Markets

Could J&J’s IPO Kick Off A Wave Of IPOs?

IPO summer? That’d be nice.

Johnson & Johnson could be leading the pack of a wave of IPOs, ending a drought that has lasted a little more than a year.

The pharmaceutical and medical device company that owns popular drugstore brands like Tylenol, Band-Aid and Neutrogena announced on Tuesday it would spin off its consumer health division, Kenvue, and launch it on the public markets after raising $3.5 billion. The company would be valued at $40 billion.

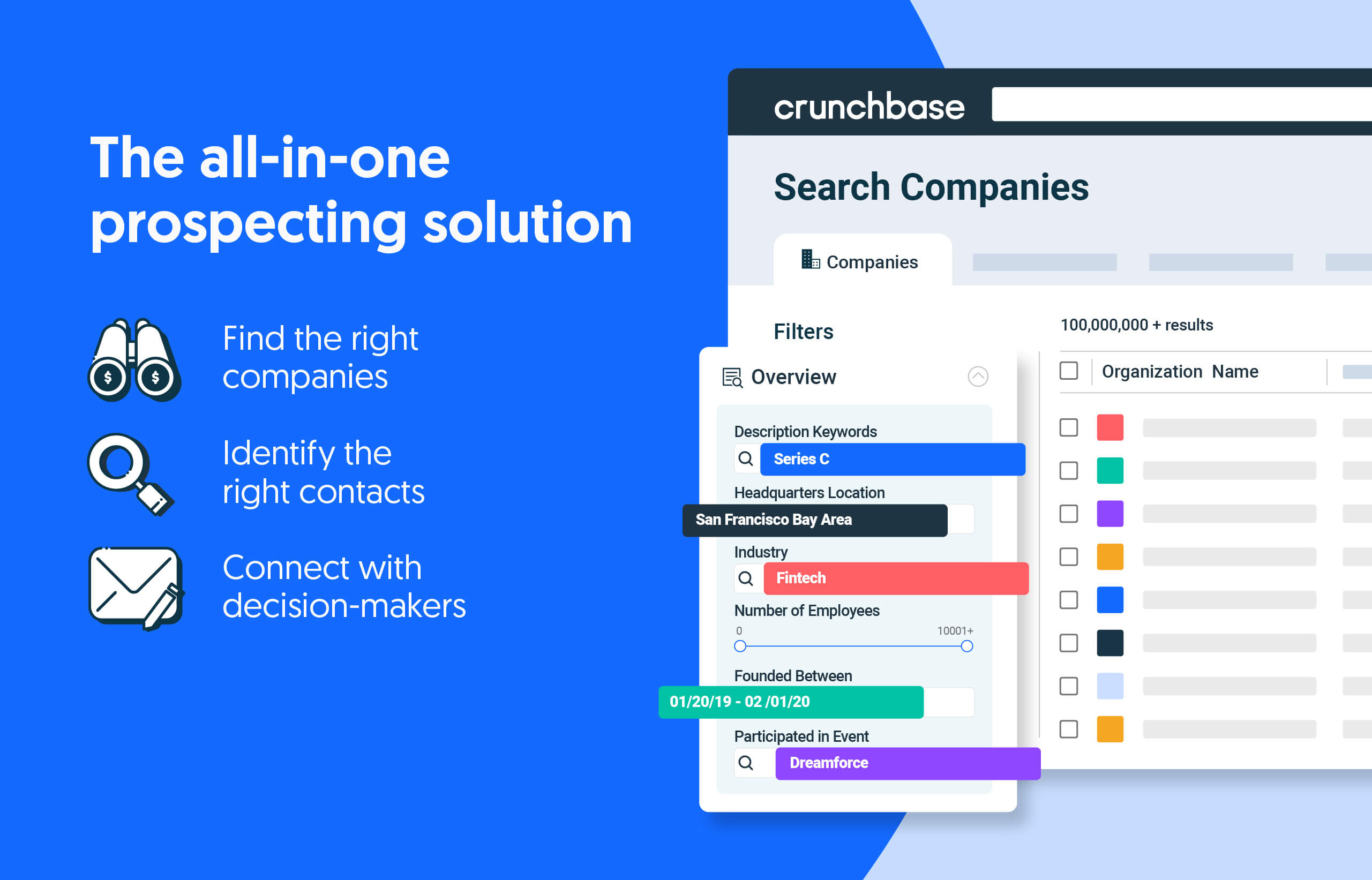

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

We’ve heard rumblings from the private market that IPOs may be back after being abandoned for more than a year. Fast fashion unicorn Shein was supposedly in talks to consider an IPO this year, and payments platform Stripe explored going public in 2024 to address expiring shares.

But this is the real deal. J&J confirmed news reports of its IPO plans, saying it would offer more than 151 million shares of stock at around $20 to $23 per share.

The long list of anticipated IPOs

It’s not the only one. BranchOut Food, a snack foods startup, filed for an IPO on Monday. After a failed SPAC merger, ticketing platform SeatGeek filed for IPO last week. Though yogurt company Chobani pulled its IPO in September, the CEO said it’s not fully off the table.

It seems like companies are enthusiastic about making their debuts in the public market, and for good reason — the loan valve from two large, startup-friendly banks has effectively been shut off. Silicon Valley Bank collapsed, almost overnight, and USB acquired Credit Suisse, tightening credit conditions.

It’s also true that many startups, after raising large volumes of capital in 2021, are starting to run out of money.

It’s a sharp turn from two years ago, when more than 400 U.S.-based startups went public. In 2022, that number dwindled dramatically to 91, according to Crunchbase data.

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Seducing stocks: Canoo Inc (NASDAQ:GOEV 5.43%), Ginkgo Bioworks Holdings Inc (NYSE:DNA -1.12%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…