Markets

Thanks for the upbeat news flow 2023, now here’s what Diana reckons will happen to us next

Investors are enjoying the fortnight that’s been 2023. Markets from Frankfurt to the Philippines have started the year on a … Read More

The post Thanks…

Investors are enjoying the fortnight that’s been 2023.

Markets from Frankfurt to the Philippines have started the year on a strong footing and Diana Mousina senior economist at AMP Investments, says we can start by thanking China’s canning of COVID-zero (a surefire boost for global growth), the hints of easing inflation and the subsequent market enthusiasm for some slowing in central bank rate hikes.

In the 2nd week of 2023 work, Wall Street saw gains across all sectors except health and consumer staples. All 3 majors gained, and US indices were 2.3% higher over the week .

EU shares lifted by 2.7%, Japanese shares rose by 1.8%, Chinese stocks were up by 0.2% while here in the badlands, Aussie shares outperformed the outperformers charging into the unknown by over 3%.

Like the states, every sector was up except utilities for some reason.

Diana says US bond yields fell over the week, with the 10-year at 3.4%.

“(The 10-yr) is well below its cycle high of 4.2% in October 2022 as market pricing for Fed interest rate hikes has declined a little and the US dollar fell and is now 10% below September highs.”

There’s been some easing on the energy front as well, while more generally commodity prices are well down from their 2022 highs.

A blazing winter has seen European gas prices dive on back to early 2022 levels.

“The collapse in gas prices over recent months means a reduced risk of a near-term Eurozone recession. Oil prices are around $80USD/barrel, agricultural commodity prices are mostly down on 2022 levels while iron ore has been rallying again, up to $111USD/tonne on China’s reopening which will lead to a lift in industrial production.”

What virus?

China hasn’t posted an update of coronavirus cases all week, that’s never a good sign.

markets might be enjoying the upbeat signals, but this silence doesn’t bode well for what’s actually happening on the ground.

Aside from the human toll, markets should be worried about the long-term impact of things getting out of hand, especially in the poorer rural regions.

There’s a concern that cases are likely skyrocketing and recent data is wholly unreliable. Mass testing went out the window with Zero-policies and Diana says narrow definitions of active cases are the only thing offiicals are offering up.

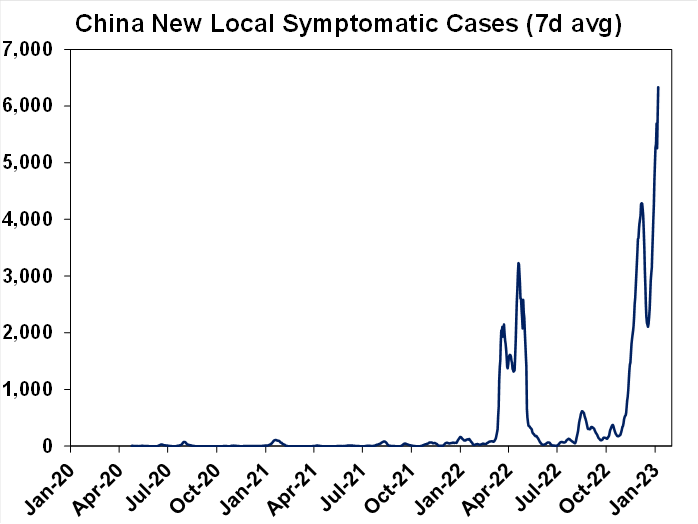

“On the last measure, just under a week ago, local symptomatic cases were averaging at ~6K/day (see the chart below).

“We wrote a note on China’s reopening here and its implications for the Chinese economy and the rest of the world. High case numbers pose a risk to the healthcare system in China (especially outside of Tier-1 and Tier-2 cities) and will disrupt March quarter economic activity but this will be temporary as Chinese vaccination rates are high, Covid variants are milder now compared to earlier strains and antivirals are available.

“A strong consumer-led recovery in economic growth is expected in the second half of the year which will boost global growth as Chinese imported demand rises and as inbound and outbound tourism resumes.”

We win: Prices continue to remain stable in China

This upbeat tone was struck by the National Development and Reform Commission on Thursday:

“With continuous bumper harvests in grain, sufficient supply of important livelihood commodities, and strong basic energy security, we are confident that we can keep overall prices stable.”

Both the english language editions of the Global Times and China Daily were quick to get the word out after an upbeat NDRC presser lauding China’s own comparatively festive inflation situation.

It’s good to be great: “stable CPI, rosy GDP targets…”

After stabbing business and retail activity through the heart over the last few years of COVID-zero policies the NDRC was pleased to share China’s consumer price index for December – just like the US, this is one of the nation’s key inflation reads. And it was thoroughly enjoyed:

“Through closely monitoring the prices of grain and energy, and improving the transport and distribution system for commodities, China was able to rein in the CPI at a time when runaway inflation was seen around the world.”

True. At 6.5% US markets were cheering Thursday’s inflationary decline from November.

Meantime in China, inflation grew by a dreamy 1.8% year-on-year. That’s a whole 0.2% ahead of the 1.6% recorded in November.

Also out Thursday: The National Bureau of Stats dropped China’s producer price index – a gauge of factory-gate prices which fell handsomely in December by 0.7% year-on-year, almost half what it was in November. (…of course, releasing a COVID-19 tsunami will help that, but no need to ruin the moment).

The message from China, with bells is simply our inflationary pressures are so much better than yours. We’ve heaps of pork, a ton of gas and hey, buy a car, enjoy the savings.

“Looking forward to 2023, although international commodity prices may fluctuate and remain high and imported inflationary pressures still exist, there is a solid foundation for China’s prices to remain stable.

EAT

AMP’s rather handy Economic Activity Trackers (*EAT… that’s my acronym, AMP may not be keen) paint a busier picture than we’ve seen for a while.

The below is based on a melange of weekly data for things like job ads, restaurant bookings, confidence, mobility, credit & debit card transactions, retail foot traffic, hotel bookings.

I went to a restaurant, so, did my bit.

“(They) spiked over the holiday period, from rising hotel and restaurant bookings as the Christmas period in 2022 was the first time since the pandemic that restrictions around travel were virtually non-existent.”

Diana says though, they’re likely to ease from here.

“Our Inflation Tracker (*IT… yeah, same) continues to track down, pointing to further downside in inflation readings across the major economies.”

People generally out and about over the festive season, less so in the US

Inflation: Piping down a little

Bang on: US December consumer price index (CPI) hit expectations

Diana: Powell almost Fed up, another 2-3 more hikes likely before a pause

“Although inflation is headed in the right direction, a few more interest rate hikes from the Fed are still likely to ensure that there is little to no chance of another inflation breakout this year. The better inflation dynamics are consistent with a slower pace of rate hikes, with a 0.25% interest rate hike likely from the US Fed at its next meeting in early February (a reduction in the pace of tightening compared to some of the super-sized rate hikes in 2022).

So Diana. Just briefly then, what are we looking at?

“2023 is likely to see easing inflation pressures, central banks hiking rates less aggressively (before an eventual pause to hikes this year and the risk of rate cuts in late 2023) and economic growth weakening but proving stronger than feared.

“This along with improved valuations should make for better returns in 2023. But there are likely to be bumps on the way – particularly regarding recession risks – & this could involve a retest of 2022 lows or new lows in shares before the upswing resumes.”

Global shares are expected to return around 7%. Australian shares are likely to outperform again, off the back of China. I’ve got a number (below 7,700 and above 7400.

But more of that later.

The post Thanks for the upbeat news flow 2023, now here’s what Diana reckons will happen to us next appeared first on Stockhead.

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Seducing stocks: Canoo Inc (NASDAQ:GOEV 5.43%), Ginkgo Bioworks Holdings Inc (NYSE:DNA -1.12%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…