Markets

The Hot Seat: Mark Gardner at Maqro Capital’s worst of 2022 and best of 2023

Mark Gardner is the Head of Investment Committee at Maqro Capital, one of Australia’s leading investment research, trading and advisory … Read More

The…

Mark Gardner is the Head of Investment Committee at Maqro Capital, one of Australia’s leading investment research, trading and advisory firms.

Here, Stockhead’s Deputy Editor and Predator/Interviewer Christian The Wolf Edwards interrogates Mark to within an inch of his life about Maqro, macro and making money in 22/23.

SH: Mark, you said to me before Xmas, the massive movements in equities over the last 12 months seem almost fictional in hindsight, what are some of the things that’ve grabbed you?

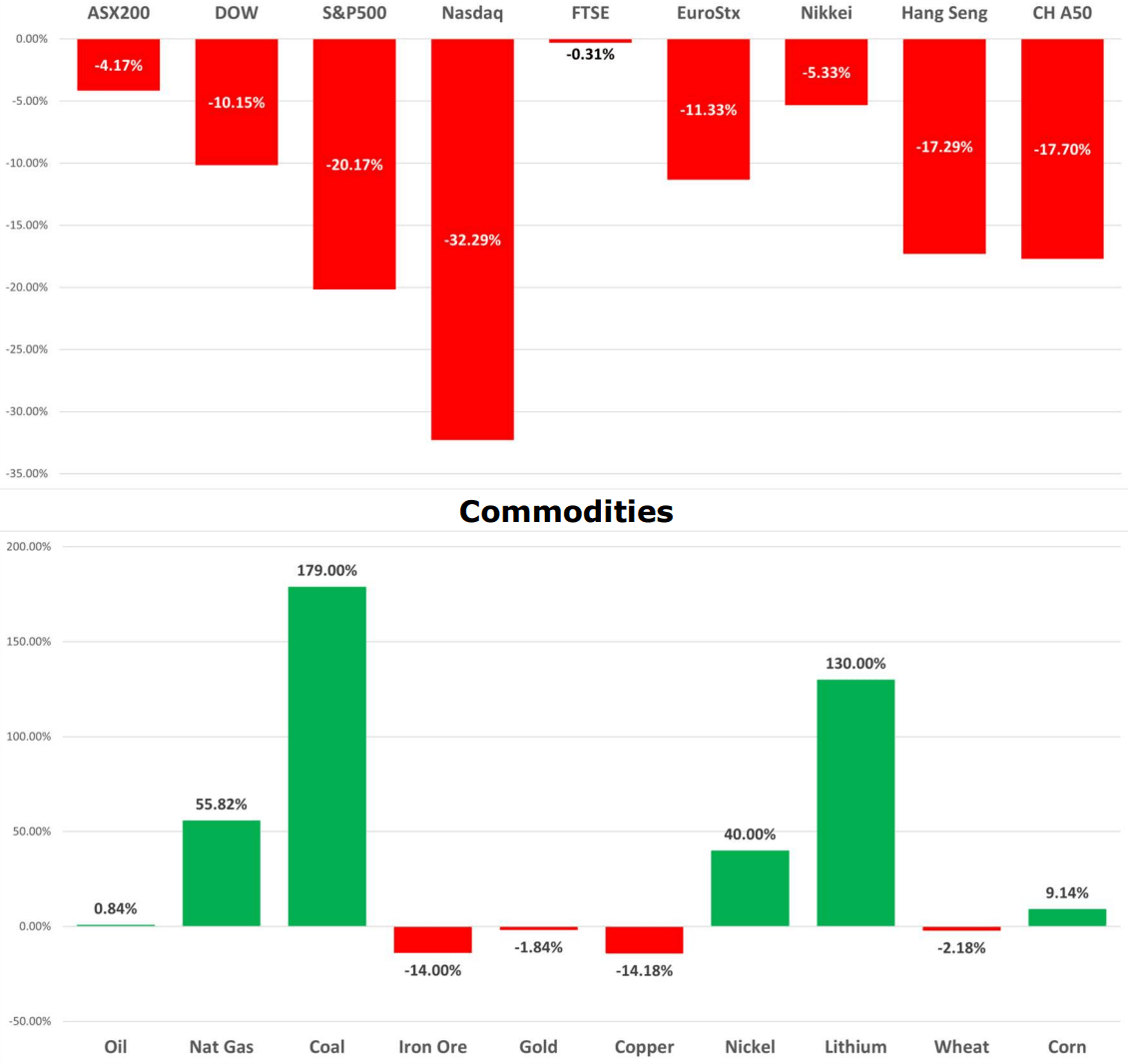

MG: We’ve seen a 20%+ range twice in equity indices; interest rates rise at breakneck speeds; central banks admit they got it wrong and then play catch up; a country invaded; lockdowns; inflation at 40-year highs; coal came back from the dead, as living costs outranked the planet; lithium stocks fall 50% rally 150% before falling 40% to finish the year unchanged and to top it all off we finish the year with the largest concern for markets being a recession while global unemployment rates are at record lows.

It’s hard to believe the AU index got back to within 9 points intraday from record highs during April.

Equities vs Commodities 2022

SH: You manage other people’s money for a living. How did you manage that in the mess we call ’22

MG: The key stance Maqro Capital took in managing the portfolios successfully this year was stepping back “to see the forest for the trees,” which helped us remain in the right sectors and outperform.

This recovery was very short-lived as US CPI data showed the highest level of YoY inflation in 40 years, forcing the Federal Reserve to pivot its interest rate outlook sharply raising interest rates by 50bps in April and 75bps in May, far quicker than had communicated earlier in the year.

SH: Looking back then, what are the indicators and moves which signalled when and how to make the segue into the right places

MG: Actually it all came down to the initial move from the US central bank. That forced the hand of the RBA – also raising interest rates by 50bps for the first time in 15 years, – triggering all sorts of investor panic about stagflation which hasn’t occurred since 1980. Most of the analysts on Wall St probably had to Google it.

…the swift change in analyst and investor outlook (based on limited economic data) really upped the uncertainty and volatility to levels where fundamentals were thrown out the window and investors (not us ofc) sold off portfolios indiscriminately.

The back half of the year was dominated by inflation data and interest rate speculation, fuelling 2 significant bear market rallies and one last (maybe) revisit of the lows.

SH: Volatility… transitory and oscillations. Come up with a sentence which uses these words, but also makes sense.

MG: The VIX averaged over 25, that’s right up with the most volatile runs since the GFC – the financial press (not this one, ofc) and pundits swung as wildly, in their opinions, adding to the general chaos.

While analysts argued inflation was “transitory” the Fed raised by 75bps at 4 straight meets – the sharpest cycle in over 40 years… the US benchmark went from 0.25% to 4.5% which – surprisingly – was a much swifter and severe central bank reaction than even during the GFC.

The last 5 inflation readings have now shown a decline and the Fed has oscillated that interest rates are nearing a peak, expected to be around 5.1% while also well-telegraphing that the it will leave rates “higher for longer” until inflation returns back to the 2% target (a mere 5.1% away).

Bonds inverted as: 2y and 10 yr over 21/22

SH: Alrighty. You said ‘oscillated’… but that’s a tense thing. Never mind. Mark. It’s been a good start to the year. 4 days in now. What’s the current state of play?

MG: Ha. In a word “uncertain”.

…Inflation remains 5.1% away from the Fed target of 2%, more rate hikes might be in the pipeline. Most analysts are looking at a tough H1 as the rate hikes bite, but I think the timeline is too fast. We still have employment numbers shooting the lights out and economic activity in the US is still very solid in some sectors.

Until we see the employment numbers pull back, I don’t see the economy slowing significantly enough for the Federal Reserve to cease hiking rates. This is the same for the RBA although how leveraged the AU economy is to the housing market will make it a more difficult job because they cant afford to go as high on rates like the Fed can.

Right now. The first 6 weeks of 2023 will likely be range bound until earnings/reporting season in February which could provide a positive catalyst, being the last of the “good times” particularly for the retailers as the cost of living did fall slightly in 2H 2022 giving consumers more disposable income.

Mark says that the provided outlooks and companies’ ability to manage their debt will be a key factor as many companies have not operated outside a zero-rate environment for close to 15 years. Forward reporting obligations have been sketchy since COVID-19.

SH: Hang on a sec, we’re going to put some charts in here, I think…

Mark’s current downside risks

Inflation remains stubborn

Interest rates peak higher than expected

China doesn’t recover

Europe – energy crisis and higher rates

Rates induced recession bites

Mark’s current potential upside catalysts

Inflation eases quickly

Rates have peaked

Shallow or no recession

China recovers

Mark’s sector bias for risks

Materials – neutral to underweight later in the year

Energy – (sub-sector specific)

Financials – Overweight

REITs – Industrial real estate only until mid-year

Healthcare – Overweight

Industrials – underweight to neutral/positive later in the year

Consumer discretionary – underweight, non-cyclical discretionary preferred

Consumer staples – overweight

Telecommunications – neutral

Technology – underweight, stock specific later in the year

Utilities – overweight

And his sector bias for upside

Materials – Overweight

Energy – (sub-sector specific)

Financials – Overweight

REITs – Overweight industrial, office and residential later in the year

Healthcare – Neutral

Industrials – Neutral to overweight later in the year

Consumer discretionary – Neutral to overweight later in the year

Consumer staples – Neutral

Telecommunications – Neutral

Technology – Stock specific to Overweight later in the year

Utilities – neutral

SH: No. I hear they’ll be lists. Anyway. Some crystal-balling now, please. What’s your short-term prognosis for the global outlook and how will you play it?

MG: Okay. Short-term – it will be all about the Fed and the US economy with high volatility likely to remain.

The catch-up nature of the swift interest rate tightening cycle is unprecedented and doesn’t give the time and space for the economy to adjust on the usual lag which will likely leave the labour market stubbornly tight and pushes back my timeline around 3 months from the consensus view.

Wage inflation could spike in Q1, which the market will respond negatively to, but how the Fed responds at this point will be key.

… I see two scenarios that will set the path for the year, from late Q1…

Scenario 1 – If Central Banks, particularly the Fed raise their peak rate level from the current 5.1% to 5.5% or above, we will likely see a severe recession around the middle of the year and continued volatility for at least 12-18 months

And scenario 2 – Central banks hold their nerve and let the current sharp hikes sink in, inflation and the economy have a slow decline, leading to a shallow recession around the middle of the year

For context, during prior recessions the median peak-to-trough S&P 500 EPS decline was 13%. In such a scenario, we expect the S&P 500 P/E multiple would fall to 14x (currently 16x) Note that around prior recessions, equity prices and valuations typically troughed while analysts were still slashing their earnings forecasts

Medium Term – Top focus is the recovery in China, Europe’s ability to manage inflation and the severity of the US recession

Our economy will depend on the housing market’s ability to handle rate hikes with the floating AUD and the China recovery will buffer the Australian economy from most external shocks.

…Companies will have to adjust to dealing with higher rates and quality will reign.

The Global economy will continue to be disjointed with China recovering, Europe walking a tightrope and the US looking at a period of adjustment to higher rates. (I should add that it is very interesting to note that no bear market has ended until a recession has been confirmed) which statistically means we’re likely to continue to have sentiment-based swings within the 2022 range until at least H2.

SH: Wrap it up.

MG: So… in summary, my outlook for 2023 is, wait and see.

It’s no cop out. Look: the level of uncertainty in the global economy and companies’ readjustment period to higher rates means that giving a definitive outlook on 2023 is not only a guess, but irresponsible.

While I agree with the analyst herd view of “rough H1, positive H2” I don’t agree with the timeline nor the specific nature of “expert” predictions.

Quality value stocks with good management will outperform no matter the sector, while growth companies’ success will be dependent on the quality of management, fiscal discipline and the size of their war chest as capital will not be freely available nor cheap. I think the 2022 range will remain largely unbroken, which lends itself to holding some cash at all times and a solid allocation to corporate bonds while we wait for the good opportunities, which will come if we are patient and not reactive.

SH: Legend.

Mark’s 1H calendar 2023 sector outlook

Materials – Overweight Q1 to Neutral from Q2

Energy – (sub-sector specific below)

– Overweight – Battery Minerals (Lithium, Copper, Silver, Gold, Nickel)

– Neutral (Agile) – Coal, Oil, Uranium

– Underweight – Renewables

Financials – Underweight in Q1 to Overweight from Q2

REITs – Low Debt industrial real estate only H1, Low Debt Diversified H2

Healthcare – overweight until Q3

Industrials – underweight to neutral/positive later in the year

Consumer discretionary – underweight H1, Stock specific H2

Consumer staples – Overweight

Telecommunications – Neutral

Technology – Underweight, stock specific until H2

Utilities – Neutral

Corporate bonds, (no lower than BBB+) – Overweight

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

The post The Hot Seat: Mark Gardner at Maqro Capital’s worst of 2022 and best of 2023 appeared first on Stockhead.

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Seducing stocks: Canoo Inc (NASDAQ:GOEV 5.43%), Ginkgo Bioworks Holdings Inc (NYSE:DNA -1.12%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…