care, which will eventually result in lowering the cost of care and improving outcomes.

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Enamoring stocks: Blink Charging Co (NASDAQ:BLNK -10.68%), Bristol-Myers Squibb Co. (NYSE:BMY -0.47%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…